As you expand your business globally, you will need to identify a secure, compliant, and swift means of accepting international financial transactions. Setting up a business account that enables financial transfers to and from the SEPA zone enables payments from 36 European countries.

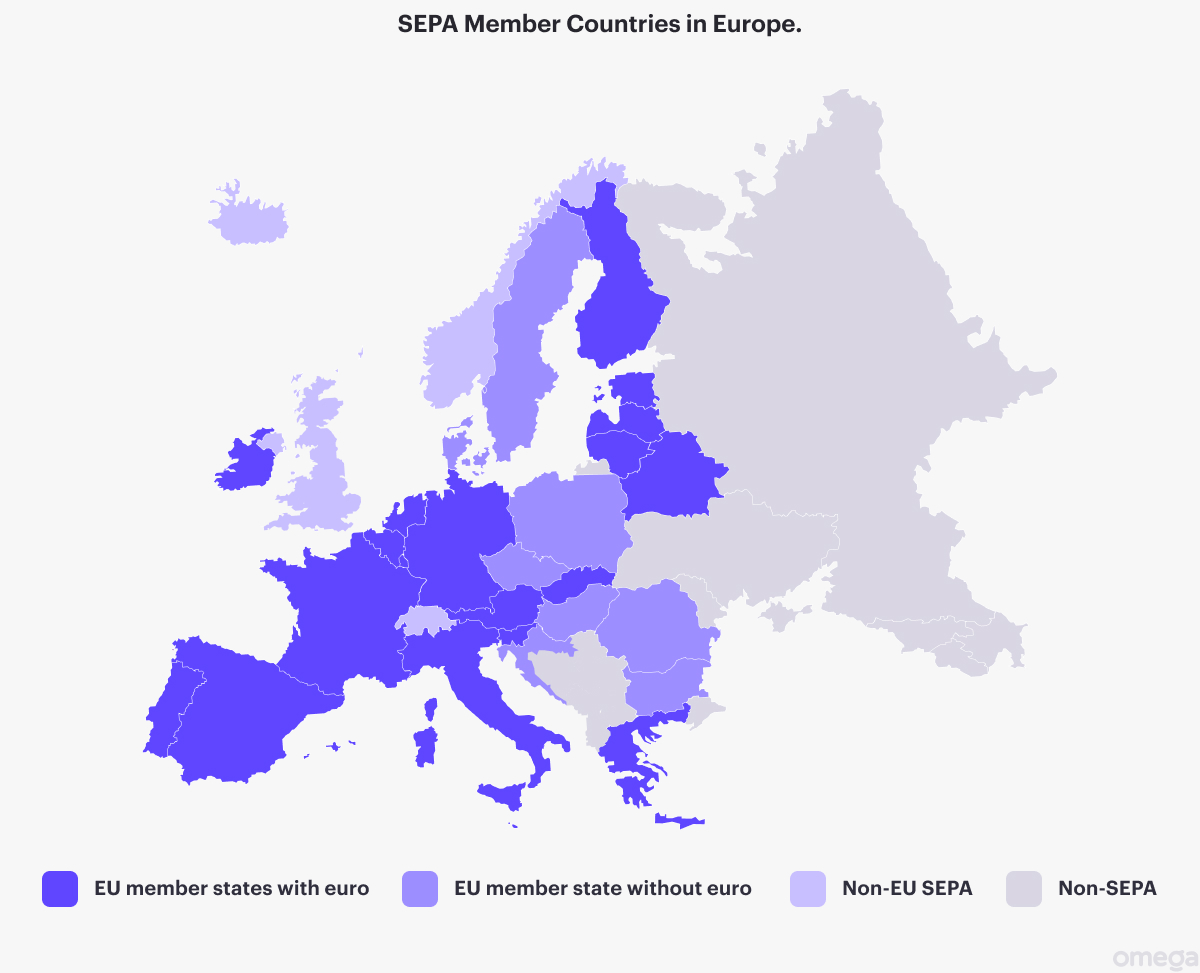

While all transfers are processed in Euros, not all countries that utilise the Euro are in this zone. Here is a review of the 2024 country list and the basics of how international transfers are streamlined and simplified as a SEPA member.

What is the SEPA zone?

The Single Euro Payments Area (SEPA) was established in 2014 as a secure, compliant, and rapid method of processing credit and debit card payments. It began with a small list of countries in the EU and expanded to include non-EU countries that utilise the Euro as a means of transferring payment. This includes transferring to and from investors, customers, and other businesses instantly or within a few business days.

What is SEPA Zone Countries?

There are currently 36 SEPA zone countries, including: Andorra, Austria, Belgium, Britain, Bulgaria, Cyprus, Croatia, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Republic of Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Monaco, Netherlands, Norway, Poland, Portugal, Romania, San Marino, Slovenia, Slovakia, Spain, Sweden Switzerland, and Vatican City.

What is zone SEPA definition?

Also referred to as the Eurozone or EU zone, this refers to all 36 countries you can send and receive SEPA Euro transfers to and from.

What European countries aren’t in the SEPA zone?

There are 50 countries and 44 sovereign states in Europe. SEPA covers the 36 countries listed above. Some of the countries that use the Euro as their currency aren’t in the zone, including Kosovo and Montenegro. Be mindful that Albania, Belarus, the Danish Faroe Islands, Greenland, Ukraine, and the Middle East aren’t in the zone.

Is Switzerland in the SEPA zone?

Yes, as of October 2024, Switzerland is in the Eurozone.

Is the UK in the SEPA zone?

Yes, as of October 2024, the UK is in the Eurozone.

Is UK in SEPA zone after Brexit?

As of October 2024, there are 27 countries in the EU. This no longer includes the UK. Despite Brexit, when UK citizens voted to leave the EU, the UK is one of many non-EU countries that remains in the EU SEPA zone. Be mindful that some non-EU countries are assessed higher SEPA transaction fees.

What are the benefits of becoming a SEPA member?

As a SEPA member, you can easily send and receive the financial transfers required to grow your business on an international level. Some of the top benefits are outlined below.

- Speed: SEPA is one of the fastest ways to complete Euro transfers, taking between 1 to 2 business days on average. Some transfers are completed in seconds.

- Ease: Setting up an Omega multi-currency account for Eurozone transfers is fast and easy. Your account provides you with a secure and compliant means of processing financial transactions in 36 countries without the hassle of setting up traditional bank accounts in each country you serve.

- Cost: Transaction fees are free for most Euro-to-Euro transfers. When fees are assessed, they are far lower than some of your other payment options.

What are the 3 types of SEPA transfers?

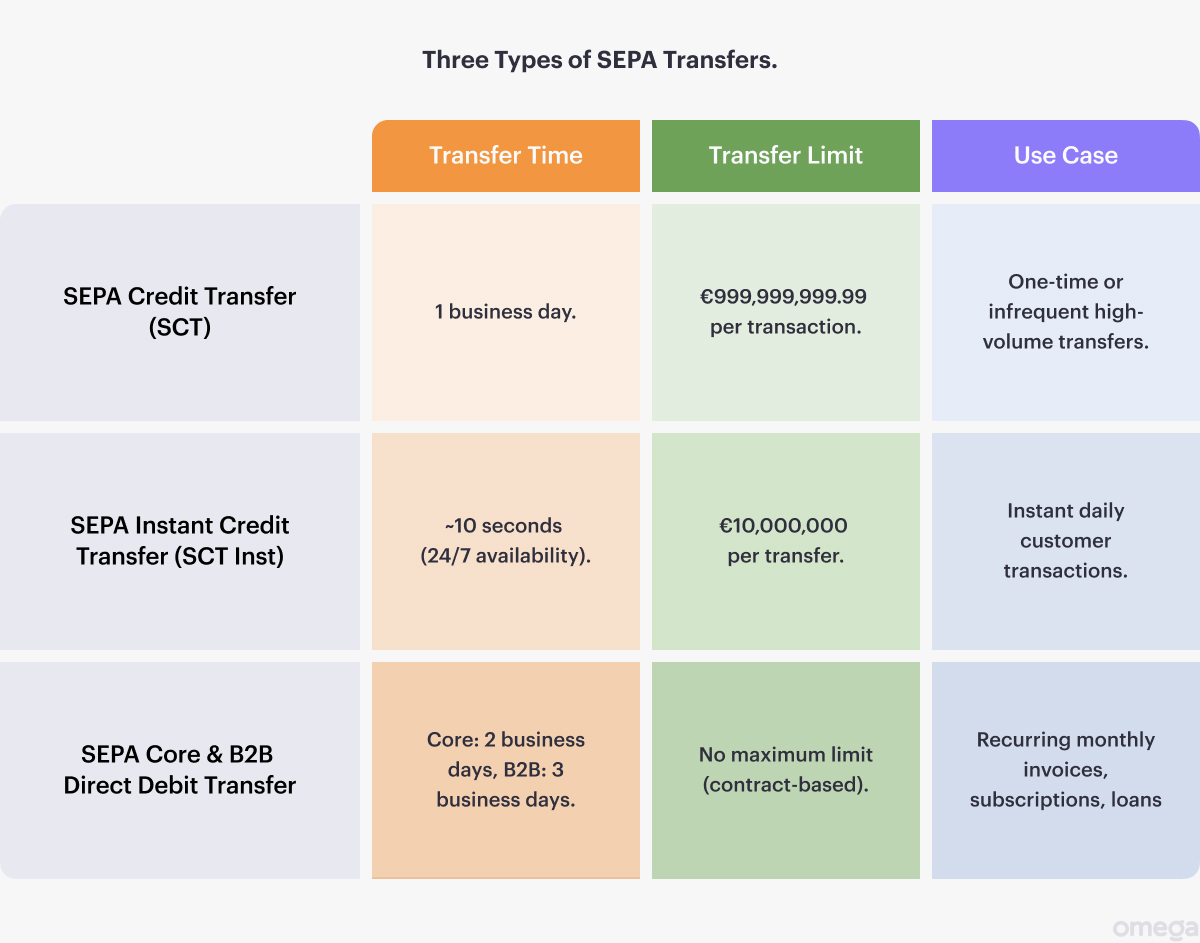

There are 3 types of SEPA zone transfers designed to streamline, simplify, and (in some instances) automate your most common financial transactions.

1. SEPA Credit Transfers (SCT)

SCT transfers are designed for one-time, or infrequent, high-volume transfers. The transfer is typically designed to send funds from one SEPA account to another using a BIC or IBAN number. This is a common option for investors to transfer funds.

- Transfer time: SCT transfers typically take 1 business day.

- Transfer limit: The maximum transfer amount per transaction is €999,999,999.99.

2. SEPA Instant Credit Transfer (SCT Inst)

SCT Inst transfers send funds direct from the sender to the recipient, with no intermediary. This instant option is available 24 hours a day, 7 days a week—including holidays. This option is most often used for processing daily customer transactions.

- Transfer time: As long as both the sender and the recipient are SEPA members, the transfer typically takes about 10 seconds.

- Transfer limit: The maximum transfer amount per transfer is €10,000,000.

3. SEPA Core and Business-to-Business (B2B) Direct Debit Transfer

There are 2 types of SEPA direct debit transactions: Core SDD and B2B SDD. Both are designed to meet your needs for recurring monthly invoices, monthly subscriptions, and loan repayments.

Banks and business accounts offer Core SDD to all senders and recipients. B2B SDD is offered at the discretion of the SEPA account provider.

- Transfer time: Core SDD transfers typically take 2 business days, while B2B SDD transfers typically take 3 business days.

- Transaction limits: Core SDD and B2B SDD have no maximum amount as they are entered into as an agreed-upon contract between the sender and the receiver.

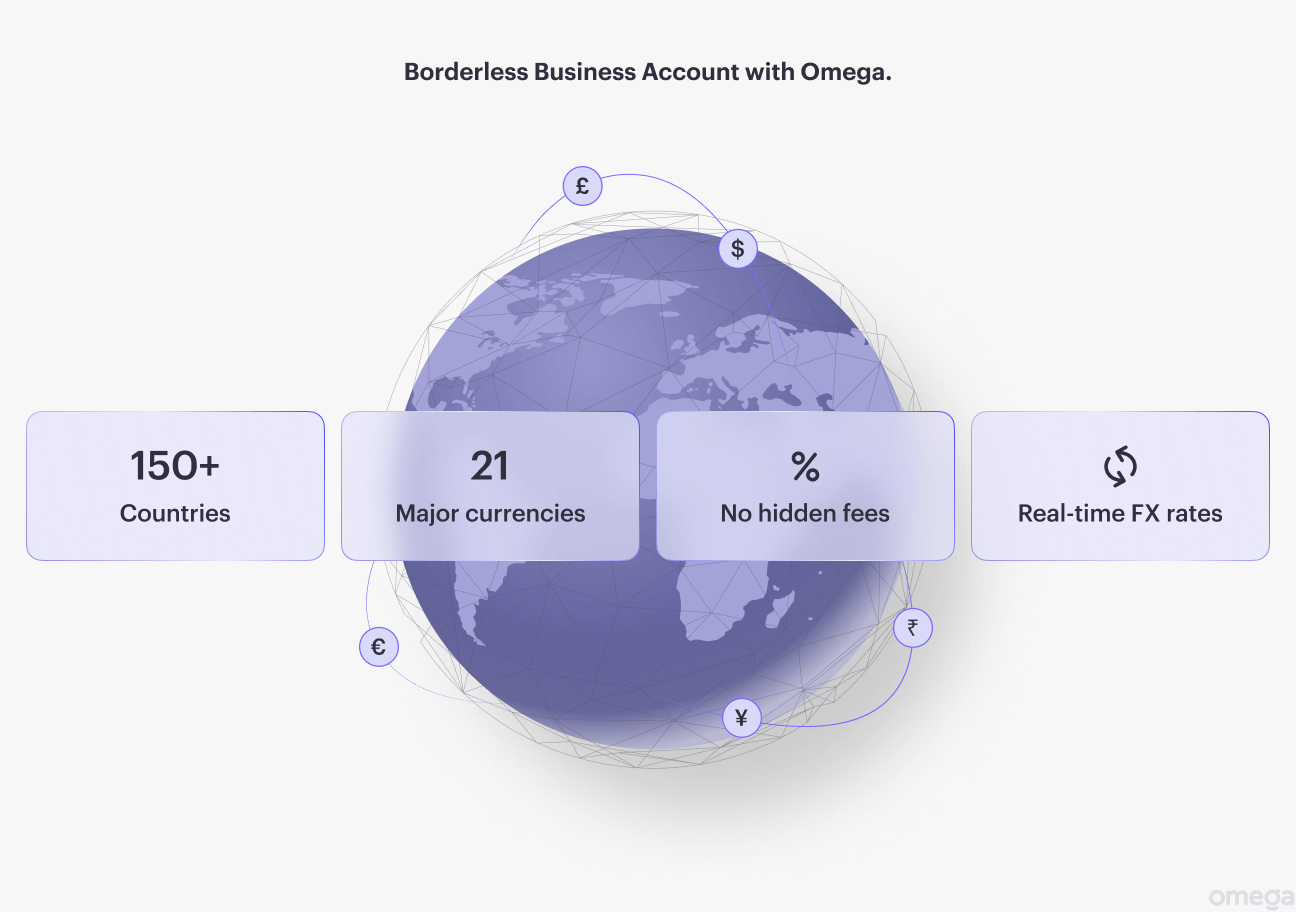

Can you transfer in the SEPA zone with an Omega business account?

Yes! Securing an Omega business account instantly enables you to send and receive SEPA transfers. In addition to the SEPA zone country list, your multi-currency business account allows you to complete non-SEPA transfers in over 160 countries.

Your Omega account is encrypted for security and in compliance with the current EU and UK Financial Conduct Authority (FCA) regulations.

Apply for an Omega business account to send and receive SEPA transfers and multi-currency transfers in Euros, British pounds, and other global currencies.