Set up a multi-currency account with GB IBAN.

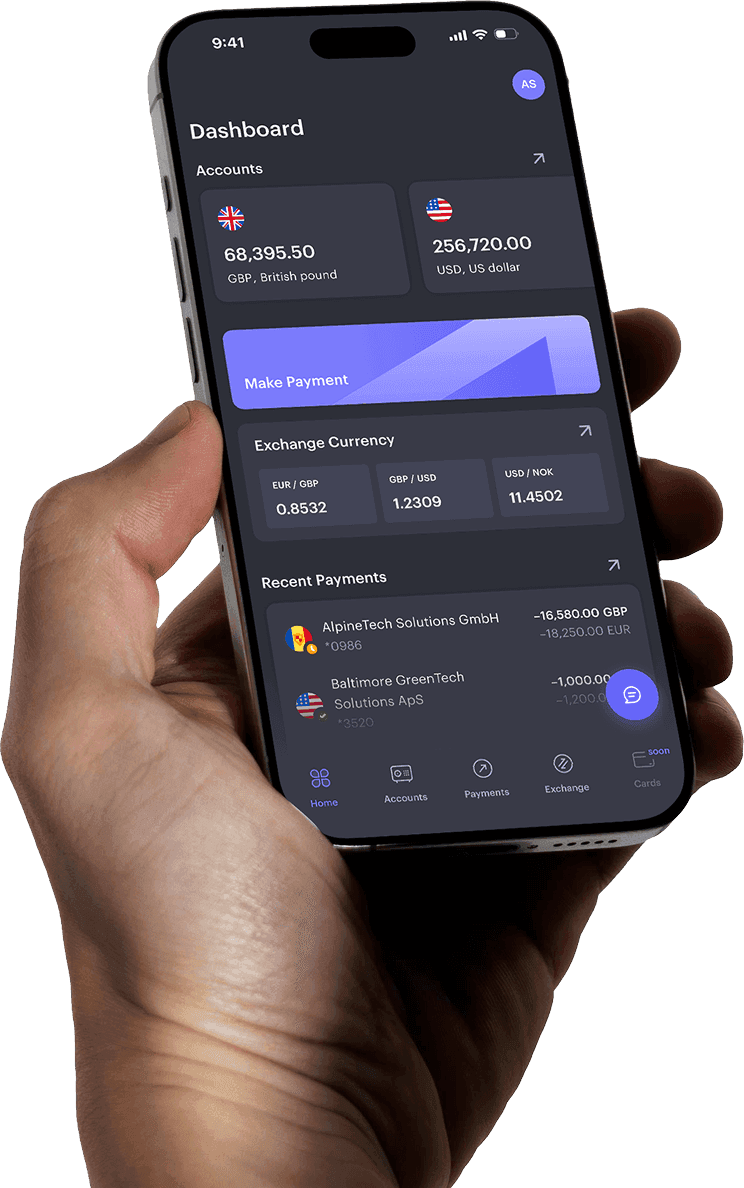

Multi-currency account with international payments, accounting, legal, and virtual office services. We call it Business-in-a-Box. The only financial platform you need to start, run and grow your business.

Effortless currency accounts with local banking details.

GB IBAN in your company name

Expand your global reach with a British IBAN.

Streamline your global cash management

Manage funds in more than 35 major currencies with multi-currency Omega account.

Know your funds are safe and secure

Your funds are 100% safeguarded with top-tier banks.

Save on costly conversion fees

Access competitive real-time FX rates with for currency conversion and cross-border payments.

Get started with a British account.

GB Account

This is an example of an GBP currency account we provide in the United Kingdom.

Account Capabilities

Multi-currency account in 35+ currencies

Instant account creation

Accounts in your business name

Outgoing payments to 150 countries

No transaction limits

Deposit Methods

UK Faster Payments, CHAPS

SWIFT

SEPA

DE Account

This is an example of an EUR current account we provide in Germany.

Account Capabilities

Multi-currency account in 14 currencies

Instant account creation

Accounts in your business name

Outgoing payments to 150 countries

No transaction limits

Deposit Methods

SEPA

SWIFT

DK Account

This is an example of an DKK current account we provide in Denmark.

Account Capabilities

Multi-currency account in 14 currencies

Create accounts instantly

Create accounts in the name of your business

Payout via Direct Debit

No transaction limits

Deposit Methods

DK T2 (formerly TARGET2)

SEPA

SWIFT

LU Account

This is an example of an EUR currency account we provide in Luxembourg.

Account Capabilities

Multi-currency account in 14 currencies

Create accounts instantly

Create accounts in the name of your business

Payout via Direct Debit

No transaction limits

Deposit Methods

SEPA

SWIFT

Highest level of security.

Omega adheres to the highest bank-level security practices to ensure the safety and confidence of our customers.

Regulated by the FCA and trusted by numerous industry partners.

All customer funds are securely safeguarded in top-tier banks.

Encrypted and kept confidential with the highest security standards.

Personal manager providing real-time care.

Dedicated phone and email support.

Available

7 days a week

7 days a week

We speak

your language

your language

FAQ

Is Omega a bank?

Omega is not a Bank. Omega is an Electronic Money Institution authorised and regulated by the Financial Conduct Authority in the UK (FRN: 901093).

What is a multi-currency business account?

A multi-currency business account is an Omega Business account where you can hold funds and conduct international payments in a variety of different currencies: AED, AUD, BGN, BHD, CAD, CHF, CNY, CZK, DKK, EUR, GBP, GHS, HKD, HUF, ILS, JOD, JPY, KES, KWD, MXN, MUR, NOK, NZD, OMR, PLN, QAR, RON, SAR, SEK, SGD, THB, TND, TRY, UGX, USD and ZAR.

Does Omega work with residents/citizens outside of the UK?

Yes, Omega can provide services to residents and citizens in over 160 jurisdictions, as long as there is a legal entity incorporated in the UK. Learn more about our process here.

What documents are needed to apply for the Omega business account?

The onboarding process is fully digital. To apply for an account, you will need to provide Omega with identification and jurisdiction-specific proof of residence. A detailed list of all required documents and information is available here.

How much does it cost to register a company with Omega?

As part of our service offering, Omega provides company registration at no extra cost. Learn more about Omega's pricing here.

Is Omega secure?

Security is built into all our products. In line with FCA regulations, your funds are safeguarded by being held in accounts with regulated banks, where they remain until you decide to make a payment.

How is my money protected?

Your funds with Omega are safeguarded in top-tier business accounts. Safeguarding laws ensure that your funds are protected in the event of a safeguarding bank's default. Learn more about Omega's safeguarding principles here.