Part of running a successful business is having a good invoicing system to collect payment. When you operate beyond your country’s borders, your invoicing system needs to support multiple currencies, payment methods, and languages. These help ensure you receive timely payment while providing a great experience to your foreign customers.

Let’s look at how you should approach international invoicing and set your global business up for success.

What Is International Invoicing?

International invoicing is the backbone of global business. It refers to the systems and methods you use to send bills and collect payments from customers around the world.

Unlike domestic invoicing, which typically focuses on a single currency, language, and local payment options, international invoicing is much broader. These systems must take into account multiple payment methods, along with the diverse regulations and standards of various countries.

Businesses must have a keen understanding of each country’s tax requirements along with knowing how currency values can fluctuate from day to day.

How to Invoice International Customers?

As technology evolves, many companies are turning to digital invoicing tools that improve efficiency while minimising errors—a crucial factor when dealing with multiple currencies and languages.

Tools made for international invoicing allow you to customise your invoices for each country without the guesswork. You can choose the country, and the invoicing software will handle currency conversions, translations, and industry regulations for each country.

Even better, you can use these tools in your own native language using the currency you’re familiar with. The invoicing software automatically converts each invoice for you, so you can work in a way you’re comfortable with while also catering to your international customers.

How to Charge International Customers?

Charging customers isn’t as straightforward as it seems. Depending on what you sell, a single invoice might include multiple charges, including sales tax, shipping fees, and other fees.

This creates lots of questions, such as “Do I charge tax on shipping?” or “Which items are eligible or not eligible for tax charges?”

Things get more complicated when invoicing international customers. Different countries have varying rules on Value Added Tax (VAT) or Goods and Services Tax (GST), which may affect how you bill your customer.

Likewise, accepting international payments means paying a small percentage of each sale to banks for currency conversion. This amount can vary by country and by bank.

If they’re using a credit card, you might also incur credit card processing fees to complete the transaction.

Some companies choose to pass these additional charges on to their customer, which means they need to be reflected in the invoice. To do this, you’ll need to understand approximately how much these fees will be — and again, this will usually vary by country.

You certainly don’t want to overcharge customers, but you also want to make sure you collect the charges you’re rightfully owed.

With our free online tool you can validate a SWIFT code and get all possible information about it.

How to Invoice International Clients From the UK?

You can use invoicing software to send invoices to international clients from your UK business. Invoicing software allows you to brand each invoice with your business details, helping you to establish a strong image.

Formatting international invoices is similar to how you’d send invoices to your local clients, with some extra details. We’ll cover those in the section below.

International Invoice Requirements

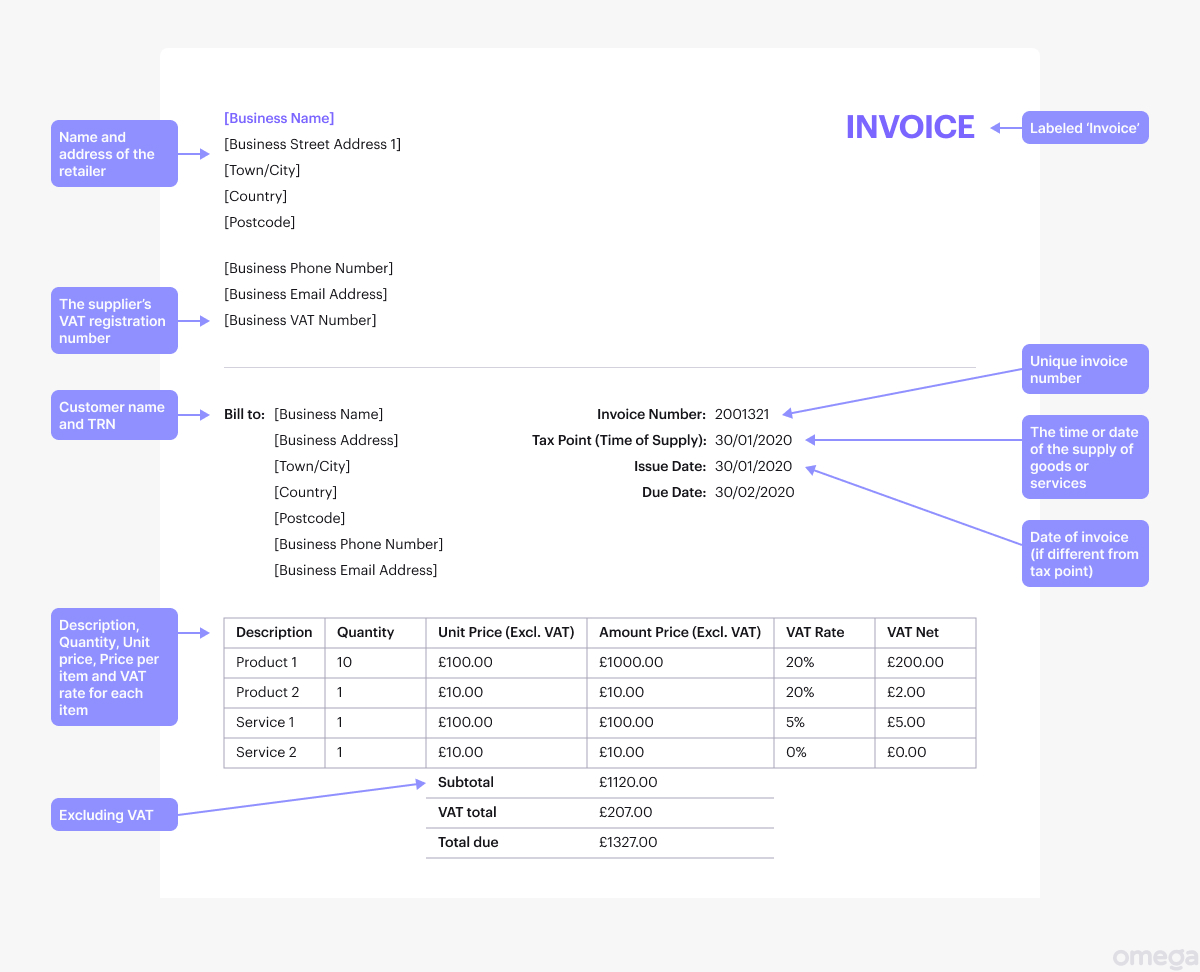

When sending invoices to clients in the UK, you’ll want to include a few key pieces of information:

- Your business name

- Business registration number

- Business address

- Business email

- Client information (business name, contact name, email address, etc.)

- Invoice number

- Date of invoice

- Clear description of services

- Currency used for the invoice

- Amount due

- Payment due date

- Preferred payment methods

- Tax information (if applicable)

You can create a template with this information and use it for all of your UK clients.

If you have not registered your business in the UK, you can easily do so. Our business registration service helps you create a legitimate business in the UK, even if you are not a UK citizen.

International Invoicing Template

International invoicing software makes it easy to create compliant business invoices for each country in which you do business. You can create a template and use it over and over again every time you need to bill a customer.

These tools not only save time but also offer other features, such as automated payment reminders, multilingual templates, currency conversion, fee calculations and estimates, legal language, and secure online payment options. Get paid in a timely manner from all of your customers, no matter where they reside.