In today’s business climate where more companies are doing business across borders, sending money abroad can feel as simple as a click of a button — or as daunting as navigating a maze.

Whether you are supporting family overseas, paying for services in another country, or investing in foreign ventures, you need to feel confident you can send money safely and avoid money transfer scams.

Let’s explore how to safely send money to other countries and make the process secure and stress-free.

4 Safe Ways to Send Money Abroad

When it comes to your finances, peace of mind is priceless! Safe money transfers do exist, and we’re sharing four of them below.

1. Look for Alternative Payment Options

There are a variety of digital payment platforms and peer-to-peer (P2P) services that offer cost-effective and faster money transfer options. Payment services like PayPal, Wise, or mobile payment apps can be more convenient, often with lower fees and faster transfer times.

Depending on the recipient’s location, these alternatives might be more accessible and could offer better exchange rates.

However, if a party is insisting you use just one type of payment option (such as a wire transfer only), that is a red flag. Trust is more important than exchange rates or fees, so make sure you are using a method that will protect your money.

2. Check Fees and Exchange Rates

Hidden fees and exchange rates can significantly reduce the amount your recipient receives. Always compare the fees and the exchange rate offered by different services, as some may charge lower upfront fees but offer poor exchange rates.

Use online tools or currency calculators to estimate the total cost of the transfer. Be wary of additional fees that might apply based on how the recipient will receive the money. Ideally, the service you choose can give these details before you transfer the money.

3. Work with Your Bank

If you are not sure about sending money safely, it is best to work with your financial institution. Many banks offer international wire transfers and can advise on other methods. Banks will also have an established process to ensure safe money transfers and can assist you if something goes wrong.

4. Double Check the Recipient’s Information

Before finalising any international transfer, take the time to double-check the recipient’s information. Small mistakes, such as a misspelt name or incorrect account number, can lead to delays or even failed transactions.

Always verify the details provided, including the IBAN (International Bank Account Number), BIC/SWIFT code, and the recipient’s name as it appears on their bank account. A little due diligence goes a long way in ensuring money arrives safely and on time.

What Not to Do When Sending Money Abroad

Sending money abroad means more details to consider. It can also have a high potential for theft or other issues, especially if you have never met the person or business you’re paying.

To avoid becoming a victim of a financial crime, consider the following tips:

- Avoid services that promise no fees or a 0% commission. Sending money internationally incurs costs, so there is no such thing as a free transfer.

- Don’t use public Wi-Fi networks to send money.

- Don’t fall for pressure tactics from international parties who request payment immediately. International payments are difficult to reverse.

- Be aware that fees and exchange rates may shift on a daily basis. This can have to do with the strength of a country’s currency as well as be influenced by the amount of money you’re sending.

- Know how to spot a money transfer scam. Usually, scammers will request money in one format only, rush the request, ask for passwords or other personal information, send a QR code that asks you to approve a collection, or offer you a large commission if you facilitate a transaction.

- Never send cash in the mail.

It is okay to ask for identification or other elements that can verify a legitimate request.

How Omega Can Help You Avoid Money Transfer Scams

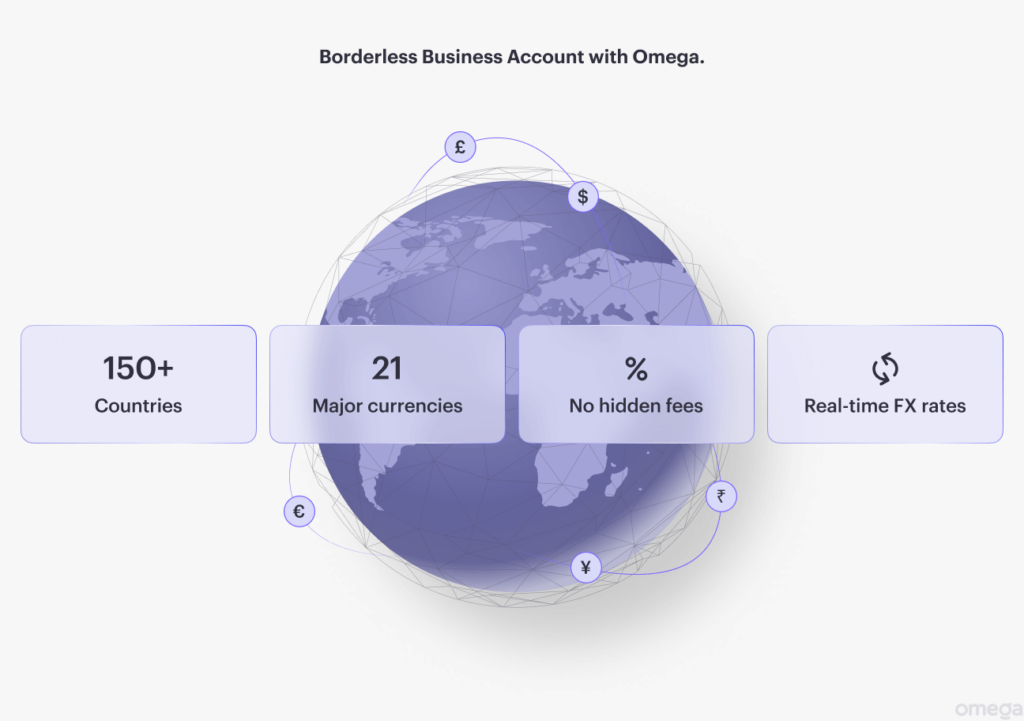

Omega is the best way to send money internationally. Our financial services give you full transparency into international payments, including exchange rates, fees, and delivery times so you can pay with confidence.

Learn more about our business account and get started in minutes!