Need to receive money from a client or supplier based in a European country? You may have been asked for your IBAN to complete the transaction and been left scratching your head. Or maybe you need foreign country IBAN and you are wondering what to expect.

It can be confusing to understand the financial system of another country, but we are here to break down everything you need to know. This article covers what EU IBAN numbers are, the format and example for various European countries, and other must-know details.

What is an IBAN Number in Europe?

In every country’s financial system, banks rely on strings of numbers and letters to identify an individual’s accounts.

While transactions within the UK use sort numbers and account numbers to act as this signifier, European nations use IBANs.

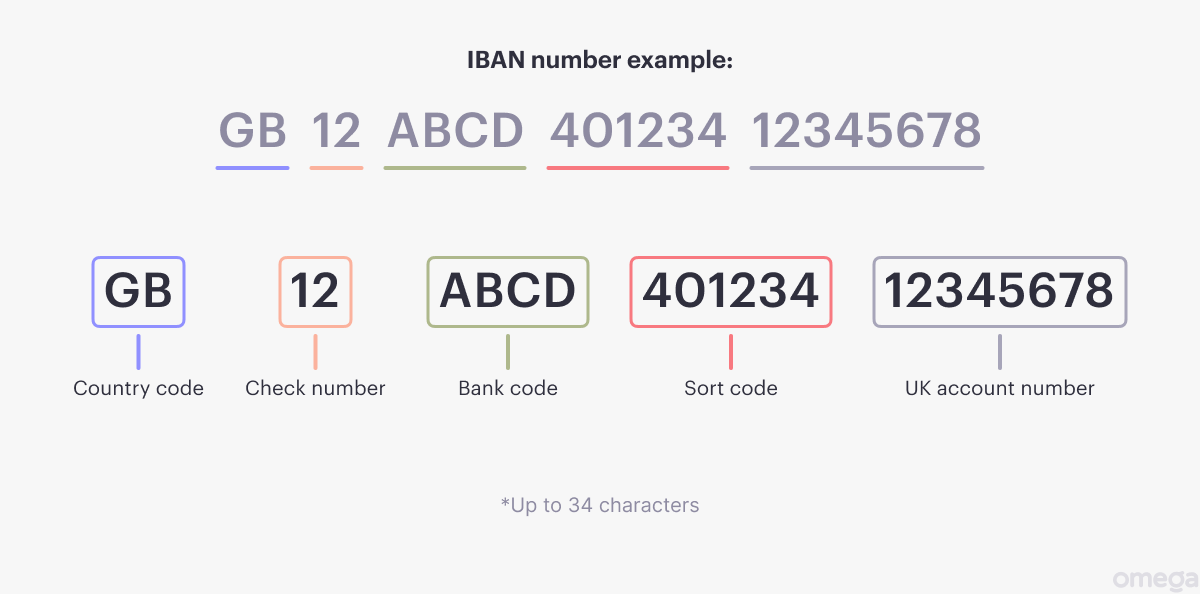

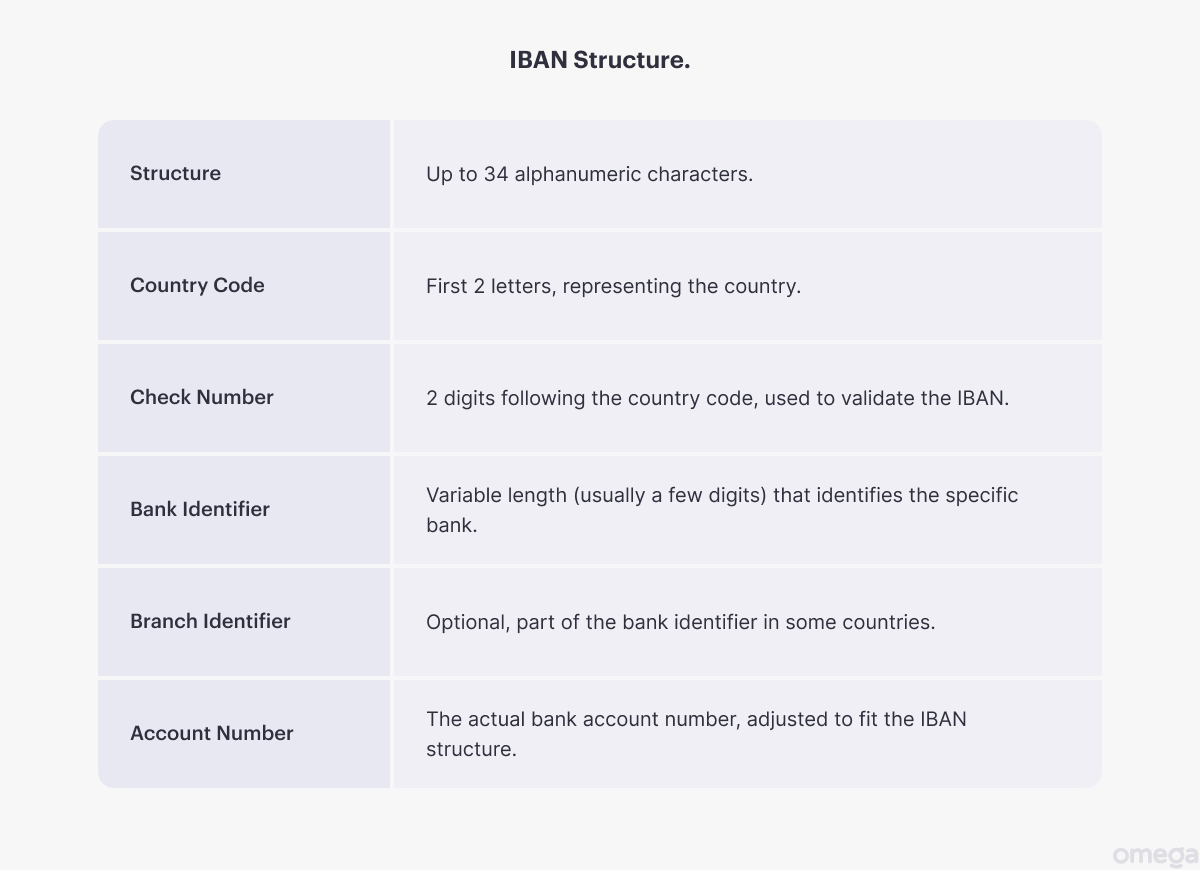

Short for International Bank Account Number, they contain up to 34 letters and numbers. This code are made with safety in mind, so nobody can use your number to make withdrawals or transfers.

This system is used throughout Europe to facilitate easier transactions across the continent, but they’re now used in many non-European countries too. In fact, more than 70 countries across the world use them.

How to Write an IBAN Number Correctly

While IBAN numbers always contain up to 34 letters and numbers, there is some variation.

Every country has its own “country code” consisting of two letters, and this goes at the start of the IBAN. Another key component is the “check digits” — two numbers following the country code.

The length of the code also varies between nations. In some countries, they are as little as 18 characters long, while elsewhere there are 34 characters in total.

In the case of the United Kingdom, there are 22 digitals, which consist of the six-digit sort code and eight-digit account number any UK account has, plus the country code, check digits, and an identifier for the bank account.

For specific examples for different countries, just check out the table at the bottom of this article.

How to Find Your IBAN number

Finding an IBAN number should be as easy as logging into your online account or checking your statement. In some cases, you may need to “generate” an IBAN from your provider.

IBAN in Europe vs SWIFT code

If you are familiar with the world of money transfers, you may also have come across a SWIFT or BIC code.

These codes are used to identify accounts for international transactions too, but they specifically identify the branch of the financial institution. You may also see them referred to as BICs, but they both serve the same purchase.

SWIFT/BIC codes are used across the world, whereas IBANs were made only for Europe (although they’re now used elsewhere).

European IBAN Examples

Let’s go through examples of European IBANs one by one.

| Country | Code | Number of Characters | European IBAN Example |

| Albania | AL | 28 | AL35202111090000000001234567 |

| Andorra | AD | 24 | AD1400080001001234567890 |

| Austria | AT | 20 | AT483200000012345864 |

| Azerbaijan | AZ | 28 | AZ77VTBA00000000001234567890 |

| Bahrain | BH | 22 | BH02CITI00001077181611 |

| Belarus | BY | 28 | BY86AKBB10100000002966000000 |

| Belgium | BE | 16 | BE71096123456769 |

| Bosnia and Herzegovina | BA | 20 | BA393385804800211234 |

| Brazil | BR | 29 | BR1500000000000010932840814P2 |

| Bulgaria | BG | 22 | BG18RZBB91550123456789 |

| Burundi | BI | 27 | BI1320001100010000123456789 |

| Costa Rica | CR | 22 | CR23015108410026012345 |

| Croatia | HR | 21 | HR1723600001101234565 |

| Cyprus | CY | 28 | CY21002001950000357001234567 |

| Czech Republic | CZ | 24 | CZ5508000000001234567899 |

| Denmark | DK | 18 | DK9520000123456789 |

| Djibouti | DJ | 27 | DJ2110002010010409943020008 |

| Dominican Republic | DO | 28 | DO22ACAU00000000000123456789 |

| Egypt | EG | 29 | EG800002000156789012345180002 |

| El Salvador | SV | 28 | SV43ACAT00000000000000123123 |

| Estonia | EE | 20 | EE471000001020145685 |

| Falkland Islands | FK | 18 | FK12SC987654321098 |

| Faroe Islands | FO | 18 | FO9264600123456789 |

| Finland | FI | 18 | FI1410093000123458 |

| France | FR | 27 | FR7630006000011234567890189 |

| Georgia | GE | 22 | GE60NB0000000123456789 |

| Germany | DE | 22 | DE75512108001245126199 |

| Gibraltar | GI | 23 | GI56XAPO000001234567890 |

| Greece | GR | 27 | GR9608100010000001234567890 |

| Greenland | GL | 18 | GL8964710123456789 |

| Guatemala | GT | 28 | GT20AGRO00000000001234567890 |

| Holy See (the) | VA | 22 | VA59001123000012345678 |

| Hungary | HU | 28 | HU93116000060000000012345676 |

| Iceland | IS | 26 | IS750001121234563108962099 |

| Iraq | IQ | 23 | IQ20CBIQ861800101010500 |

| Ireland | IE | 22 | IE64IRCE92050112345678 |

| Israel | IL | 23 | IL170108000000012612345 |

| Italy | IT | 27 | IT60X0542811101000000123456 |

| Jordan | JO | 30 | JO71CBJO0000000000001234567890 |

| Kazakhstan | KZ | 20 | KZ244350000012344567 |

| Kosovo | XK | 20 | XK051212012345678906 |

| Kuwait | KW | 30 | KW81CBKU0000000000001234560101 |

| Latvia | LV | 21 | LV97HABA0012345678910 |

| Lebanon | LB | 28 | LB92000700000000123123456123 |

| Libya | LY | 25 | LY38021001000000123456789 |

| Liechtenstein | LI | 21 | LI7408806123456789012 |

| Lithuania | LT | 20 | LT601010012345678901 |

| Luxembourg | LU | 20 | LU120010001234567891 |

| Malta | MT | 31 | MT31MALT01100000000000000000123 |

| Mauritania | MR | 27 | MR1300020001010000123456753 |

| Mauritius | MU | 30 | MU43BOMM0101123456789101000MUR |

| Moldova | MD | 24 | MD21EX000000000001234567 |

| Monaco | MC | 27 | MC5810096180790123456789085 |

| Mongolia | MN | 20 | MN580050099123456789 |

| Montenegro | ME | 22 | ME25505000012345678951 |

| Netherlands | NL | 18 | NL02ABNA0123456789 |

| Nicaragua | NI | 28 | NI79BAMC00000000000003123123 |

| North Macedonia | MK | 19 | MK07200002785123453 |

| Norway | NO | 15 | NO8330001234567 |

| Pakistan | PK | 24 | PK36SCBL0000001123456702 |

| Palestine | PS | 29 | PS92PALS000000000400123456702 |

| Poland | PL | 28 | PL10105000997603123456789123 |

| Portugal | PT | 25 | PT50002700000001234567833 |

| Qatar | QA | 29 | QA54QNBA000000000000693123456 |

| Romania | RO | 24 | RO66BACX0000001234567890 |

| Russia | RU | 33 | RU0204452560040702810412345678901 |

| Saint Lucia | LC | 32 | LC14BOSL123456789012345678901234 |

| San Marino | SM | 27 | SM76P0854009812123456789123 |

| Sao Tome and Principe | ST | 25 | ST23000200000289355710148 |

| Saudi Arabia | SA | 24 | SA4420000001234567891234 |

| Serbia | RS | 22 | RS35105008123123123173 |

| Seychelles | SC | 31 | SC74MCBL01031234567890123456USD |

| Slovakia | SK | 24 | SK8975000000000012345671 |

| Slovenia | SI | 19 | SI56192001234567892 |

| Somalia | SO | 23 | SO061000001123123456789 |

| Spain | ES | 24 | ES7921000813610123456789 |

| Sudan | SD | 18 | SD8811123456789012 |

| Sultanate of Oman | OM | 23 | OM040280000012345678901 |

| Sweden | SE | 24 | SE7280000810340009783242 |

| Switzerland | CH | 21 | CH5604835012345678009 |

| Timor-Leste | TL | 23 | TL380010012345678910106 |

| Tunisia | TN | 24 | TN5904018104004942712345 |

| Turkey | TR | 26 | TR320010009999901234567890 |

| Ukraine | UA | 29 | UA903052992990004149123456789 |

| United Arab Emirates | AE | 23 | AE460090000000123456789 |

| United Kingdom | GB | 22 | GB33BUKB20201555555555 |

| Virgin Islands, British | VG | 24 | VG07ABVI0000000123456789 |

| Yemen | Ye | 30 | YE09CBKU0000000000001234560101 |

Can You Have an IBAN Number Outside of Europe?

As you can see in the table above, there are plenty of nations in the Middle East, the Americas, and Africa that have their own IBANs.

Even for those who don’t reside within one of the many countries that offer business accounts with IBAN, global accounts make it possible to operate an IBAN from anywhere to facilitate easy transactions.

International Transfers Made Easy

Sending money across borders can be confusing, but digital solutions are paving the way for the next generation of money transfers.

If you are running a company and working with clients, suppliers, or customers in Europe, an Omega business account makes it easy to navigate these transactions — no matter where in the world you are.

Get started in as little as ten minutes to see whether it is right for you.

Disclaimer.