For every expanding company, there comes a moment when it’s time to grow beyond its headquarters. If you have thought about expanding your physical presence in the UK, you might have considered creating a UK branch.

What should you know about successfully opening a branch office in the UK? Is it possible to do it as a non-UK citizen? We answer these and other questions in the article below.

Opening a branch office in the UK: Things to know

Once you have decided to take your business to the next level, having a presence in other countries, especially in the UK, is good for trade. Not only does it allow you to operate more freely, but you can also build an extra layer of trust with your partners.

However, as you will quickly find out, opening a branch office in the United Kingdom will require both your time and effort. For the branch office to run smoothly, there are a number of steps you must take. But the good news is that setting up a branch is quite easy, and anyone can do it – even a non-resident, as long as they have a UK-registered office address.

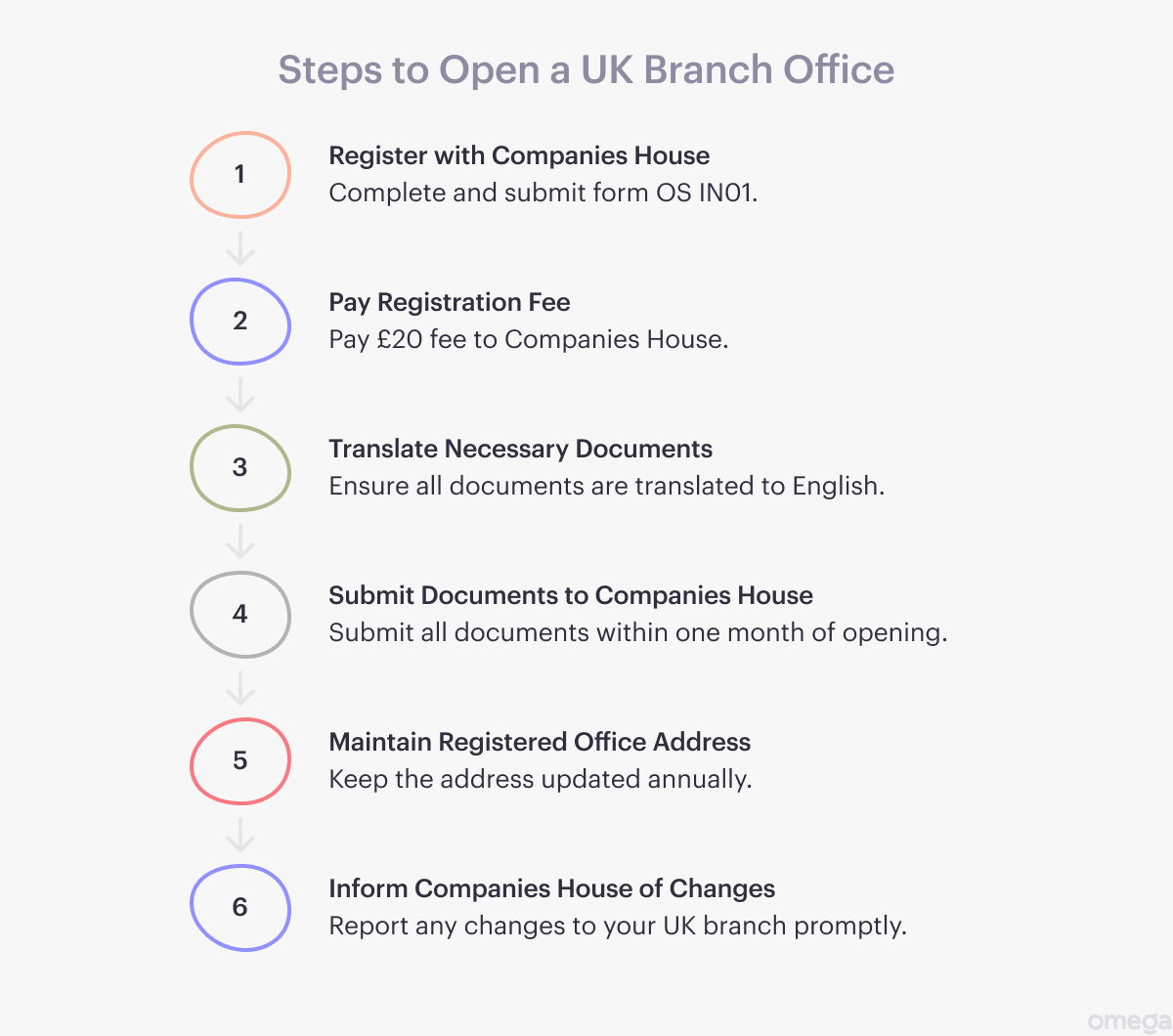

Step 1: Register with Companies House

The first step to getting a UK branch office address is to complete a government form, OS IN01. Within it, you will have to include your company’s name, address, key people, the company constitution, accounting requirements, and other details.

Once you have filled out the form, you must return it to Companies House within one month of opening for business. Note that there is currently a £20 registration fee.

Step 2: Translate the necessary documents

To establish a UK branch office, you will also have to provide Companies House with all the critical documents of your company, including your firm’s constitutional documents, translated into verified English.

What happens after you have created a UK branch?

If you have managed to successfully establish a branch, keep in mind that you will need to maintain a registered office address for a year. Likewise, you will have to maintain the same relevant statutory registers throughout the financial year. If any changes occur to your UK branch, you will have to inform Companies House.

Benefits of opening a UK branch

Those who decide to expand their business can expect several perks. Most importantly:

- The parent company can enjoy greater tax benefits. This is because, in most cases, anything you earn at the branch office will be handled by tax treaties signed between the country of the parent company and the UK. Consequently, you won’t have to worry about double taxation.

- Greater control. In any decision-making processes, the branch office must report to the parent company, which gives it more power and control.

Final thoughts

Once you are ready to expand your business to new lands, establishing a branch in the UK is something that can offer many advantages. But with so many details to think about, it is easy to get overwhelmed in the process.

Luckily, you don’t have to do it alone! Our team at Omega will register your company in the United Kingdom and handle all the practicalities while you can focus on other tasks. Get in touch with us today, to learn more about the process.