Bookkeeping mistakes can be costly, especially when you are using incorrect bookkeeping data to make important business decisions. Most businesses fail due to cash flow issues, and it is estimated that 57% of small businesses in the UK struggle with cash flow. A single error in your records could create a tailspin of financial hurdles — but you can defend your business when you know what these errors look like and how to prevent them.

Let’s explore the most common bookkeeping mistakes that affect businesses and how you can detect and avoid them.

1. Ignoring Small Purchases

Every purchase and every dollar matters in a business. Minor expenses add up quickly, but they are often brushed off and not tallied in your bookkeeping.

One of the top bookkeeping mistakes you can make is treating small expenses like personal expenditures. Every purchase should be recorded, ideally the same day you make the purchase. This will give you the most up-to-date look at your business finances and ensure nothing becomes forgotten.

2. Failing to Reconcile with Bank Statements

Your books say one thing, your bank statement might say another. In an ideal world, these two sources should align perfectly. If they don’t, there is something wrong and you won’t get the fullest picture of your financial health.

Other challenges like accepting foreign currency can make the bookkeeping process even harder. Exchange rates can vary, additional fees may apply, and some transactions simply don’t go through. It is important to have all of your financial data in one place so you can compare the numbers

When you receive a bank statement, reconcile it with your bookkeeping software. This helps you spot potential transactions you may have forgotten to log. It can also help you prevent fraud or unauthorised spending, both of which will impact your cash flow.

3. Data Entry Errors

Bookkeeping is still a mostly manual process, even with good software, receipt scanners, and digital statements. A single error (e.g. a missing decimal point, a miskeyed number) can have devastating consequences on your finances. You might spend money you don’t have, or hold off on purchases that could potentially help your business because you think you can’t afford them.

Having systems and checks in place can prevent this common bookkeeping mistake. It is better to double-check your work than let a mistake go unnoticed for days or weeks.

4. Not Planning for Taxes

Taxes are a necessary part of doing business. Like it or not, you know Tax Day is coming and will need to set aside money to cover your share.

This is one of the most common bookkeeping mistakes a business can make, especially in their first few years when cash flow is unpredictable. Do some research ahead of time to see how much you may owe and how those large lump payments will affect your business. Remember, if you don’t have the funds to cover your tax bill, you will incur additional penalties that will hurt your finances even more.

5. Not Handling Books Every Day

One of the most costly bookkeeping mistakes is treating your books like an afterthought rather than a part of your daily workflow. Books don’t manage themselves, and you need to update them every day to get the clearest understanding of your finances.

It might not be the most fun thing you do each day, but stalling isn’t helpful. Manage your books regularly so you never have to guess about logged transactions or reconciliations. It’s easier to handle errors or address questionable transactions the moment you know about them.

6. Poor Hiring Decisions

Of all the bookkeeping mistakes to avoid, poor hiring decisions is arguably the most important. Things like hiring are part of a much larger learning curve. If you are new in business, you might not know how to hire someone for this role. Or worse, you might delegate this role to yourself.

No matter your business size, bookkeeping is truly a full-time job. It requires someone with experience, along with attention to detail and the ability to self-manage. Put your books in the wrong hands (including your own) and you risk crippling your business.

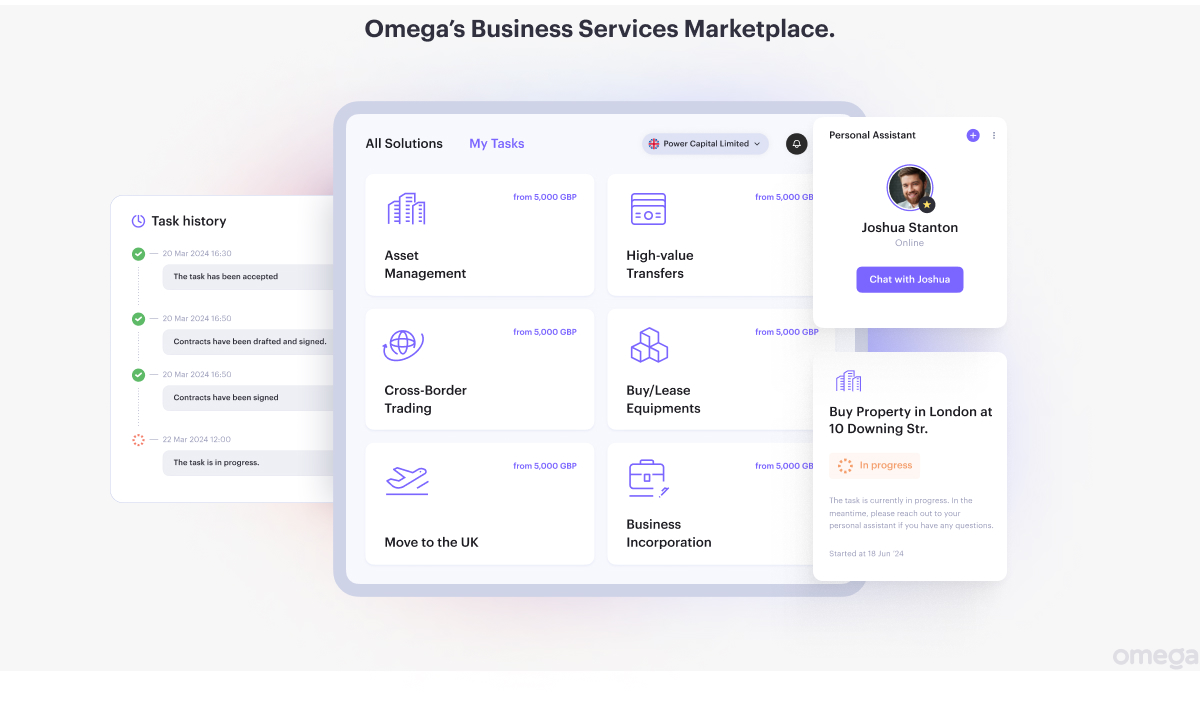

Overcome the Top Bookkeeping Mistakes with Omega

Cash flow issues and other bookkeeping business mistakes can happen to any business, even well-established ones. One way to avoid bookkeeping mistakes is to work with a trusted outsourced partner who has systems and safeguards in place to find and fix errors before they cost you.

Omega offers a third-party business accounting services to help you stay on top of finances so you can focus on what you do best. If you are using Omega for your business account, you will have access to all of your business financial data in one place so you can optimise its performance.

Contact us today to learn more.