When you do business in a globalised industry, you may come across times when you need to send money to another individual or business quickly. While quickly sending a few dollars to a friend via Venmo or Paypal can suffice, what if you need to send a large sum?

The last thing you want is to risk your money not arriving at its intended destination securely, especially if the destination is overseas. This is when a wire transfer, the fastest way to send money electronically, may come in handy.

But what about a bank transfer? How does it differ from a wire transfer, and which one is the better option for your financial needs?

Let’s break down the differences between these two common methods of transferring funds – and learn how an Omega Business Account can make international transactions much easier.

What Are Wire Transfers?

Generally speaking, wire transfers are used to send a larger sum of money quickly and securely – and are most often used to send amounts internationally. They work by electronically transferring funds from one bank account to another, usually within the same business day.

While they may take a few more steps than other financial transactions, you’ll gain a few benefits along the way:

A few instances where a wire transfer may be needed, particularly for entrepreneurs or business owners, include:

- Paying remote employees or contractors

- Making large purchases, such as equipment or inventory

- Sending money to suppliers or partners in other countries.

As you can imagine, having a bit of extra security and assurance that the money being sent is protected can give you much more peace of mind.

What Is a Bank Transfer?

Bank transfers – also known as credit transfers – are more common for domestic transactions. A bank transfer works in much the same way as a wire transfer in theory but is not the exact same process:

Bank transfers are often chosen when transferring smaller amounts of money domestically, as they tend to have lower fees. Think of it as sending a check without the wait time for it to clear.

What Are The Differences Between a Wire Transfer and Bank Transfer?

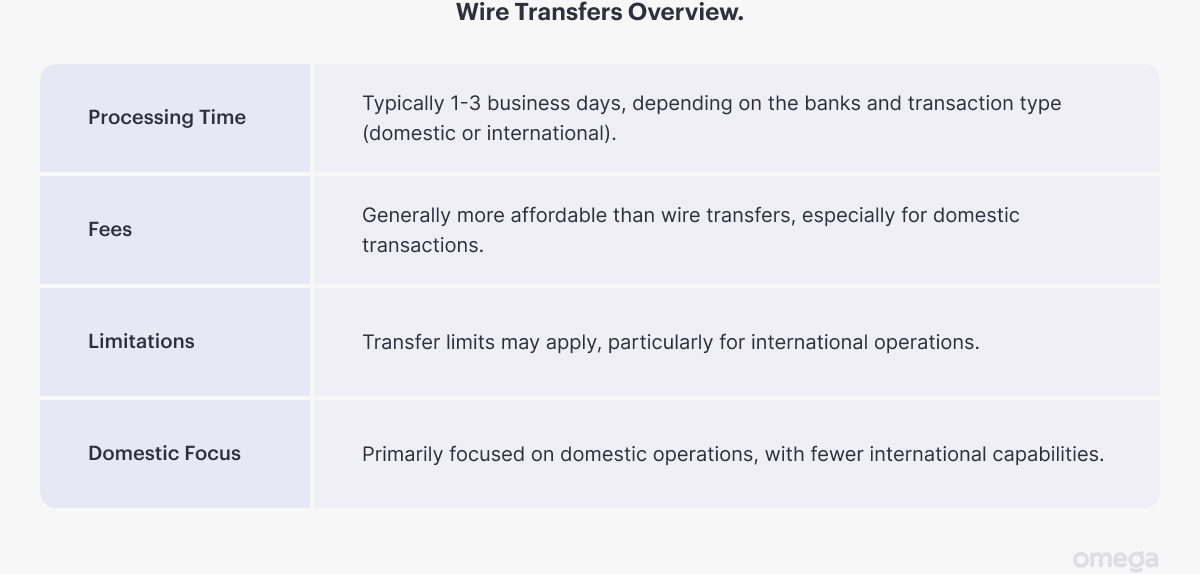

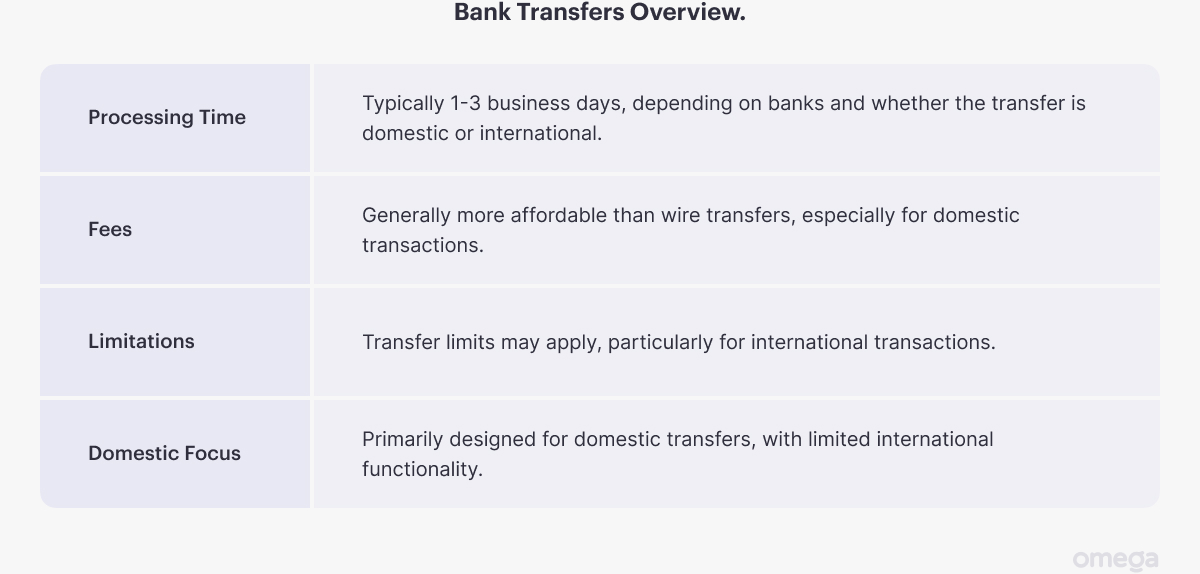

So, which of the two is right for your financial needs? While both offer a safe and secure method of sending money, there are some key differences to consider.

How to Choose Between Wire Transfer and Bank Transfer

While choosing between wire transfer and bank transfer, knowing what you need to send and where you are transferring it is key. Here are some considerations to think through before you choose between a bank transfer and a wire transfer:

- The urgency of your payment.

- The amount you are sending.

- If it’s a domestic or international transfer.

- The fees you are willing and able to pay.

- The currency exchange rates, which apply to international transfers.

If you want full flexibility, why not choose a payment platform that takes the confusion out of the process?

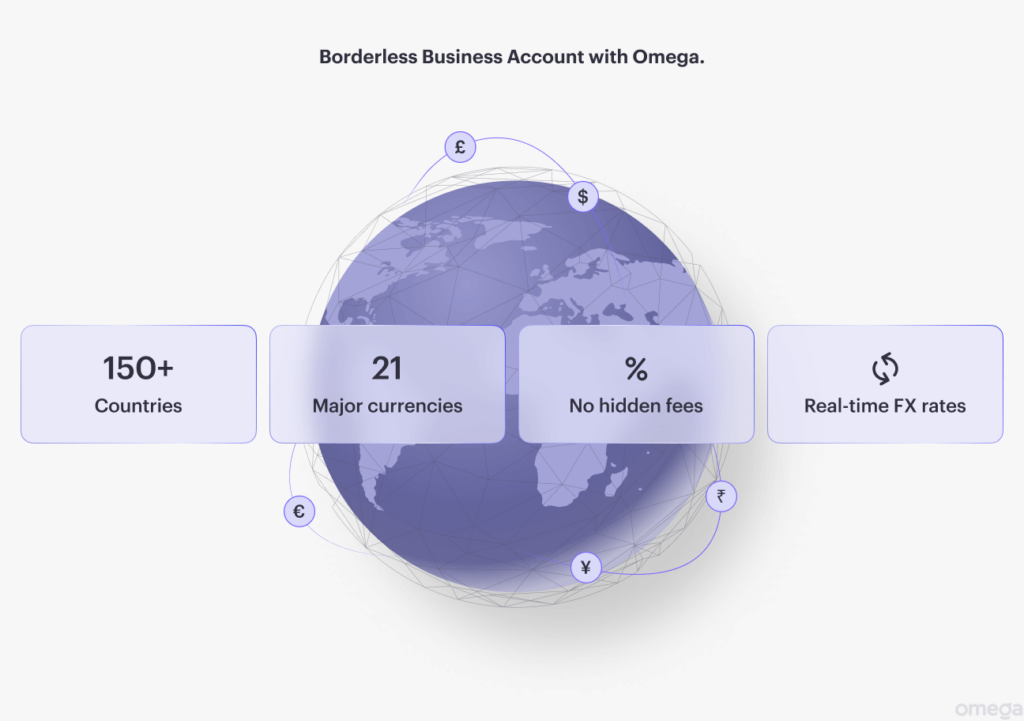

An Omega business account offers a versatile solution to all your transfer needs, combining the merits of bank and wire transfers – perfect for entrepreneurs or business owners who are serious about scaling their business rather than jumping through hoops.

Want to smoothen your international transaction process? Visit Omega today to learn more information on how we can help your business grow.

Frequently Asked Questions

What is the difference between wiring and transferring money?

Wiring money is generally assumed to mean using a wire transfer service, which may be faster since it can be used for international and major transfers. Transferring money is more general and may involve any of several means, including bank transfers, which are usually slower but cheaper for domestic transactions.

What is the difference between a wire transfer and SWIFT?

SWIFT stands for the Society for Worldwide Interbank Financial Telecommunication. It is a network of financial institutions the world over by which one institution can securely send information to perform wire transfers. It is not used on every wire transfer but on many international ones.

Can I wire money from bank to bank?

Yes, you can wire money from one bank to another. In fact, it is one of the most common ways to send large sums or make international transfers. With Omega’s business account, however, you have been afforded similar speed and security without the high fees commonly associated with traditional bank wires.

While traditional methods work, Omega is the modern and efficient alternative that truly fits the needs of today’s international entrepreneurs like yourself. Our business account combines the best of wire and bank transfer capabilities, giving you a flexible and cost-effective solution for all your financial needs. Learn more about Omega’s business account today.

Disclaimer.