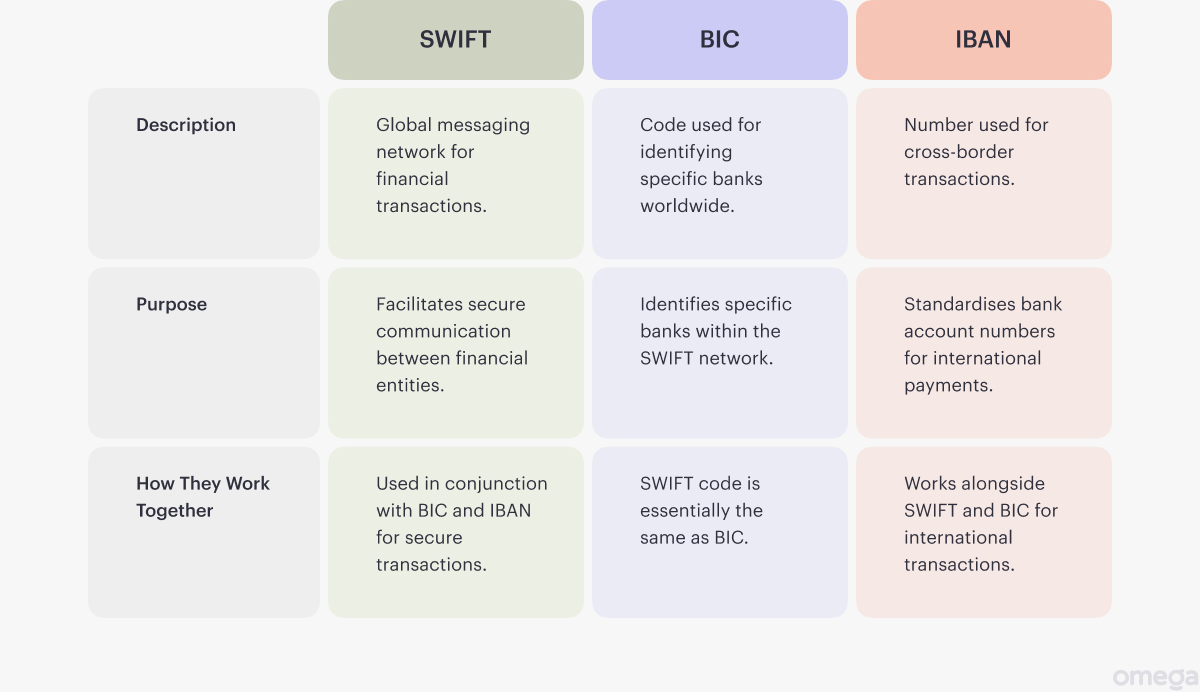

SWIFT, BIC, and IBAN are all three essential components to navigating the global financial landscape to ensure your money goes exactly where you need it to be in a timely and secure manner. This article intends to simplify and decode the seemingly complex big three terms regarding international banking.

Understanding SWIFT, BIC, and IBAN

For starters, IBAN (International Bank Account Number) is your bank account number in international lands. It consists of up to 34 characters and in the UK for example typically breaks down into the following:

Note: Your bank code, sort code, and account number may differ from the example above. You can easily find your unique IBAN on your statements. If not, ask your bank teller or customer service representative.

Your IBAN contains everything you need to make international transactions, including the country code, bank code, bank branch, and account number in the UK. Think of it as a passport for your money to travel to places.

Next, we have your BIC (Business Identifier Code), which is, simply put, your bank ID code, typically 8 or 11 characters long, that helps identify banks worldwide whenever money is sent. It is your BIC code that enables transactions to take place between two specific banks (yours and the second party). This is broken down into the following:

By this point, or eventually, you will come across the terms BIC and the SWIFT code (or SWIFT address) which are often used interchangeably, which might sound like two separate things, but they’re both essentially the same, which brings us to our final term. So, the next time someone mentions the BIC/SWIFT code, you now know they mean the bank ID code.

SWIFT (Society for Worldwide Interbank Financial Telecommunications) is a wide communications network for global financial institutions that exchange transactional information safely. To date, SWIFT is used by 212 countries around the world! Remember, SWIFT is the network, but the SWIFT code is your BIC.

Key Differences and How They Work Together

To clarify (as it may be confusing to most of us, if not all), the SWIFT code and BIC are NOT separate terms; they are the same. Your BIC/SWIFT code helps guide the money sent to the specific recipient’s bank ID.

On the other hand, SWIFT is simply the network banks use to exchange financial information whenever money is being sent or received worldwide.

Now we have your IBAN. The IBAN was initially intended for use within Europe only, but today, they’re used in over 70 countries worldwide! By now, you may be wondering how safe an IBAN is. The answer: Very.

The IBAN has been deemed secure by Eurozone financial regulators as with the IBAN; your account can only receive payments from other parties, but no withdrawals or transfers can be made with your account.

Altogether, they make up a robust financial mechanism to ensure your transactions are safely received and sent to respective recipients. Not as sophisticated as you thought, right?

Finding Your SWIFT, BIC, and IBAN

You now know the difference between the terms, but how do you find them in practice? We have you covered!

Finding My SWIFT/BIC

While there are a few options, such as contacting your bank’s customer service representative or teller, you can log in to your online banking by simply selecting the following:

- Your account that intends to use your BIC/SWIFT code.

- Your intended bank statement for use.

Once you download the PDF containing the full statement, your BIC/SWIFT code should be found right under your account summary.

Finding My IBAN

Similar to finding your SWIFT code/BIC, you can either contact your teller or select the following options after logging in to your online banking account:

- Your account that intends to use your IBAN.

- Your intended bank statement for use.

Doing so, will download a full statement, on which you can find your IBAN below your account summary on the right-hand side. And that is simply how you find your SWIFT code/BIC and IBAN.

FAQs

Is the SWIFT code equivalent to an IBAN?

No. The SWIFT code, an 8—or 11-character bank code, helps send your money to a specific and intended bank address. The IBAN is your international bank account number, 34 characters long, and it contains your country code, account number, bank name, and bank branch, to name a few.

Do I need a SWIFT code or an IBAN number?

It depends. Having a SWIFT code and an IBAN number enables easier transactions from overseas while keeping your sensitive financial details safe and sound for countries (e.g., Europe) that adopt the system that uses SWIFT codes/BIC and IBAN.

To check you have the right SWIFT/BIC code, use our free online tool.

Is a SWIFT code the same as a BIC?

Yes. Though the SWIFT code and the BIC are used interchangeably, they are the same.

Putting SWIFT, BIC, and IBAN in Action

Understanding the seemingly technical terms is no easy feat to begin with—until now. Knowing the differences between SWIFT, BIC, and IBAN is paramount to successfully navigating international banking securely, especially for business venturers like yourself.

What if we told you there is an even simpler way to make international business transfers? Learn more about how your business can make international payments in one go with Omega.