The benefits of utilising foreign exchange (forex) for payments or money management far outweigh the potential challenges. However, you do have to do a bit of homework to ensure the team or systems in place align well with your business goals. Otherwise, you run the risk of getting lost in a frequently evolving industry where regulation and economic policies drastically impact market dynamics.

To better understand how the foreign exchange payment structure can impact your operations, here are some of the more common challenges with payments you’re likely to encounter, as well as innovative solutions offered by our team at Omega.

Current State of Foreign Exchange

The cross-border payments market is projected to grow to $238.8 billion in 2027 with a CAGR of 5.3% (on average). This doesn’t account for currency exchange in crypto or other vehicles outside of “typical” market interactions and fiat currency.

To put it another way, the future of forex trading and payments is only going to grow. Introducing automation, AI-backed systems, and the fact that the UK remains the single largest centre of foreign exchange activity means that getting into forex payments now is a wise strategic move.

Having a system in place to help manage currency values as they rapidly fluctuate or pursuing business infrastructures that allow for flexibility when dealing with foreign exchange payments ensures your business is properly prepared for the future.

Top Challenges in Foreign Exchange Payments

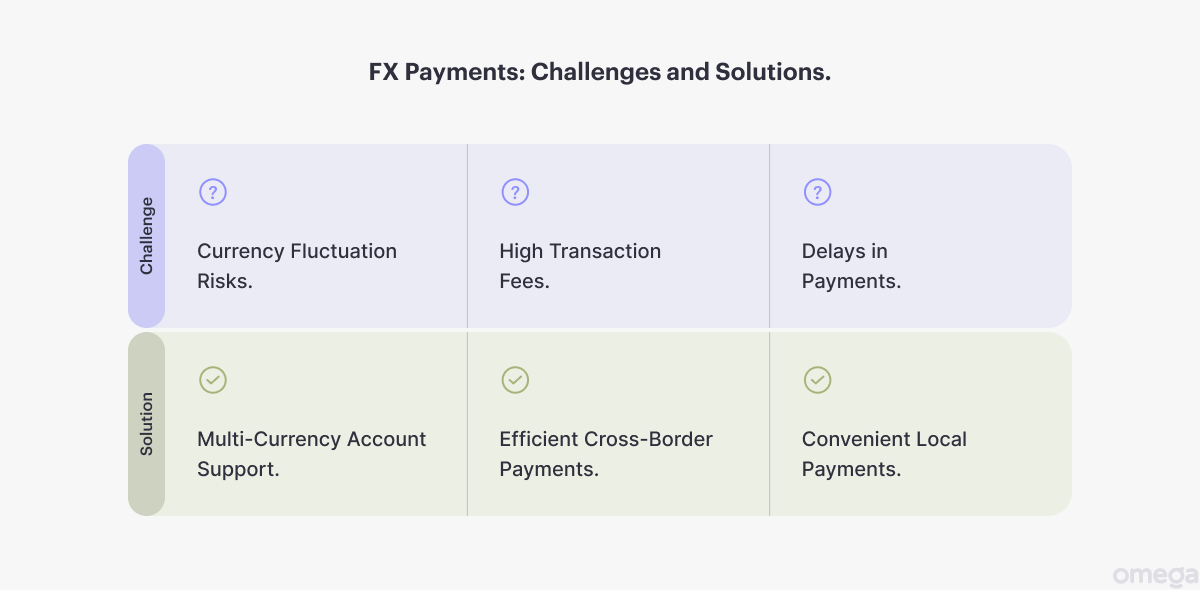

1. Currency Fluctuation Risks

There is no way to properly predict currency fluctuation. It is the most significant risk businesses face when accepting international payments. Geopolitical issues, unpredictable costs, and constantly shifting profit margins due to resource abuse and misallocation lead to elastic financial planning that directly impacts final currency rates – at the moment.

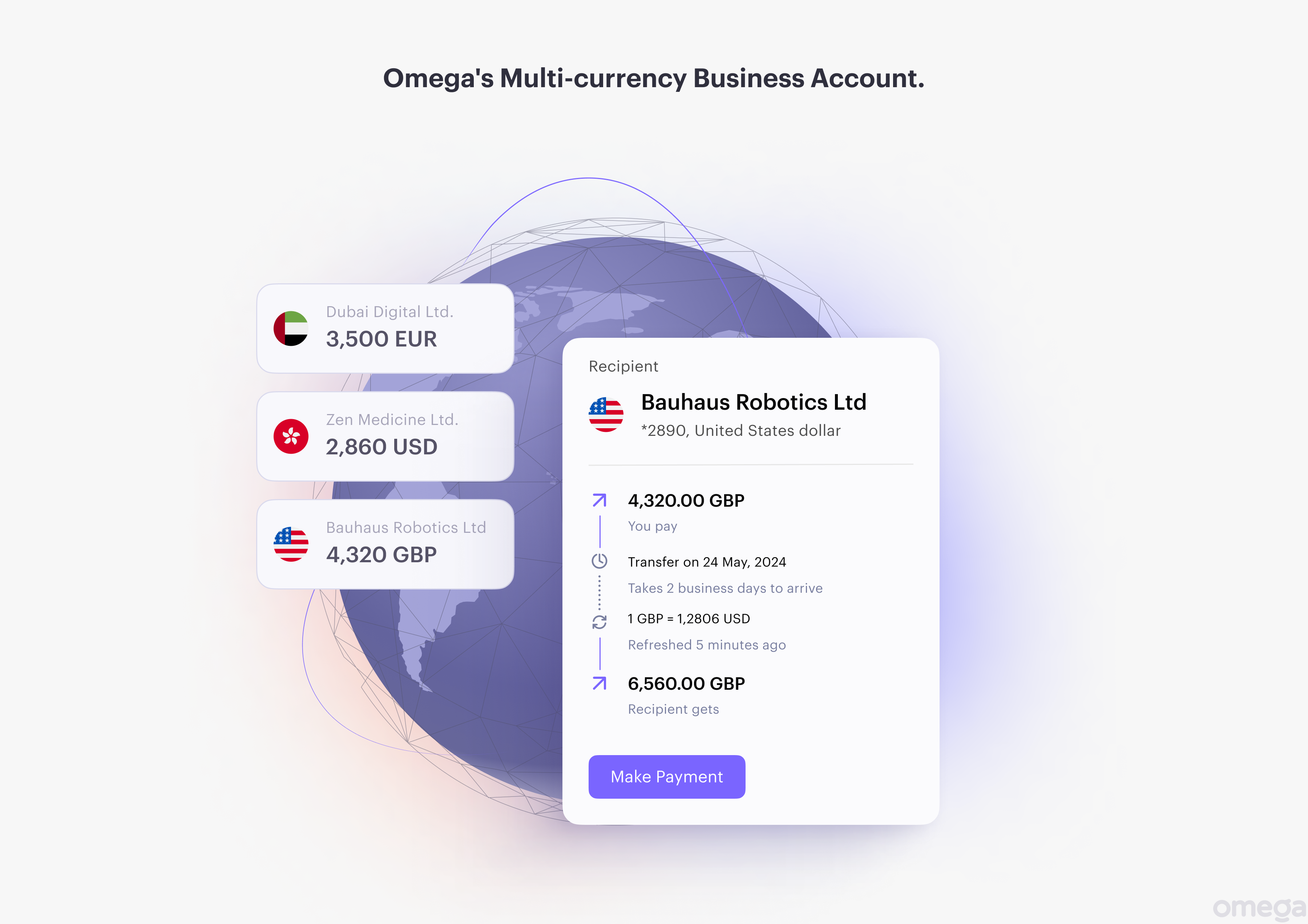

When you are facing an ever-changing currency market, expand your platform to account for using more than a few options. Omega offers Multi-Currency Account Support, allowing businesses to manage up to 21 currencies. This flexibility ensures companies can hold and exchange currency at the best possible rates, lowering the chances of price fluctuations imposing losses.

2. High Transaction Fees

Financial institutions of all types are waking up to forex payments growing in popularity. These organisations want to get a “piece of the pie” by imposing high fees. Over time, the accumulation of evolving fees leads to a loss of profit margins.

Your business must seek out opportunities to lower fees without sacrificing quality of service. Omega provides a solution through Efficient Cross-Border Payments using SWIFT and SEPA payments. Instead of being stuck in a traditional fee structure, your business receives competitive exchange rates and lower fees, efficiently minimising potential financial burdens.

3. Delays in Payments

International payments can and will be delayed. Money moves between time zones and currency differences, creating slow processing times. Whenever intermediary traditional banks get involved, these transaction chains tend to add more “links,” further extending your anticipated payment duration.

With Omega, your business is afforded the Convenient Local Payments program using GBP. This ensures a much quicker and far more efficient payment processing period by simplifying options in Omega’s network. Strong relationships and improved cash flow management boost business transactions so you can get back to what essential tasks matter most.

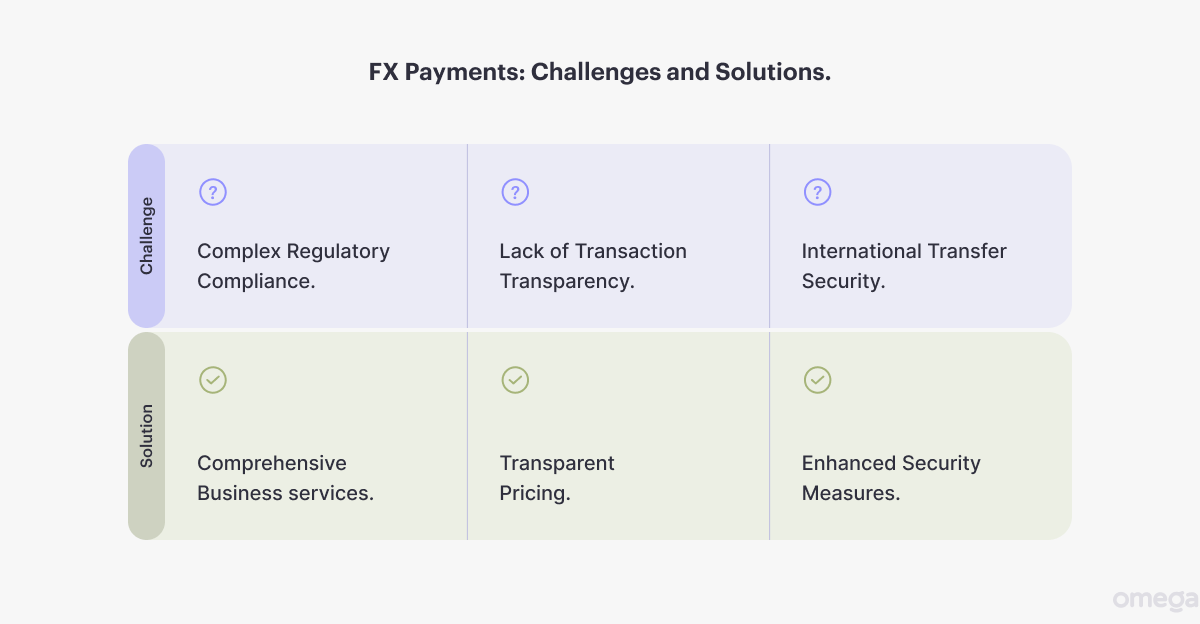

4. Complex Regulatory Compliance

The more foreign exchange payments you issue or receive, the greater the complexity. Various regulations in each corresponding country or standards you must meet place an undue burden on your business to navigate such a landscape unless you have some form of guidance.

Omega recently expanded its platform to include Company Registration and Accounting Services. These provisions streamline how your business is managed and set up in the UK, offering crucial support when navigating varying regulations and standards so you remain fully compliant with local laws.

5. Lack of Transaction Transparency

Foreign exchange payments are a complicated process. Unfortunately, many suppliers and users of forex are well aware hidden fees and unclear exchange rates can lead to massive profits. A business without the same level of knowledge risks mismanaging funds due to no “true cost” explanation in financial planning.

Your business needs to collaborate with a provider offering clear terms. For example, Omega uses Transparent Pricing, so all clients have a clear and upfront understanding of potential fees and exchange rates. This transparency builds trust with everyone involved and opens doors to more accurate cost estimates.

6. International Transfer Security Concerns

Around 32% of UK businesses are attacked by a cyber threat at least once a week. Phishing, ransomware, hacking, and other cybercrimes put international transfers at risk. Without proper protections in place, your business could experience a significant shortfall due to lost time, transfers, and financial data.

Omega champions the use of Enhanced Security Measures through multi-factor authentication and advanced encryption standards. This protects your transfers from unwanted prying eyes, fraudsters, and cyber-attacks. In addition, you’ll receive Dedicated Personal Managers offering tailored support that ensures every transaction is overseen with the utmost care and security.

Wrapping Up

The world of foreign exchange payments and money management is only going to expand in the near future. The more businesses from all over the globe adopt these processes, the greater the risk imposed.

That is unless you secure the services of vetted and experienced providers like Omega. Everyone from entrepreneurs looking to establish business in the UK to legacy companies can overcome the common challenges to forex payments through Omega’s comprehensive suite of services.

Simplify your international payments and improve operations by signing up for a Business Account with Omega. In only a few minutes, you’ll have a multi-currency account with international payments, accounting, legal support, and virtual office services. Available in 68 countries, this is your answer to success on the global business stage.

Disclaimer