Roughly 5.6 million UK businesses send and receive payments from each other, as well as leading companies around the globe. This massive volume of transactions requires speed and support to accurately deliver and receive crucial funds.

Both the BACS and CHAPS payments offer a way for businesses of all sizes to engage in a higher level of commerce – especially for those companies operating internationally.

Understanding what these two payment methods are, how they differ, and what the strengths and weaknesses they bring to the table for your unique business model is crucial in moving forward with current financial operations.

What are BACS Payments?

BACS represents the Bankers Automated Clearing Services. As one of the UK’s most reliable forms of transfer payments, nearly 100 million different transactions flow through this system every single day.

You typically find BACS payments with the use of credit cards, debit cards, and even some RFID or similar third-party processors like Apple Pay. Most often, direct payments from a bank to a business are used via BACS. Something like receiving pay from a business to an employee or paying for supplies when you’re renovating your home.

There is a ceiling on the amount of money transferred of £250,000. The transaction fees are typically low, but some banks may tack on additional value. Finally, BACS usually takes between two and three days to clear completely. A fun fact to know is that the UK government uses BACS to credit pension accounts.

Using Omega allows business accounts to leverage multi-currency accounts, allowing easy and straightforward to trace international transfers without high expenses.

What are CHAPS Payments?

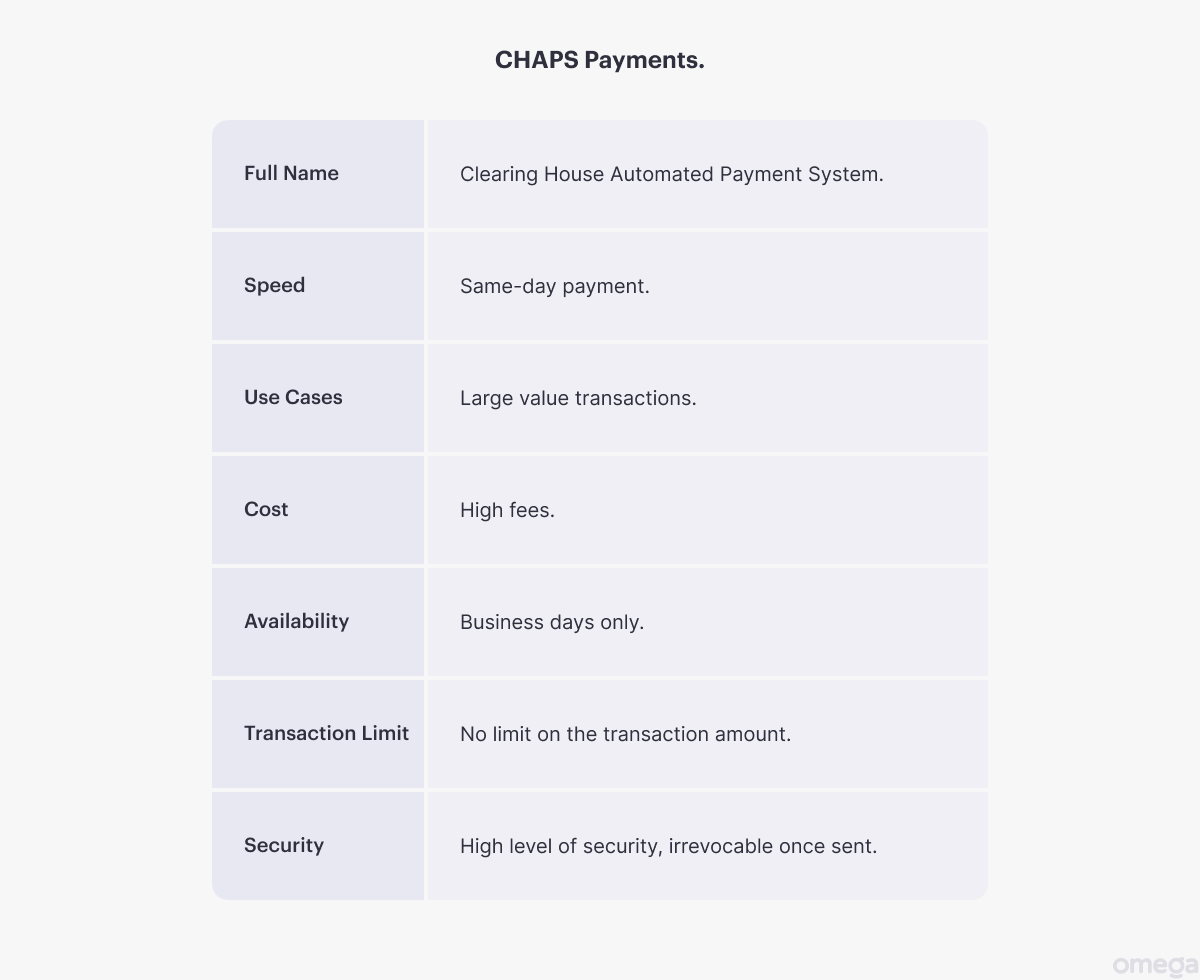

CHAPS payments are a bit different. This form stands for Clearing House Automated Payment System. Instead of being designed for smaller transactions that can take a bit of time, CHAPS focuses more on larger volume situations where daily resolution of funds is crucial for operations.

The quick transactions are also because CHAPS works only with sterling. That tacks on much higher fees between banks of anywhere from £15-£30 a piece. In other words, while you gain speed and volume, you do pay a premium price for each transaction.

There is no ceiling to conducting CHAPS transactions, which is why larger corporations prefer this method when dealing with massive payoffs during the day – assuming the order gets in before 3 pm local bank time.

You will typically see CHAPS used to acquire a new business, pay large corporate transactions, make real estate purchases, and other equally high-value options. When you use CHAPS with Omega, you get simplicity itself. Business accounts do not need to follow traditional banking services, allowing for advanced handling and higher levels of security for your peace of mind.

CHAPS vs. BACS: Key Differences

The difference between BACS and CHAPS payments comes down to only a few key elements. Understanding these factors helps determine which is suitable for your unique needs. This can include:

- Is BACS or CHAPS quicker for your needs? BACS takes two to three days to complete, meaning you slow your overall transaction process. CHAPS is extremely fast, often completed within the same day.

- Is there a cost factor in the CHAPS and BACS difference? The average cost of a BACS transaction is only 5p or so (with some additional fees if you’re using traditional banking). The cost for CHAPS is much higher, often in the £30 range.

- Are there any limits to a BACS or CHAPS transfer? While the former is designed for smaller payments, you run into a problem if you want to transfer more than £250,000. Anything over that size is better suited to the second system.

Knowing the BACS and CHAPS meaning and how they will apply to your particular business model informs the appropriate system needed for your business.

When to Use BACS vs. CHAPS?

What are better really depends on what type of business you are operating. For example, if you have a chain of bakeries operating early in the morning and conducting thousands of small transactions for coffees, donuts, and bagels, you should choose to use BACS payment.

In contrast, during trading season, a football club needs to make well over £250,000 payments to secure players, pay off vendors, and deal with anticipated employee insurance for the upcoming year. That is when using CHAPS makes way more sense. You have fewer transactions but at a much higher amount per item.

Either way, businesses managing cross-border operations or large ventures are better served through Omega’s unique platform. This provides a safe, reliable, and streamlined method for switching between BACS vs CHAPS payment systems whenever the need occurs – without suffering time delays.

Final Thoughts

Stop wondering which is faster payment BACS or CHAPS or how to make use of each system independently to maximise your profits. When you get the basic outline of how each works, you are a step ahead of many other business owners.

Just remember BACS equals larger volume, smaller sized transactions with low fees over a few days, and CHAPS means high value, one-time purchases for big-ticket items on the same day. That is a good starting point to ensure you are picking the right solution for your operations.

If you are a business requiring a method to switch between either payment transfer system, using Omega’s business accounts is a surefire solution. You gain a flexible, secure platform designed to scale and grow alongside your business, whether for daily operations or high value purchases.