In today’s global economy, doing business rarely means sticking to a single country and currency — or even a single continent. If you want your financial management to reflect this new reality, opening a borderless business account is the way.

This guide covers everything you need to know about this new account type and how an Omega Business Account ticks all the boxes.

What is a borderless business account?

Typically, business accounts are linked to the account holder’s country and carry out transactions in the domestic currency by default. You may still be able to send money to accounts that use other currencies, but it’s rarely straightforward and tends to come at a (literal) cost.

Borderless accounts offer a modern alternative, revolutionising the idea that accounts must be tied to a specific location. Instead, these accounts facilitate transactions between various currencies and countries.

Although the exact features may vary between account types, they all have one thing in common: a focus on making international transactions simple and low-cost.

This may mean a multi-currency account that allows you to have different accounts for different currencies, all under the same provider. Other times, borderless accounts facilitate easy, user-friendly conversions between currencies. Or, they may do both!

Key Benefits of Borderless Business Accounts

If you’re still wondering why borderless business accounts are a better option than standard accounts, we’ve outlined the main benefits below.

Few or No Hidden Fees

Before the emergence of borderless accounts, currency conversion was an expensive affair.

For instance, PayPal Merchant charges a 1.29% fee for receiving international transactions from within the EEA and a 1.99% fee for receiving money from other markets. These charges are in addition to the standard fees for business transactions.

PayPal is far from alone here, with many other payment providers and financial institutions having similar fee structures.

Since borderless accounts are made with international payments in mind, they keep fees involved in switching between currencies to a minimum.

Better Exchange Rates

Some payment providers or banks may claim that they don’t charge for currency conversions but carry hidden costs through poor exchange rates.

When you pay for something with the credit or debit card associated with your bank account, you generally have no choice but to pay whatever they are offering you.

This is often very different from the real-time exchange rate.

Since borderless accounts are designed with currency conversions in mind, they offer competitive conversion rates. This may mean offering the interbank exchange rate (the rate established financial institutions can access for conversions) or another real-time exchange rate.

Convenient Conversions

Traditional bank accounts often automatically convert money between currencies when you make a payment in a non-domestic currency, leaving you no choice but to pay over the odds.

Borderless accounts provide a way for you to have some control over the exchange rate and handle your conversion in the way that’s most convenient for you.

For instance, if you run a British business and receive euros from one client, you can hold them in your euros account and use them for a euros payment another time.

More Credibility

If you’re doing business with a company from another country, having a business account that allows you to accept or transfer in their native currency gives you more credibility.

This helps you gain more trust from your clients or customers and encourages them to do business with you. Everyone likes the familiarity of using their own payment system and a currency they understand.

Introducing Omega

Omega offers a borderless business account specially designed for international entrepreneurs.

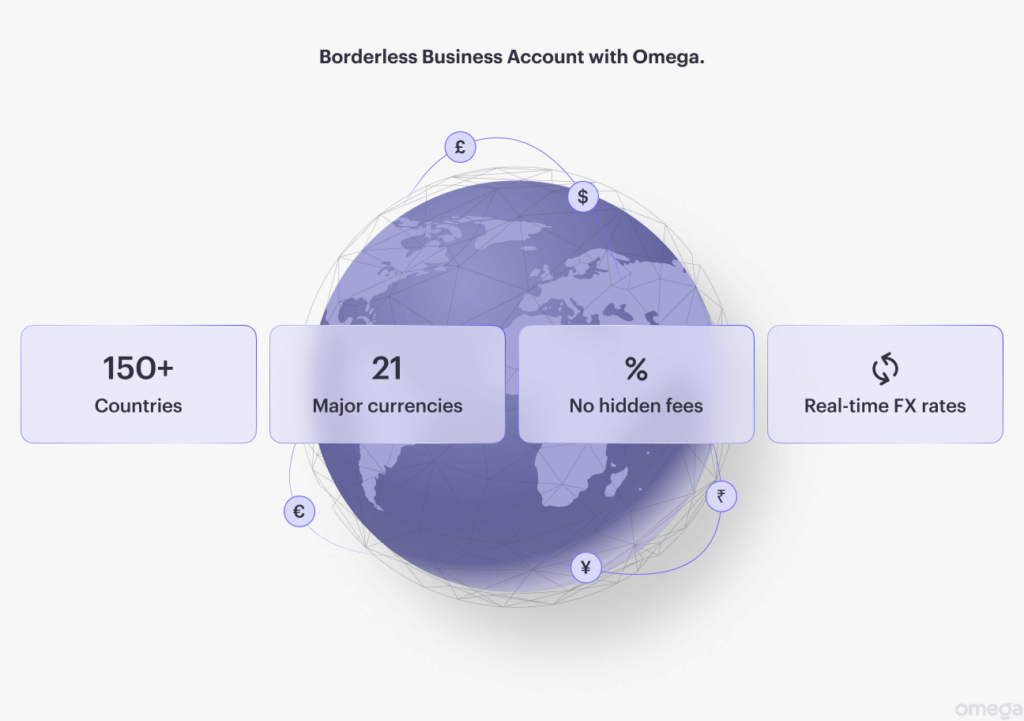

It offers real-time FX rates for currency conversion, giving account holders access to some of the most competitive rates on the market. Accounts support various local payment schemes too, including SWIFT and SEPA. Which means you can make outgoing payments to more than 150 countries and hold funds in more than 20 different currencies.

Yet Omega goes beyond the usual benefits associated with a borderless account. It aims to be a one-stop-shop for all business needs, offering features to help companies handle accounting, legal, and other administrative tasks.

All this money is kept safe thanks to safeguarding from third-party UK and European financial institutions, and regulation from the Financial Conduct Authority (FCA).

Join the Borderless Revolution

Borderless business accounts give companies an easy way to work with customers and clients from across the globe. With low fees, easy conversions, and the credibility of local accounts in different countries, you will no longer be tied to your geographical location.

Get started with Omega today and access all these benefits, along with a comprehensive suite of business services designed to set up your business for success.