Thanks to the rapid growth of digitalisation, the last few years have seen nothing short of technological breakthroughs. Today, we see the fintech space creating innovative solutions, disrupting the old order of the financial landscape. Omega is one of the financial trailblazers in the fintech space, as it aims to provide customers more than traditional banks offer.

This article delves into everything you need to know about Omega, traditional banks, how they differ, and everything else in between so you, as an entrepreneur, can make the most informed decision possible. Let’s get to it.

Understanding the Basics

Omega offers a business account that provides more than just financial services in multiple currencies. It also delivers services to aid new business owners or those looking to start a business venture in the UK. Unlike traditional banks in the UK, such as Halifax, Lloyds Bank, or Santander UK, Omega is an EMI (Electronic Money Institution), not a bank.

Traditional banks in the UK (or anywhere else in the world) are long-established financial institutions. They offer various financial services such as personal or business loans, ATM networks, and cash deposits and often have physical branches.

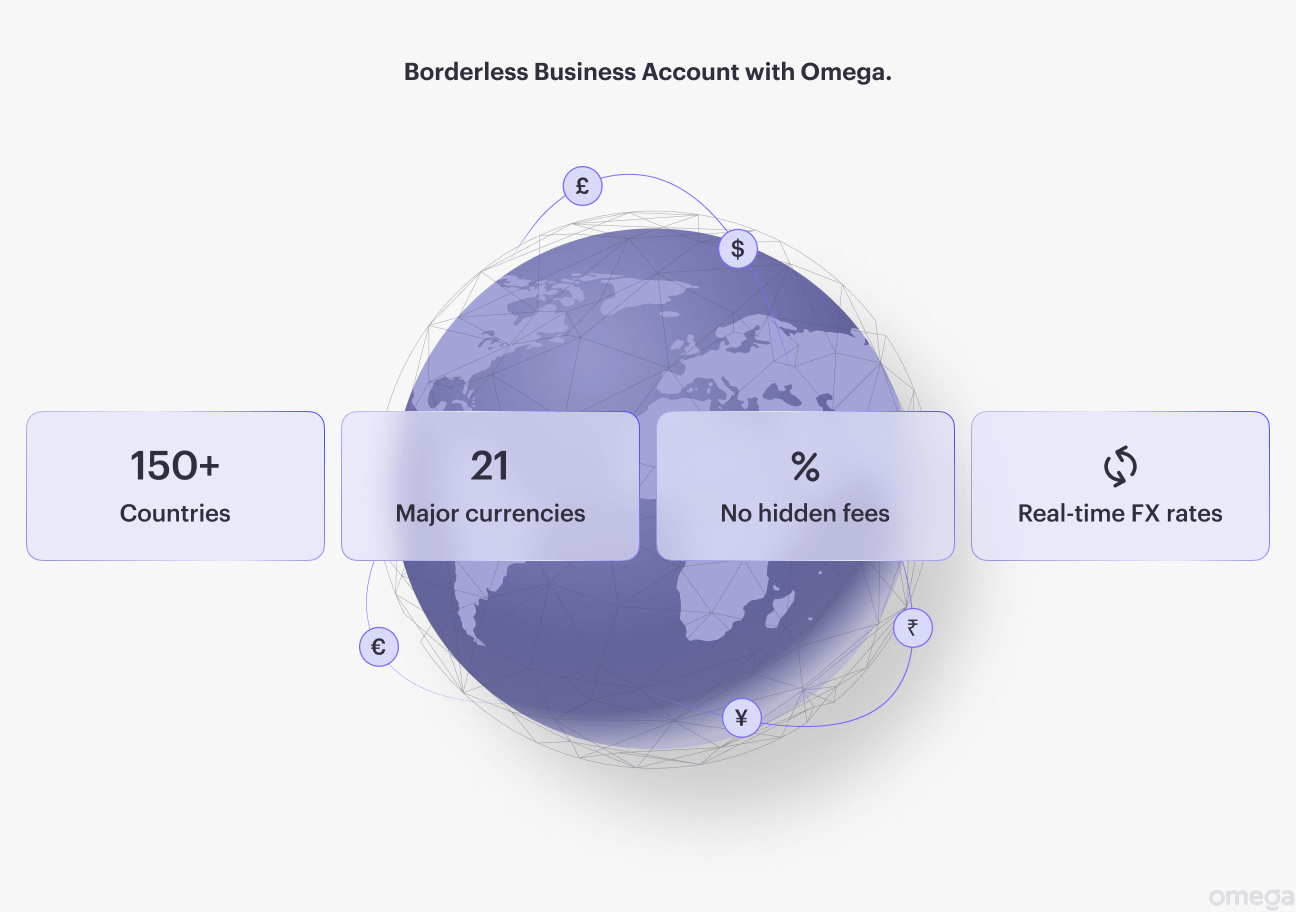

Omega shares similar financial services to traditional banks, including multi-currency accounts to send and receive money in various currencies, competitive foreign exchange rates, including the FX deduction fee (about 1 to 3% of the converted amount), and global and local payments.

Key Features of an Omega Business Account

You may wonder, what makes Omega Business Account stand out from the traditional bank accounts most people are already used to? We are glad you asked!

Business Account Services

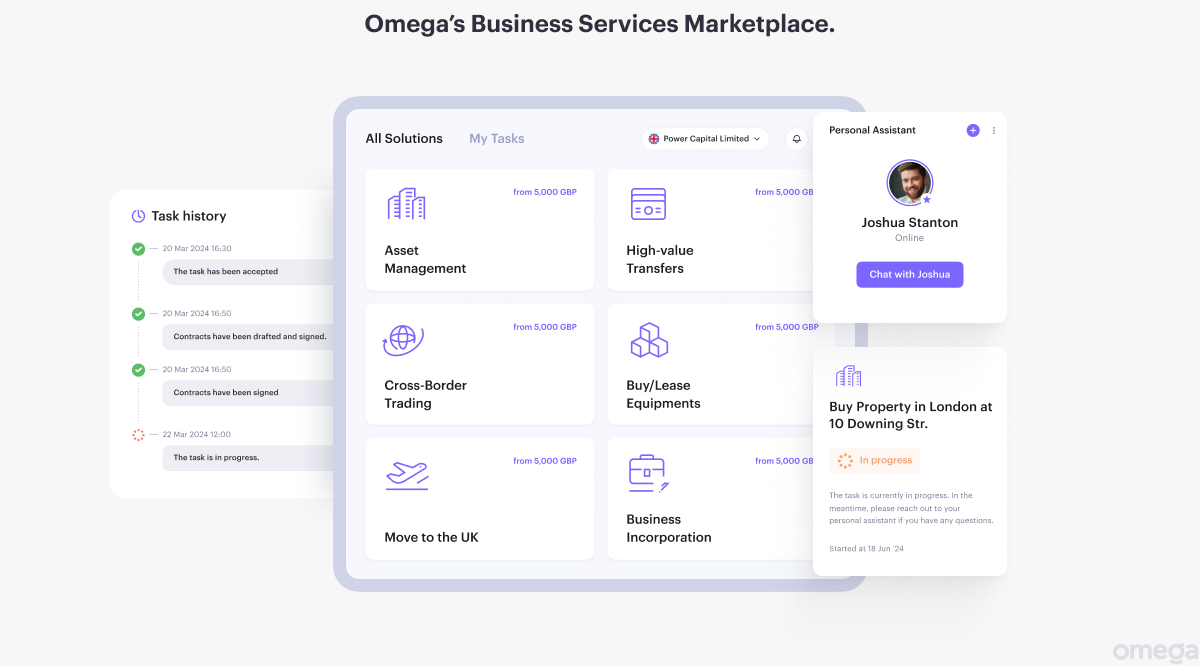

Unlike traditional banks, Omega tailors its services to provide business owners with the proper tools and guidance through Omega’s business services to get their businesses up and running, from registering a UK company to providing core business services such as accounting, legal, cross-border operations, high-value ventures and immigration.

Multi-currency GB IBAN

Having an International Bank Account Number (IBAN) in your UK business name can enhance your business’ credibility and the value of your services. IBANs contain all the details you need to make international transactions. Imagine your money having a passport to safely go anywhere in the world—that is an IBAN.

As endorsed by the Eurozone financial regulators, IBANs are considered secure as your business account with the IBAN can only receive payments in over 22 major currencies from senders, not making withdrawals or transfers with your account.

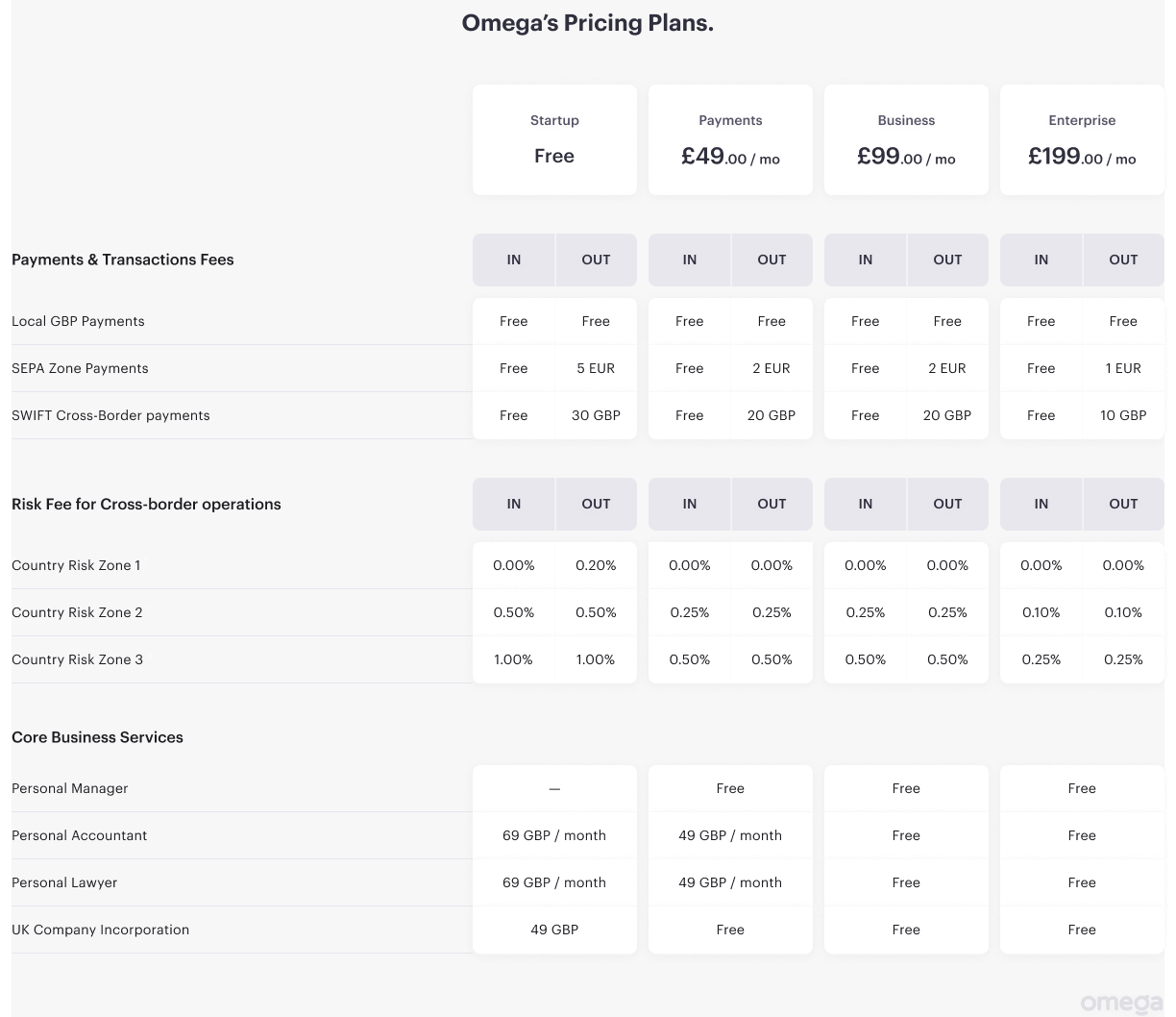

Competitive, simple, and transparent pricing

When it comes to pricing, fee structures can get complicated in traditional banks, given that these banks are large corporations but not with Omega. Omega understands how important transparent and straightforward pricing plans are, especially to business owners.

This is why Omega prides itself on offering various transparent payment plans based on your different business needs. These plans include core business services such as having a personal third-party accountant and lawyer, payments and transaction fees. They also cover SWIFT cross-border payments, SEPA Zone payments, FX conversion fees (at 1% of the converted amount), and a risk fee for cross-border operations.

What Traditional Banks Offer

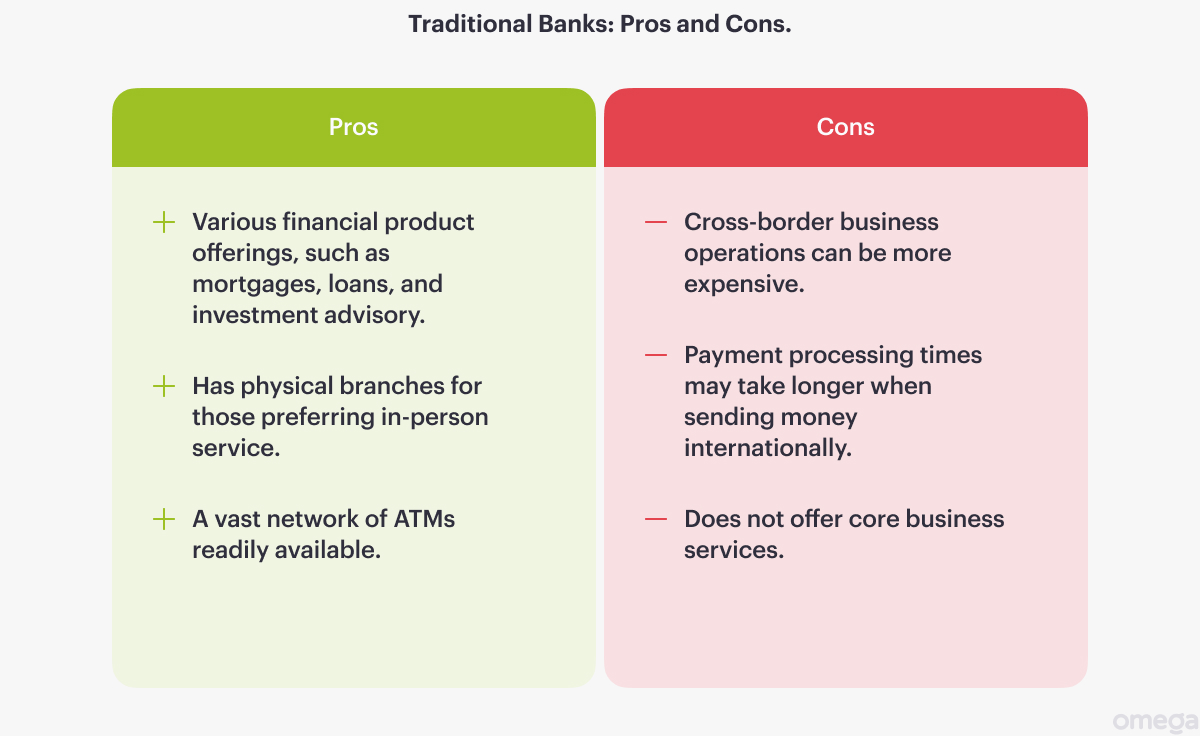

As you may know, traditional banks are more tailored towards general financial purposes, though they do offer a wide range of services for businesses, such as credit options through loans, checking and savings accounts, essential account management, and investment advisory.

Traditional banks also increasingly offer digital and mobile banking services for financial management at your fingertips. Examples include depositing checks online, managing accounts, and transferring money.

Though traditional banks in the UK facilitate cross-border transactions, their process and transfer times may be more complex and lengthy than Omega’s. Given the size of these company structures, banks often require more documentation and longer wait times for account setups or payment processing. Wire transfers are commonly the way to send international payments.

Lastly, banks offer a vast network of ATMs to manage finances at multiple locations where you live and can often be found inside or near a physical branch for in-person customer service.

Understanding the differences

Informed decisions are often the best decisions for any person or business. The final verdict on opening a business account with Omega or a traditional bank account depends on your business needs and circumstances, as there is no one-size-fits-all option.

The last few years have shown how rapid technological advancements can change the business dynamics in any industry, and it is vital that your business adapts just as quickly. As a fintech startup, Omega understands how pivotal flexibility can be in changing times and helps companies leverage these changes through our suite of business services.

Regardless of your choice, we hope you know more about the difference between opening a business and a bank account. If you are still unsure, contact us to learn more and ask any inquiries so we can help you take the best step forward.

Disclaimer.