We live in a time where no boundary is too far to reach with the power of globalisation that has seemingly blurred the lines from one national market to another. This emphasises the importance of understanding the dynamics in international foreign exchange (or FX for short) payments.

If you are reading this, you are probably wondering: first, what are international FX payments and how do they work? This article intends to dive into the two questions head-on and other essential factors you must consider when using FX payments. Let’s get to it.

Understanding Foreign Exchange

Foreign Exchange (FX) payments are transactions that convert one currency to another (e.g., Euros to USD). This enables customers and businesses to send and receive their respective country’s currency, which can become leverage for companies that allow this.

As a business owner, you know how crucial it is to ensure and maintain healthy stakeholder relationships. FX payments strengthen these relationships by allowing suppliers overseas to receive their due payments in their currency promptly and without hassle.

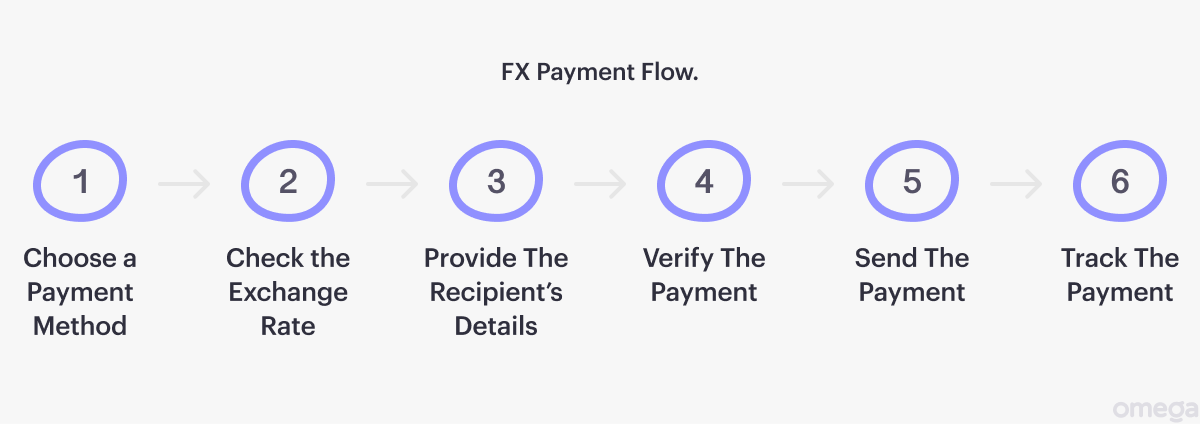

The Mechanics: How FX Payments Work

To make things easier to grasp, here is an example of how FX payments work. Say you are a merchant based in the US contacted by a UK customer ready to buy. Here is a brief overview of how FX payments come into play.

- A UK customer visits and places an order from your e-commerce store. Before paying, they switch the currency switch feature on your site to GBP (the British Pound). If you do not have a GBP account, your bank will usually exchange the currency for you, so you will then receive the payment in USD.

- Your payment processor manages your payment through a credit card, wire transfer, or other method. This allows the currency conversion to occur at the current exchange rate.

- When the FX payment comes through, you will get the equivalent purchase amount in USD converted and exchanged from GBP with minor FX fee deductions (typically 1% to 3% of the converted amount). These fees go to your payment processor or any other intermediary banks that may or may not be involved in the transaction.

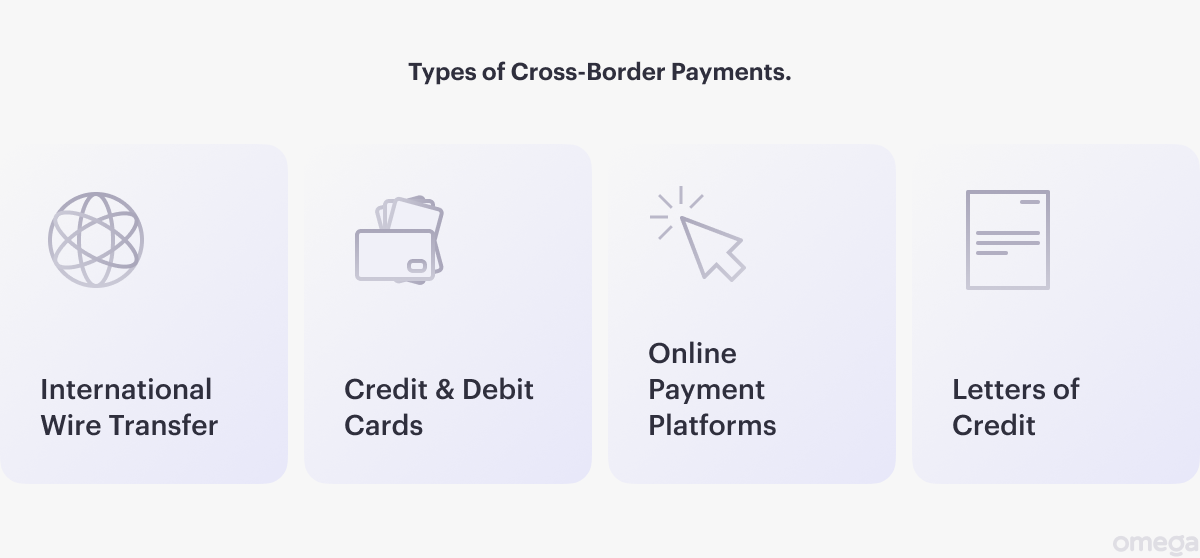

Types of FX Payments

While there are various ways to make cross-border transactions, here are some of the most common ways merchants send and receive international payments.

Wire Transfers

As you may already know, wire transfers enable international (and domestic) transactions from one bank account to another without an intermediary. Most people prefer this method due to its security, reliability, and directness.

International wire transfers often occur through SWIFT (a vast telecommunications network for global financial institutions that exchange transactional information safely), ensuring the safe passage of all transactional data exchanges through a standardised system of codes.

Credit Cards or Prepaid Debit

It stood the test of time for a good reason—it is widely accepted, secure and relatively straightforward.

Customers can load their prepaid debit or credit card using a particular currency, and cards issued by Visa, Mastercard, and American Express, for example, are acceptable. However, this FX payment type is only limited by how much the customer adds to it, and currency conversion fees still apply regardless.

Pros and Cons of FX Payments

Below is an overview of strengths and considerations in using FX payments for your business.

Pros

- Widen your target customer base. Enabling FX payments enables your business to reach international markets, diversify your customer base, build your brand, and potentially increase revenue. This helps strengthen your business against relying on a single economy of a country.

- Gain competitive advantage. Convenience is crucial in customer retention; FX payments promote this by reducing buying friction from your customers.

- Build customer trust and loyalty. Providing trusted and familiar payment methods keeps your customers at ease, knowing their payments and financial information are secured and protected from fluctuating exchange rates that may occur.

- Navigate legal and regulatory nuances of international transactions. Complying with and knowing international financial standards, such as AML (anti-money laundering) and KYC (Know Your Customer), enables your business to compete legally and ethically, avoiding any legal complications should your company do otherwise.

Cons

- Cross-border transaction fees. These fees may be costly when making international payments, especially for financial institutions and banks.

- Exchange rate fluctuations. When conducting international FX payments, you should expect high volatility. Determining the exact payment’s worth in the receiver’s currency can be tricky when the transaction is completed.

- Bank operational delays. Due to differing time zones, operational hours, and regional holidays, this may lead to FX payment delays.

Using International FX Payments to Your Favour

As we enter a more globalised economy, business owners need to stay ahead competitively and always be mindful that small details can make a huge difference between making or breaking a business.

Using FX payments correctly can help ensure your company’s competitiveness and earn consumer trust and loyalty, which in turn sets the foundation for a strong and diversified customer base.

If you are a fresh startup or a small business owner with a handful of years in the business who is new or somewhat familiar with FX payments, you know that decisiveness and calculated risk are crucial to moving your business forward.

To do so, you need the right resources, support, and consultation before fully integrating FX payments into your business; that’s where we specialise. At Omega, we can do more than just make fast, cost-effective international transfers.

We are a Business-in-a-Box, where your business can open a multi-currency account with international payments, legal, accounting, and virtual office services at your discretion. Learn more about how you can make cost-saving and fast global payments simply.