Choosing to opt for self-assessment this tax season? Here are the dates to know. If you are an international entrepreneur setting up a company in the UK, knowing (and abiding by) the tax system is key. The last thing you want is to run afoul of tax issues that could cost you more than just late fees!

One of the most important parts is knowing when your tax return is due. This is the date by which you should either submit your return or have filed for an extension. Let’s take a look at the key dates for self-assessment tax returns in the UK so you can stay compliant and avoid penalties.

Want to see how you can save more and stay ahead of the tax season? Omega has the business accounts entrepreneurs depend on to make their money work for them.

What Is The UK Tax Year?

Before we get into the deadlines you’ll need to follow, let’s look at the UK tax year.

Unlike many countries, the UK tax year doesn’t run from January to December. For businesses and individuals in the UK, the tax year runs from 6 April to 5 April the following year. For example, the 2023/2024 tax year started on 6 April 2023 and ended on 5 April 2024.

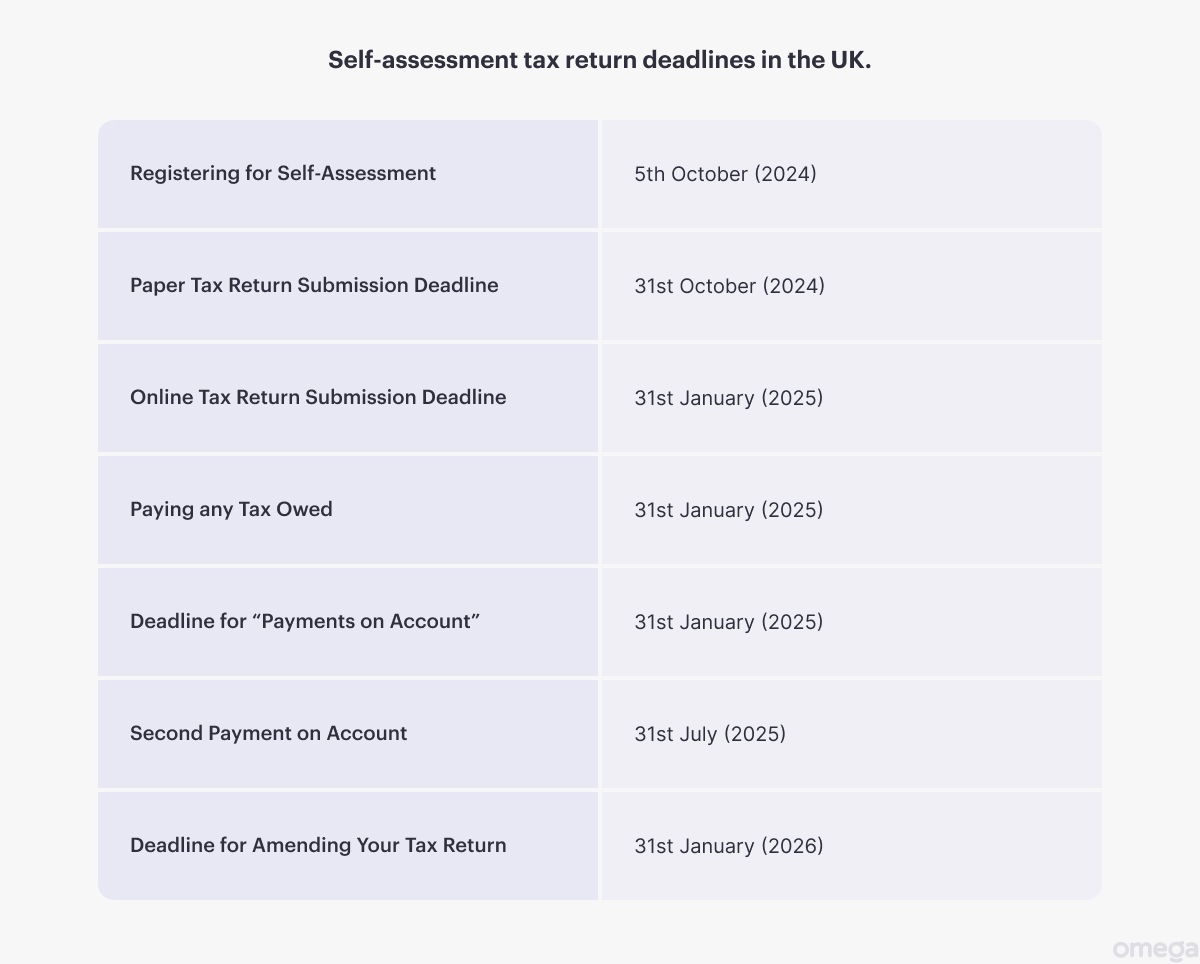

Self-Assessment Key Dates

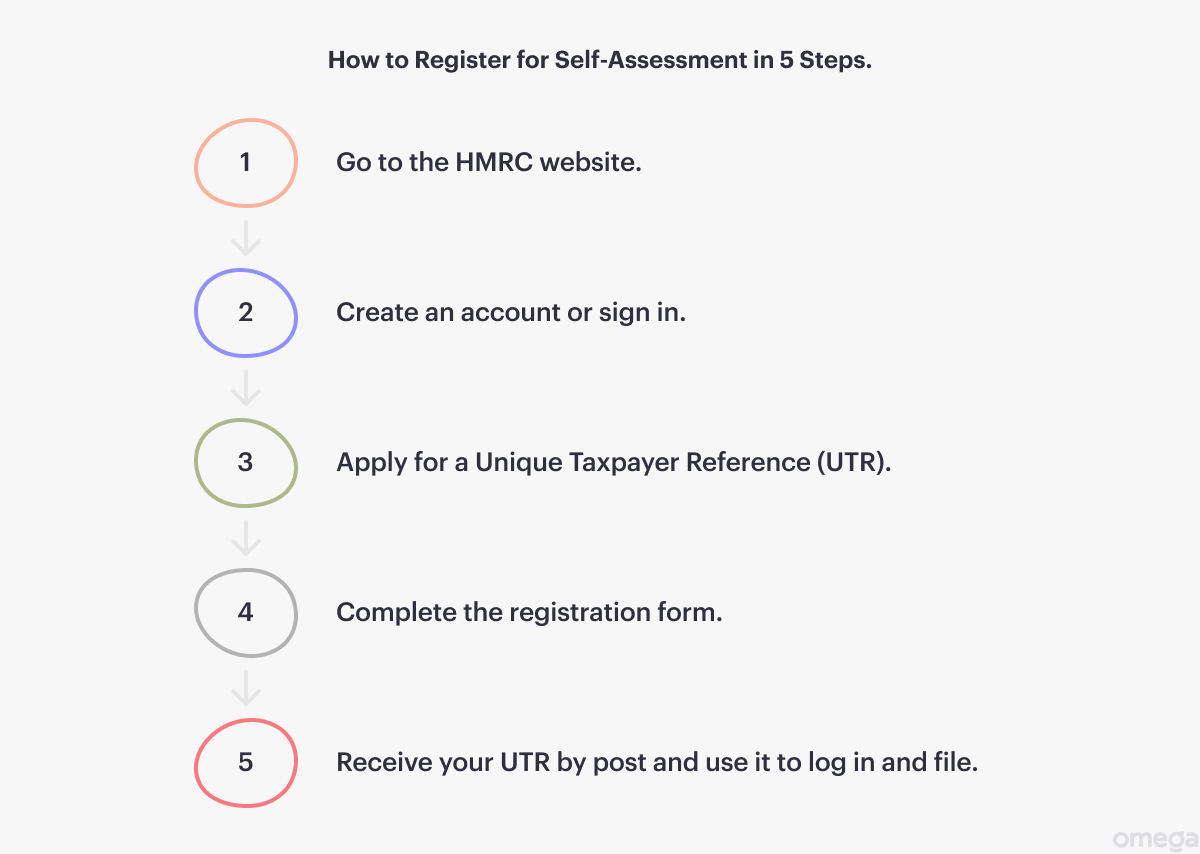

1. Registering for Self-assessment: 5 October

If you are new to self-assessment and haven’t filed a return before, you need to register with HM Revenue and Customs (HMRC) by 5 October following the end of the tax year for which you need to submit a return.

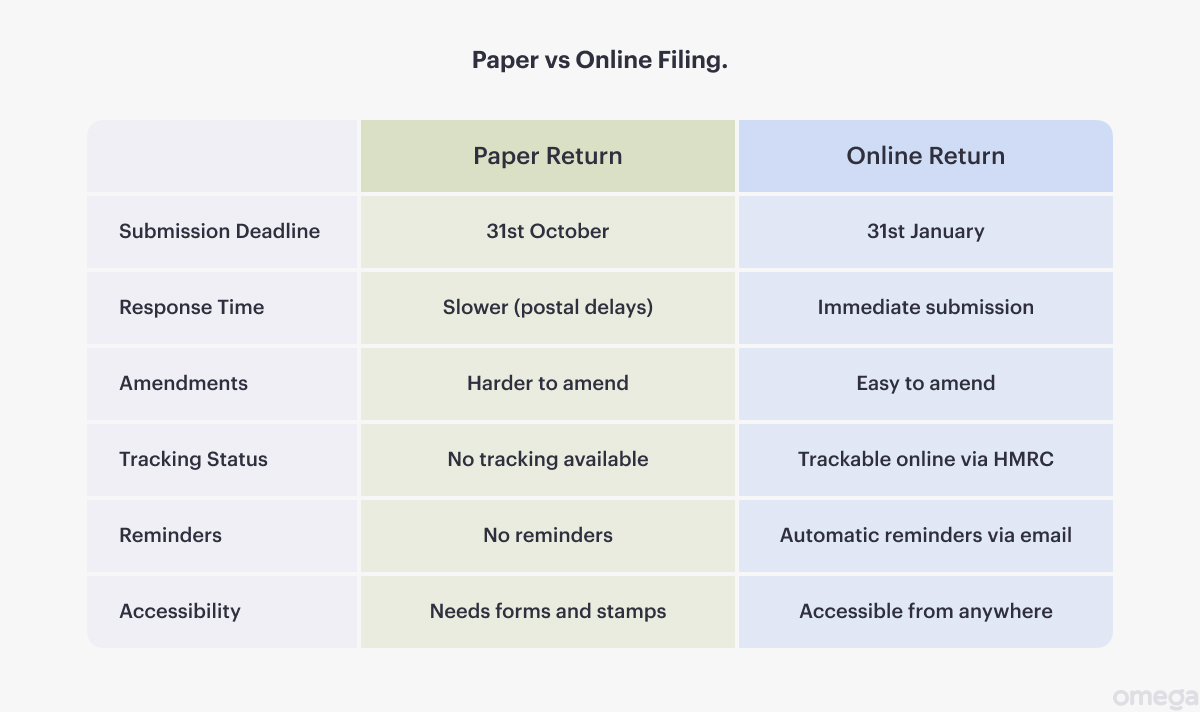

2. Paper Tax Returns: 31 October

If you want to submit your tax return on paper, you need to do so by 31 October following the end of the tax year.

3. Online Tax Returns: 31 January

Online submissions need to be in by 31 January following the end of the tax year. This is also the deadline for payment of any tax due.

4. Payments on Account: 31 July

If you make advance payments towards your tax bill (known as ‘payments on account’), there’s usually a second payment deadline of 31 July.

Corporation Tax Deadlines

For limited companies, the deadlines are different – so you will want to know exactly which type of company you are running to know which date to follow!

- Filing Deadline: Your company tax return must be filed within 12 months of your accounting period end date.

- Payment Deadline: For companies with taxable profits up to £1.5 million, corporation tax is due nine months and 1 day after your accounting period ends.

Tips for Meeting Tax Deadlines

1. Start Preparing & File Early

Don’t wait until the last minute to prepare your tax return. Start early, and you will have time to gather all the necessary documents and get help if you need it.

2. Keep Accurate Records

Keep detailed financial records throughout the year. This will make completing your tax return so much easier and faster.

3. Use Digital Tools to Your Advantage

Consider using accounting software or digital record-keeping tools to make financial management easier. Omega’s business account has built-in tools to help you track income and expenses, making tax time less stressful.

4. Set Reminders For Key Filing Dates

Mark the tax deadlines in your calendar and set reminders well in advance so you don’t miss any important dates.

5. Don’t Be Afraid To Get Professional Help

If you are unsure about any part of your tax return, consider getting advice from a qualified accountant or tax professional.

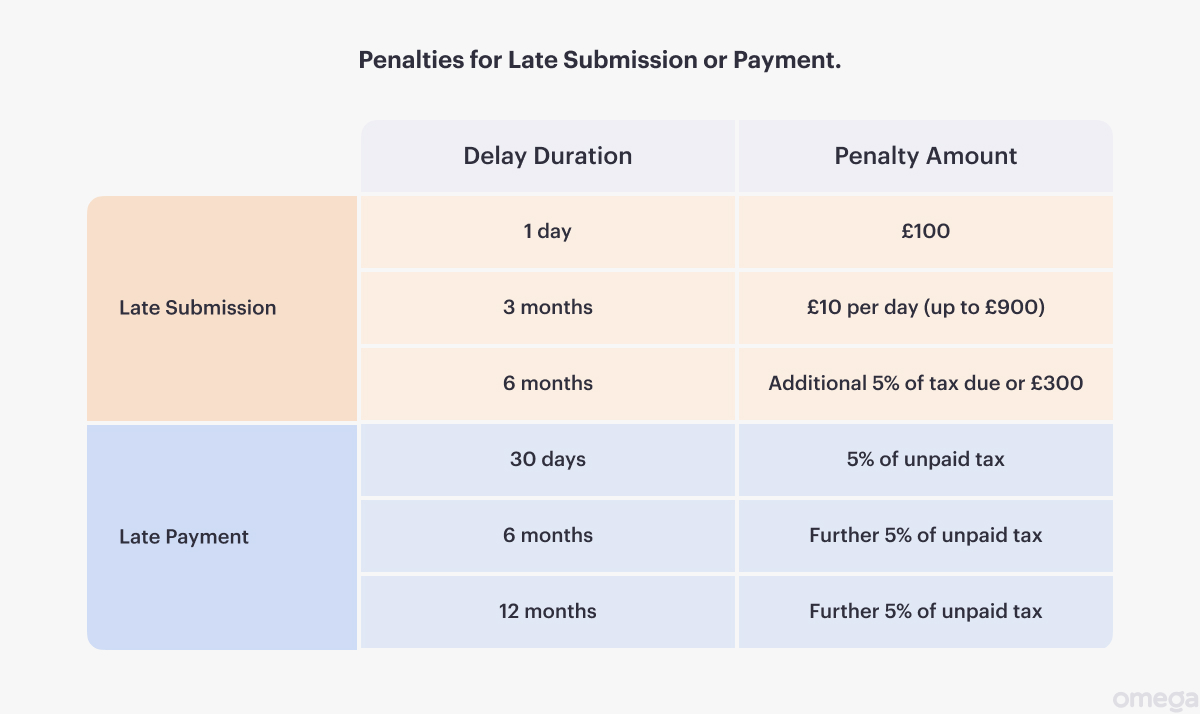

Late Filing Penalties

Missing tax deadlines can result in penalties from HMRC. These can be:

- A £100 fixed penalty for late filing.

- Additional daily penalties of £10 per day (up to 90 days maximum of £900) for returns more than 3 months late.

- Further penalties for returns 6 and 12 months late.

As a business owner, you would rather spend money on your business than pay late fees and fines. Make sure you submit your return and pay any tax due on time to avoid these penalties.

How Omega Can Help This Tax Season

Running a business and keeping on top of tax obligations can be tough, especially for international entrepreneurs new to the UK system. At Omega, we partner with entrepreneurs and business owners to offer business accounts designed for companies operating in the UK.

With an Omega business account, you can:

- Track income and expenses, making tax time easier.

- Appoint a third-party accountant specialist to assist you every step of the way.

UK tax return deadlines are key to your business running smoothly. Stay informed of the dates and use Omega’s business account to manage your finances, and you will be HMRC-compliant and penalty-free.

Remember, tax laws can change, so always check the HMRC website or consult a tax professional for the latest information. With planning and the right tools, you can navigate the UK tax system with ease and focus on growing your business.

Disclaimer.