For most founders, creating a startup is all about the vision. But while maintaining a budget is hardly the most glamorous or interesting part of running a business, going without one isn’t an option. The statistics say it all — 57% of UK businesses reported turnover challenges in October 2024, with many stating economic certainty as a major issue.

A start-up budget is one of the best tools at your disposal to minimise financial problems. Let’s look at five of the biggest reasons for budgeting.

Why is a Budget Important for a Business?

There are countless reasons for why a startup budget is so useful, but we have outlined five of the most crucial below.

1. Cover High Start-Up Costs

Every company has costs. But when you are just getting your business off the ground, costs are often at an all-time high due to the substantial upfront investments. These are trickier to budget for than the routine payments and overhead costs of a more established firm.

You may have to consider the following costs:

2. Uncertain Revenue

Established businesses tend to have a consistent revenue stream or multiple sources of potential income — while budgeting is still crucial in this case, it does leave a little extra room for manoeuvre.

Meanwhile, startups are often solely reliant on grants and investments for their first few years of operation. Others may have a small number of clients or customers, but not yet enough to completely cover costs.

Therefore, startups rely on cash reserves to cover all their costs for a fixed period (such as one or two years), with uncertainty about where money will come from once this period is over. This may come from external startup funding or their own personal capital.

It’s therefore crucial for them to budget carefully and ensure the funds they have can last them as long as needed.

3. Access to Credit

Many businesses need to borrow money at some point in their journey to balance their expenses with the money coming in. While startups are increasingly relying on personal capital and alternative sources of funding, it is always good to know that loans and credit are available as an extra lifeline to tap into when needed.

But budgeting failures can make it harder (or even impossible) to obtain this much-needed funding.

Lenders look at financial statements like balance sheets and cash flow to see how creditworthy a business is. If these show that a startup has poor cash flow management, they may be more apprehensive to lend to you.

Also, if poor budgeting leads to late payments or high debt utilisation, it can hurt your credit score, which will make you less likely to be approved for loans.

4. Strategic Investment

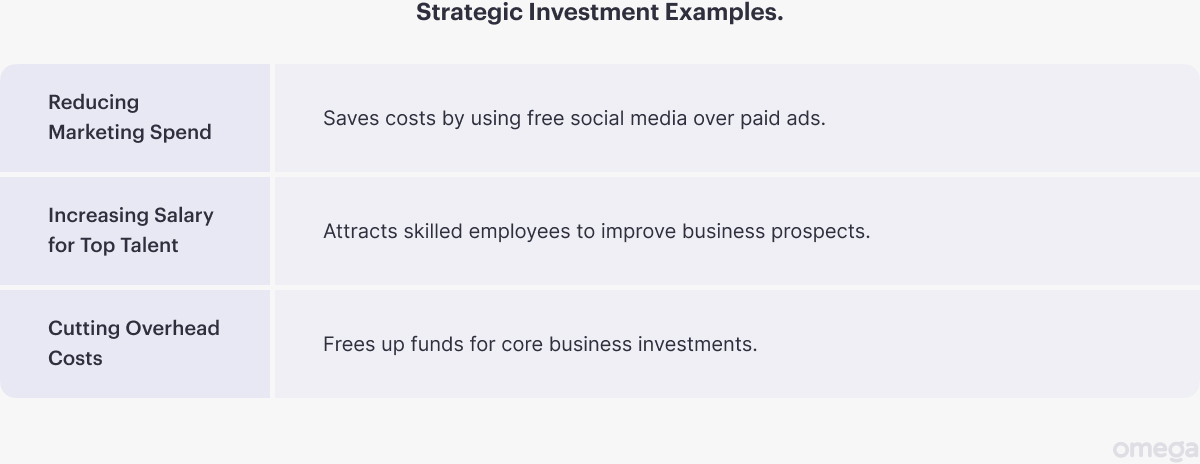

One of the main reasons for budgeting in business is to give you a clear picture of where your money is going. Without a budget breaking down costs and income, you are effectively feeling in the dark and hoping that you are spending and saving the “right amount.” But once you know the real numbers, you can begin to be strategic.

In some cases, you may realise that you are overspending and find ways to save money. For instance, you may find that you are spending more than you can afford on marketing and will stick to a more cost-effective option, such as using free social media posts instead of paid ads.

But other times, you may realise that you can afford to spend a little more. You may find that you have enough wiggle room to afford a salary high enough for one of the best developers in the business, which will help the startup to stand out and succeed.

Whatever the case, a budget helps you to be more strategic and intentional about how you use your money.

5. Performance Measurement

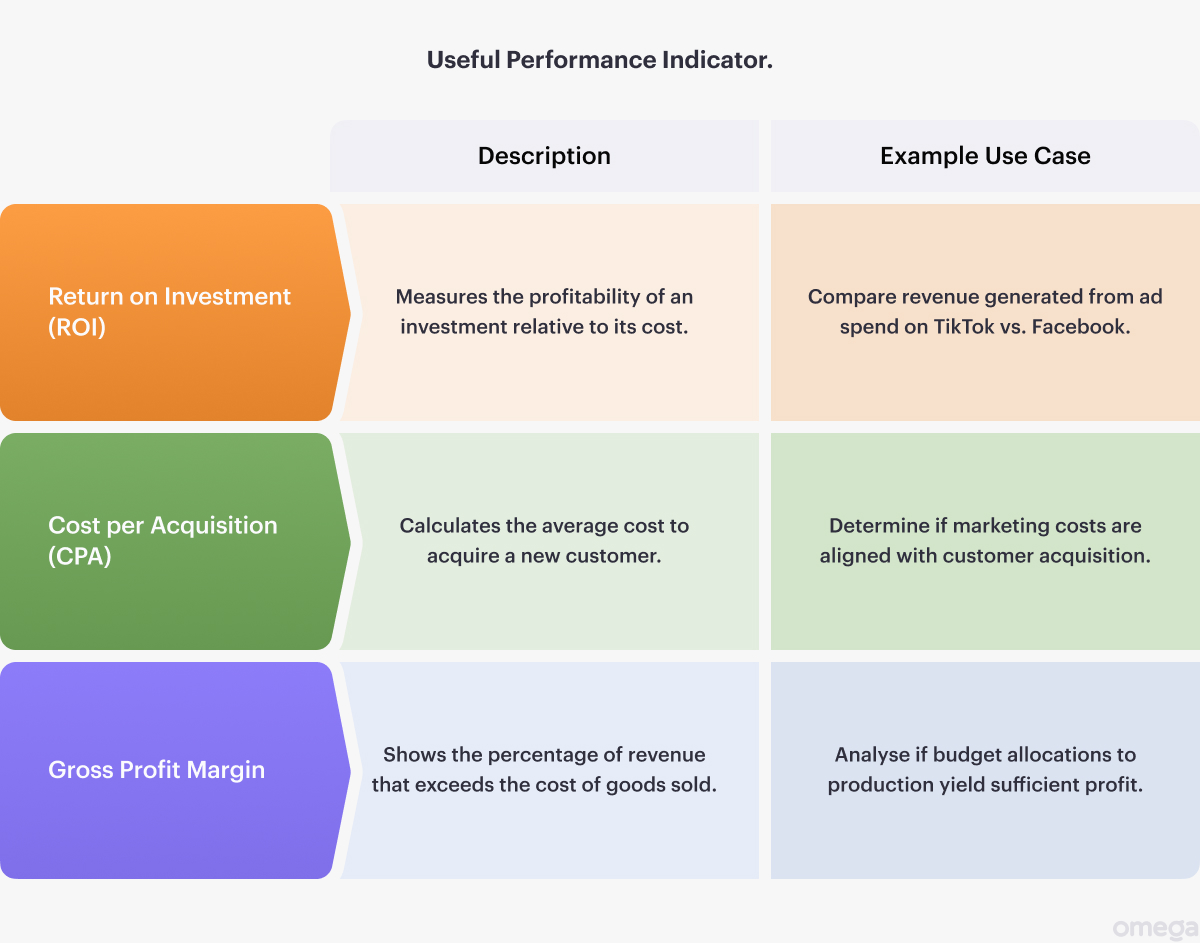

The most important reason for budgeting is to balance costs and spending. But it can also be used to work out financial performance indicators and determine how successful some of your business decisions are.

By looking at your financial allocations and the results they yielded, you can see which areas were the most successful. For instance, it might turn out that you allocated the same funds to ad campaigns on TikTok and Facebook, but the Facebook campaign brought in more revenue.

Budget Your Way to Brilliance

A startup budget increases your chances of covering the high initial costs of starting a business, navigating uncertain revenue, and retaining access to credit. It also helps to be more strategic about how they use their money.

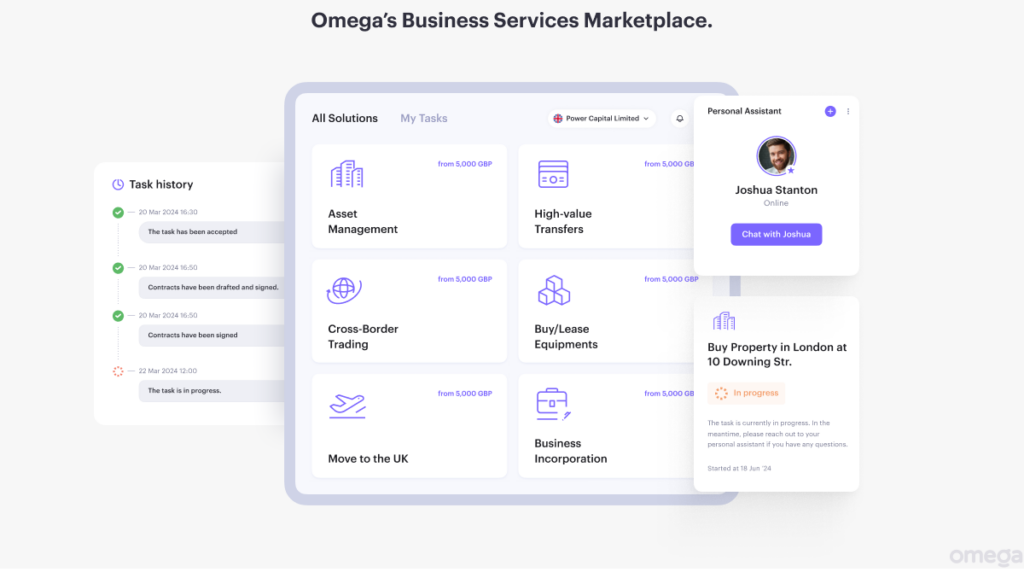

Budgeting for startups is all about having the right tools at your disposal. A business account with Omega is the perfect tool to streamline your financial management.

Not only does it have the usual tools for handling payments, but it also offers dedicated third-party services for accounting, asset management, and more, with the aim of providing one place for all your business needs.