Over the past few years, the way we work and live has changed in more ways than one. With the gig economy thriving, you might be wondering, ‘When do I need to open a business bank account’? And why do you really need to do it?

Even in 2024, it is surprising how many businesses, especially start-ups, are making life harder for themselves by not having all their business money matters in order. In this article, we explain how a business account could save you time and money.

What is a business bank account?

To put it simply, a business bank account helps you separate your personal finances from your business operations. When you have a business account, you can get a better understanding of your incoming and outgoing transactions. Depending on the way your company works, there is almost always a business bank account that fits your specific needs.

Is it a legal requirement to have a business bank account?

According to the law, it is only a legal requirement to have a business bank account if it is a limited company registered with Companies House. So, technically – freelancers, sole traders, contractors, and gig workers – are not obliged to have one.

However, that doesn’t mean you shouldn’t consider having a business bank account. In many cases, it is quite advantageous.

The benefits of a business bank account

The exact perks of having a business bank account depend on the way your company works. But here are some of the perks you can expect:

Easier to organise your finances

No one really likes using spreadsheets, right? Bookkeeping is by no means a fun task, but keeping your business expenditure separate will make the annoying process less painful. It will also help you follow your business expenses to offset them against tax.

Moreover, with Omega’s business account, you will receive dedicated corporate and accounting services, which means even less hassle for you.

Enhanced credibility for your company

A business bank account doesn’t just help you keep your books in order. It is also a tool to support your branding and business name, which gives you more credibility. Otherwise, asking a customer or client to make a payment into your personal account can make it seem like you have something to hide.

Better suited for business

If you are using your account simply to make and receive payments, it may seem like you don’t have a need for a global business bank account. But as your operations grow bigger, you might require more complex banking services, such as international payments.

Final thoughts

Is your business already in full swing? In that case, it’s best to set up your business bank account as soon as possible.

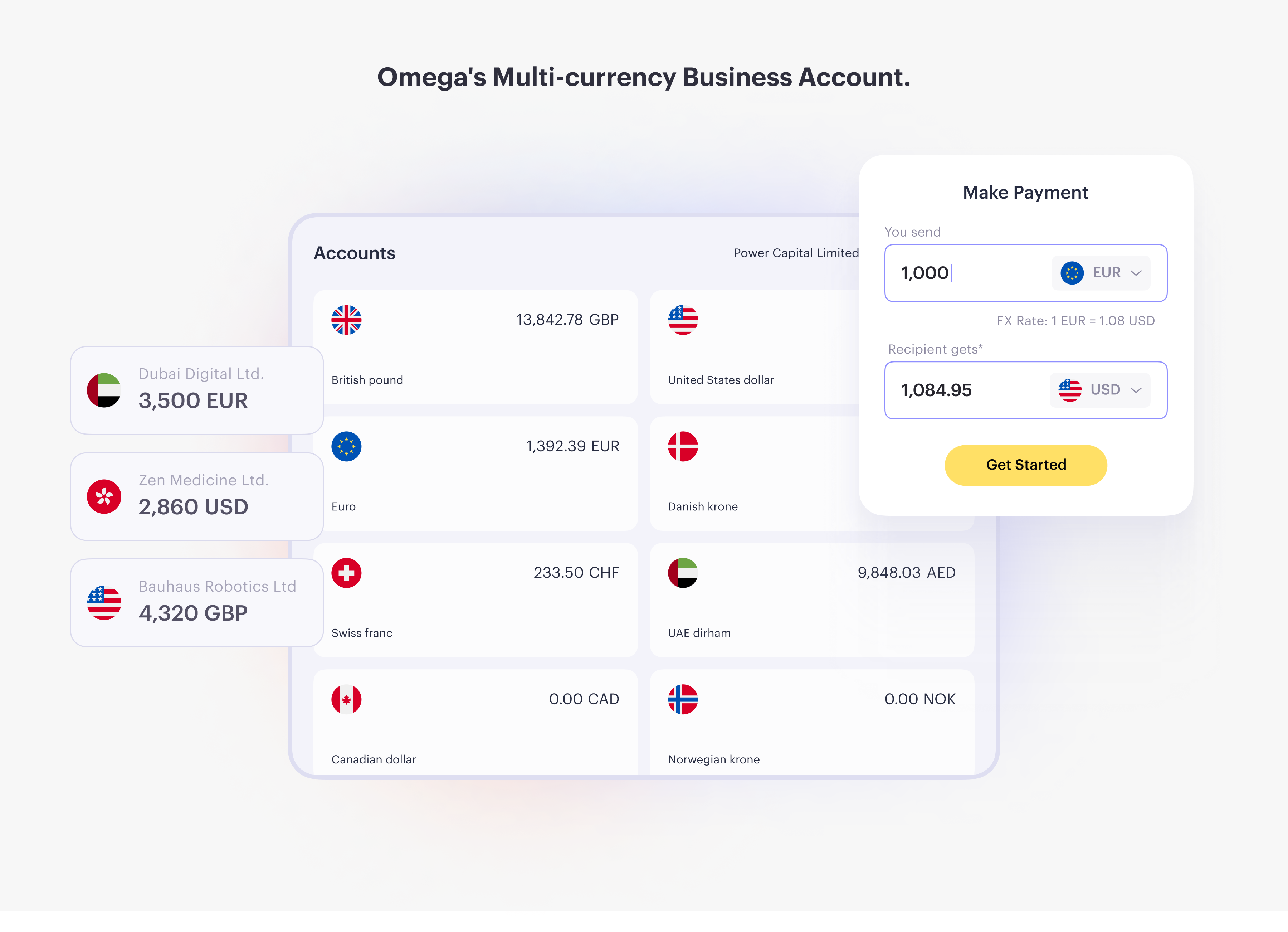

With Omega, you get access to multi-currency accounts, competitive FX rates, company registration services and many other useful tools that can help you take your business to the next level.Interested in learning more? Here, you can take a look at how you can apply to Omega’s business account.