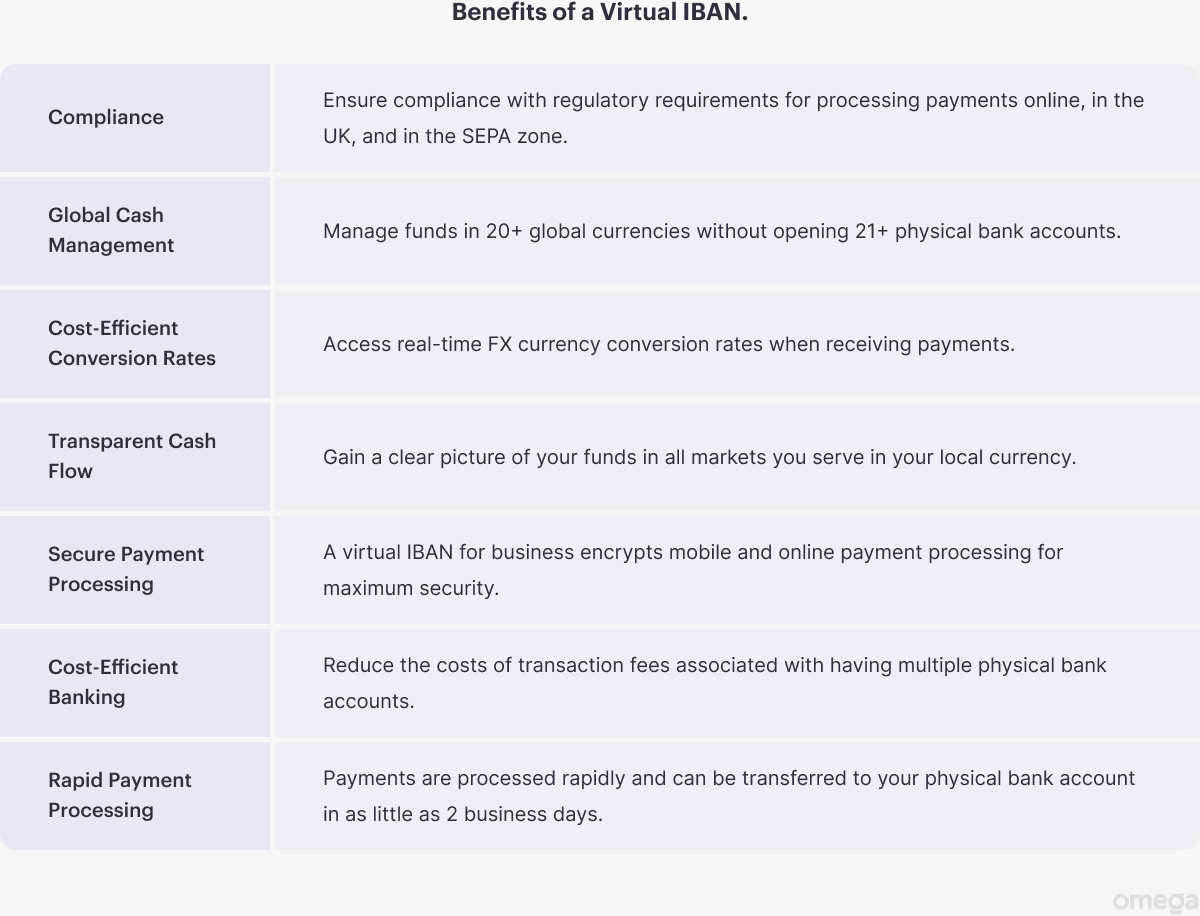

As you expand your business internationally, you must establish a compliant means of payment processing in each region you serve. In the past, business owners had to open a new bank account in each country. This is time consuming, expensive, and dated. An innovative alternative is obtaining a virtual IBAN account for business.

What is a virtual IBAN?

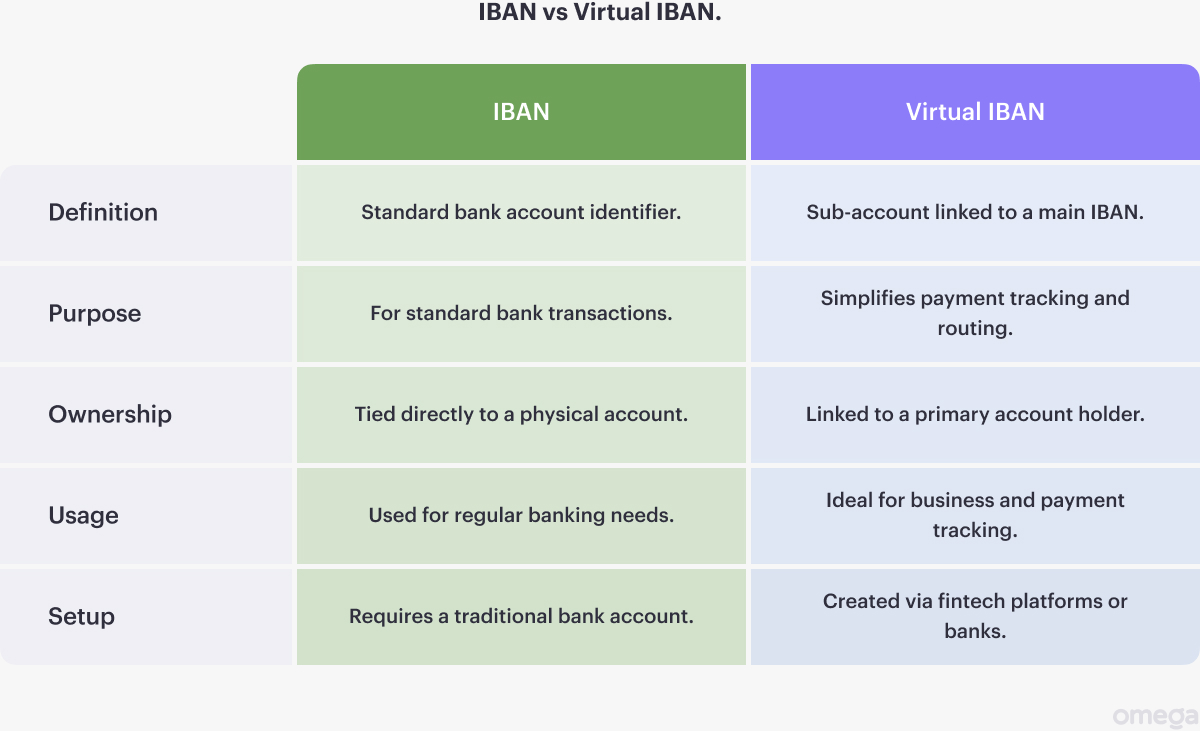

An international bank account number (IBAN) is required to process payments in the foreign countries you serve. A virtual IBAN provides you with a compliant method of international payment processing. It enables you to convert international funds to your local currency and route it to the physical business bank account in your country.

What is the difference between an IBAN and a virtual IBAN?

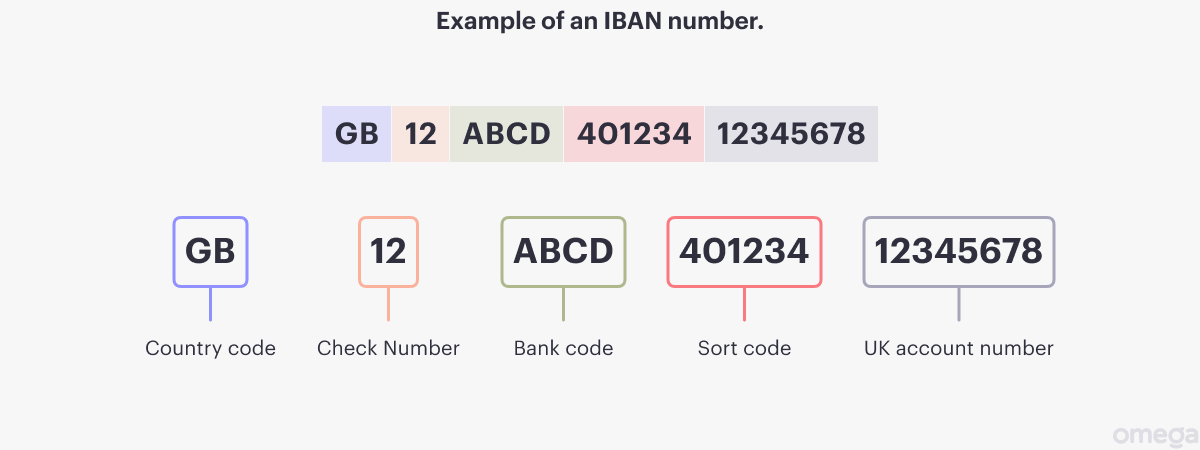

A standard IBAN is the number associated with a physical bank account. The length of the number varies by country and can be up to 36 numbers long. A 2 letter country code precedes the letters. In the UK, the code is “GB”.

What is virtual IBAN?

A virtual IBAN is also a series of letters and numbers as outlined above. However, it is a regulatory-compliant alternative to opening a physical bank account. You can process your online payments in multiple countries and currencies and transfer the money to the business bank account in your country. The transfer and currency fees are cost-effective, and you avoid the time and hassle of managing multiple bank accounts.

Your Omega business account expands your reach with a British IBAN.

How does the virtual IBAN work?

Your clients will never know whether you have a physical or virtual IBAN number. When they place their order for your physical product, digital subscription, digital product, or virtual service they process their payment as they would on any e-commerce website.

In terms of payment processing, physical and virtual IBANs meet the global regulatory standards for Payment Card Industry Data Security Standard (PCI DSS). Payments are processed without exposing your IBAN number or business bank account information.

Once your payment is processed, it will convert from the global currency to your local currency. You can transfer your funds to your physical bank account or use them to process outgoing transfers and financial transactions.

Benefits of using a virtual IBAN for business

It has never been easier to manufacture, ship, and fulfil products globally. In addition to establishing your supply chain, you must ensure compliant payment processing for physical products. Also for non-physical products, including SaaS, digital downloads, monthly subscriptions, and virtual services.

Virtual IBAN providers streamline and simplify the receipt of cross-border and multi-currency transfers. This includes consumer payments and a range of incoming and outgoing financial transactions.

How to open a Virtual IBAN account with Omega?

An Omega business account is a preferred virtual IBAN example. In addition to ensuring smooth payment processing, we offer a growing range of indispensable business services.

We are authorised and regulated by the UK’s Financial Conduct Authority (FCA) and our funds are secured in top-tier banks. We are SWIFT-compliant and allow payment processing throughout the SEPA zone.

Create your Omega business account in 3 simple steps.

- Submit your application, which takes about 5 minutes to complete.

- It takes 1 to 2 business days to process most applications, sometimes longer.

- Once approved, your Omega account is open and ready to complete transfers.

Reach out to learn more!

If you have questions about the benefits of an online IBAN account versus a physical bank account—book a free call to discuss the difference. Take your business to the new heights with Omega.

Disclaimer.