When you are running a business in the UK, you are responsible for ensuring you comply with requirements to report tax correctly. In addition to corporation tax, businesses must consider value-added tax (VAT), which is levied on goods and services on the point of sale. With more than £150 billion collected in VAT over the last tax year, this is a hugely significant tax.

Confused about which items VAT applies to or how to register for VAT? This article provides a complete guide to everything you need to know including how VAT works, examples, and whether to register.

What is Value Added Tax (VAT) and How It Works? Simply Explained

VAT is a type of tax paid on the purchases of goods and services. It applies in 175 countries, including the UK and the EU, though rates vary between nations. However, there is no VAT in the USA.

Since VAT is charged on consumption, VAT is known as a consumption tax. Consumers pay it at the point of sale, rather than businesses selling the items and paying tax after. This also means it is charged at each stage in the supply chain.

VAT is accounted for in the prices of goods and services rather than paid separately, so most prices include VAT (though some businesses prefer to list VAT separately to the price).

But while it is an indirect tax, businesses have the responsibility of reporting it to Her Majesty’s Revenue and Customs (HMRC).

How to Find VAT Number

If you are registered for VAT, you can find your VAT number on your VAT registration certificate, which is available online through your HMRC business tax account. This document also contains the due date for the first VAT return.

The UK VAT number format is the letters “GB” and a string of nine numbers. For instance, GB123456789. Outside of the UK, VAT numbers may look different.

What is the VAT Rate in the UK?

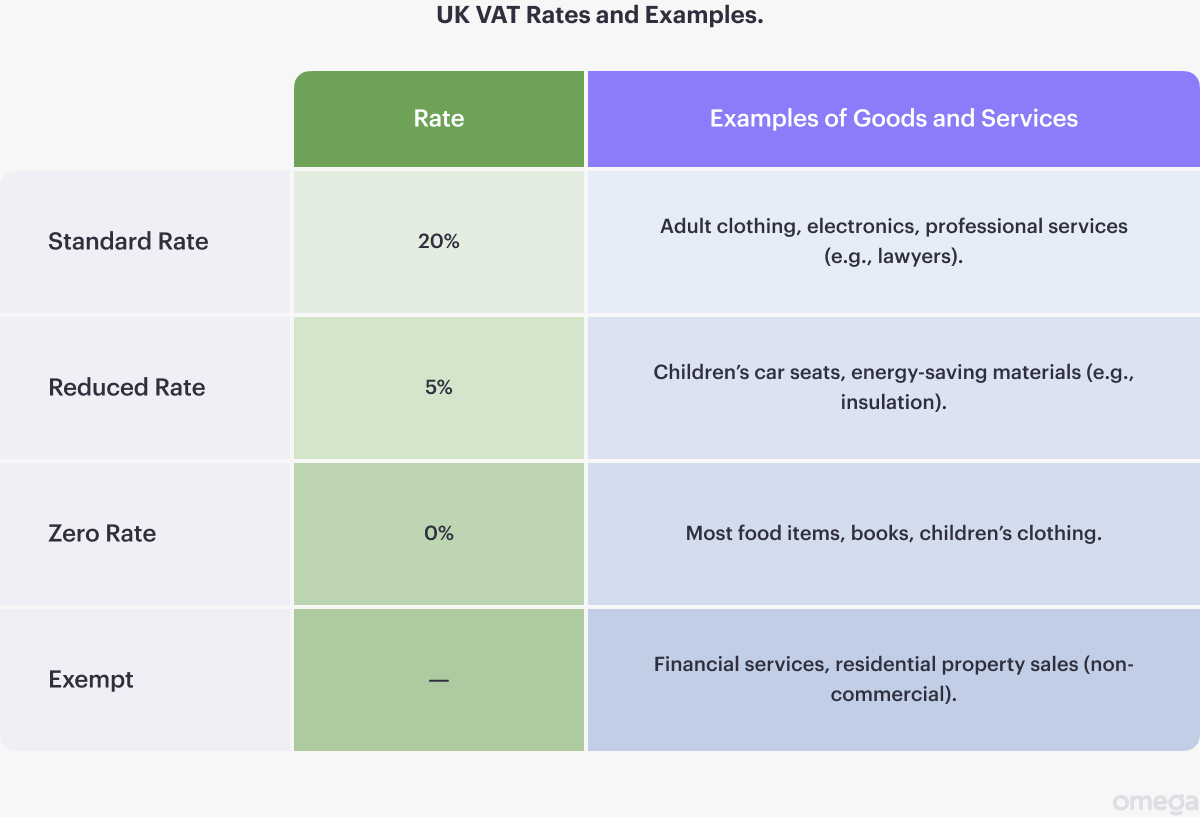

In the UK, the standard VAT rate is 20%, which increased from 17.5% in 2011. There is also a reduced rate of 5% on some goods and services (such as children’s car seats).

Certain goods and services are exempt from VAT, such as food, because they are deemed to be essential. As mentioned, rates differ between countries, and VAT rates in Europe are different from those in the UK.

How is VAT Calculated in the UK?

Let’s look at an example of VAT payment.

Say that a business sells a pair of jeans to a customer. The price decided by the company might be £20. But since VAT applies to adult clothing, there will also be a VAT of 20%. This means that the price the consumer actually pays is £20 plus 20%, which is £24.

What Are Some Examples of a Value-Added Tax (VAT)?

The majority of goods and services incur VAT, from furniture to televisions to hair cuts to professional services like lawyers or accountants.

Some examples of VAT that aren’t on goods or services include:

- Loaning or hiring goods

- Staff meals

- Sales of business assets

- Commission

- Business goods for personal use

There is VAT on restaurant food in the UK, even though most food is exempt. Takeaways are also exempt.

As for VAT on the sale of residential property in the UK, existing homes are usually exempt from VAT since they are between individuals rather than businesses. However, there are some possible exceptions, such as properties for business use and newly built homes.

What is the VAT Registration Threshold?

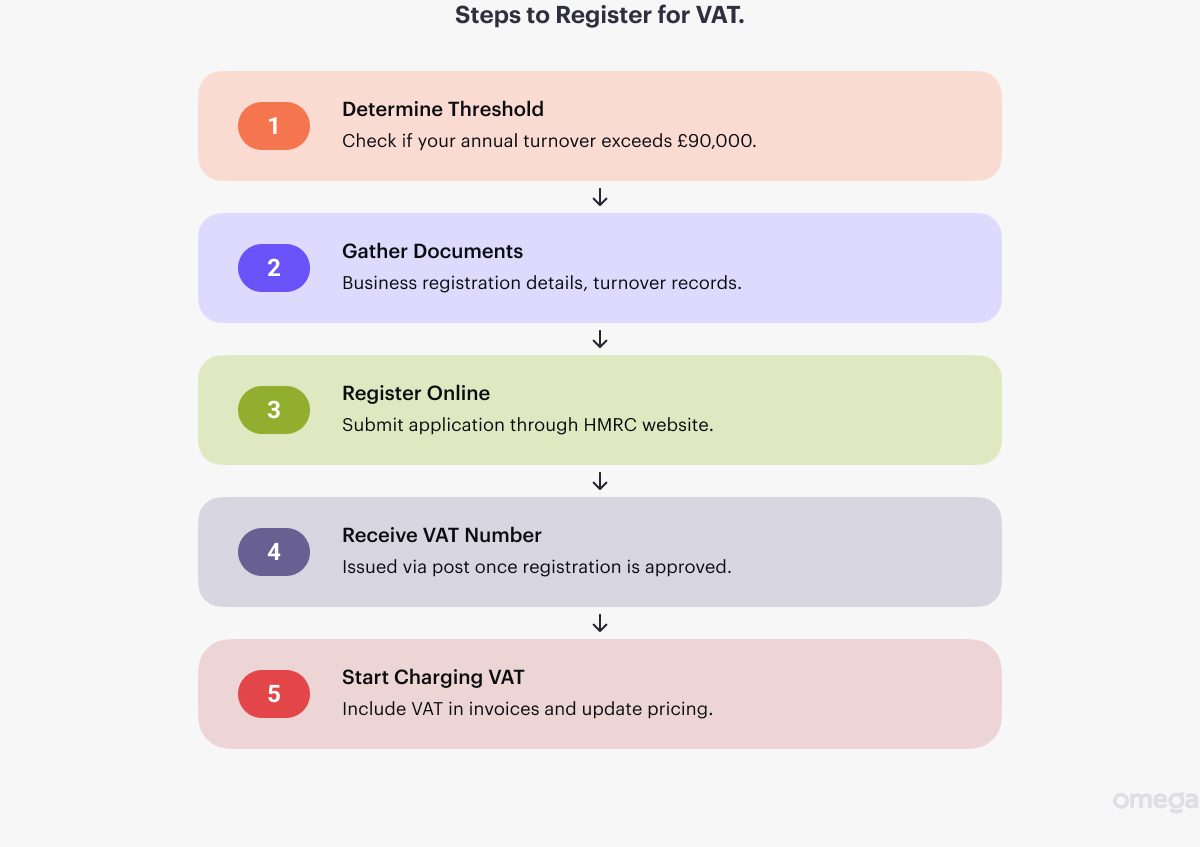

UK businesses need to register for VAT once they have a turnover of over £90,000 (up from £85,000 from April 2024). This includes both incorporated businesses and sole trades, but it excludes charities, which have separate rules. After reaching the threshold, businesses must charge VAT on goods and services and incorporate it into prices.

Businesses that aren’t registered for VAT cannot charge VAT on their goods and services. However, businesses below the turnover threshold can still register for VAT. To register, just head to the HMRC website and submit the required documents. You will receive your VAT number by post.

Should You Register for UK VAT?

For businesses that earn above the turnover threshold, registering for UK VAT is a legal requirement. Failing to register could result in legal action or penalties from HMRC.

But even for those who earn less, it is worth considering whether to register. Doing so means they can claim the VAT back, which we’ll cover in more detail in the next section. VAT registration can also make the business appear more professional. Registering for VAT means companies can include it on invoices or receipts, which gives them greater credibility.

How to Claim Back VAT for Your Business

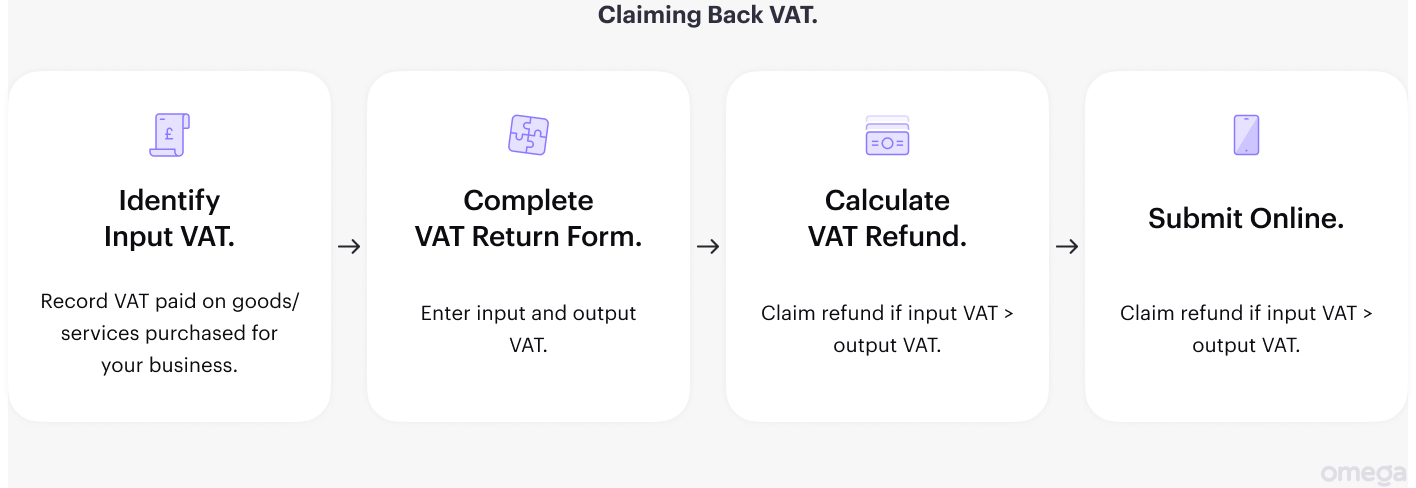

Since VAT is charged at each stage in the supply chain, companies can claim back VAT they paid on their business expenses. This involves completing a VAT return. You can do this online on the HMRC website, and you will generally complete one return per quarter.

When completing a return, you will need to enter how much VAT you charged on your services and goods (output VAT) and how much VAT you paid on goods and services from other companies (input VAT).

You will then work out the difference between the two — and if input VAT is higher, you can claim the money back from VAT.

VAT and the Rest of the World

Usually, goods that are exported or services that are provided to customers in other countries aren’t subject to VAT. This includes VAT at on services from the EU to the UK and VAT on services provided outside UK

VAT on exports from the UK usually comes under the zero-rated category, meaning there is a rate of 0%.

The Takeaway on Taxes

Even if you are not legally required to register for VAT right now, it is wise to get to grips with how the system works so you are prepared. In summary:

- VAT is a consumption tax paid by customers at the point of sale.

- Businesses with an annual turnover of more than £90,000 need to register for VAT.

- Companies can claim VAT back by filling out a form with HMRC.

A business account with Omega helps you to navigate this sometimes-confusing world by offering not just standard financial services like transfers, but also accounting tasks. This allows you to claim back your VAT the easy way to outsource the task to professionals.

Disclaimer.