The UK is now the world’s third largest venture capital market, followed by the US and China. This thriving market attracts global startups and established brands looking to capitalise on the UK’s growth.

This includes international businesses expanding to the UK and startups seeking funding in emerging cross-border markets. Below are the top 10 venture capital funds in the UK to consider for your seed round or series funding.

What are the best venture funds in United Kingdom?

As of September 2024, Statista reports that Innovate UK leads the pack, with around 4,300 companies in their investment portfolio. They are followed by Crowdcube and Tech Nation with 1,200+ companies each.

What is the largest VC in the UK?

Innovate UK is the largest fund by both portfolio and total number of Exits. However, in terms of Exit value, DST Global and techUK surpass Innovate UK.

Now let’s dive into the top 10 firms.

1. Innovate UK

Innovate UK is an extension of the UK Research and Innovation (UKRI) agency. It is a national funding agency sponsored by the department for Science, Innovation and Technology. While not an official government agency, this fund actively collaborates with government agencies.

The fund invests in a broad range of products, processes, and services (including science and research) that are deemed innovative. Funding is available to registered UK businesses.

2. Crowdcube

Crowdcube isn’t a traditional VC firm, it is a crowdfunding platform. Instead of securing traditional venture capital investors, investors are everyday consumers who believe in the brands they invest in. One of the benefits of crowdfunding is that it raises capital while building loyal customers.

Crowdcube vets each company before their crowdfunding goes live. In exchange for their investment, investors often preorder products pre-production. Your business must be registered in the UK (or another Crowdcube country) to receive funding.

3. Tech Nation

Tech Nation provides a variety of resources for technology startups and founders. They have programs that support entrepreneurs in creating a strategic plan for success.

In terms of investment, their VC programs prepare entrepreneurs for pre-launch pitching and securing funding for seed, series, and IPO. They also guide and advise on exit strategies. Tech Nation has a Visa program for global tech talent.

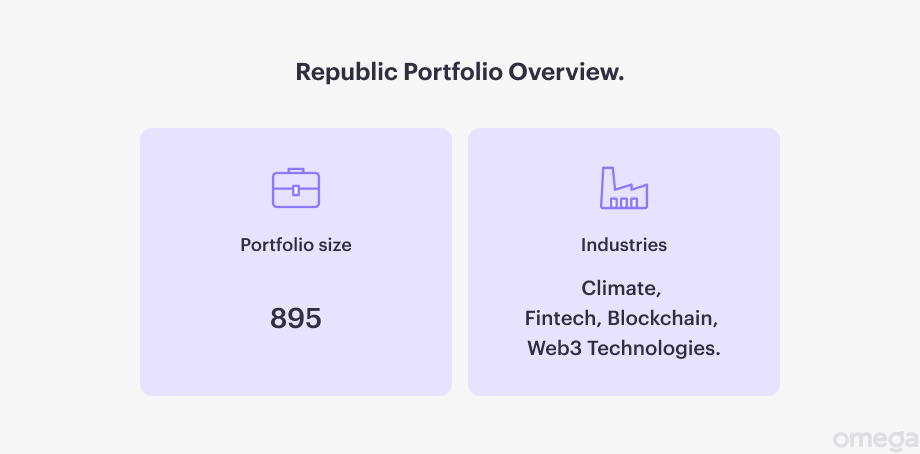

4. Republic

Republic (formerly One Republic and Seedrs) is a global private investment firm supporting early-stage entrepreneurs. The investment model is elevated crowdfunding, as investors invest in set share prices. Most of its companies are in fintech, blockchain, and web3technologies.

Republic is accessible to businesses in a variety of countries. For Europe, you will need a SEPA ZONE business account to receive your funding.

5. Index Ventures

Index Ventures backs companies from seed to IPO and is the VC firm behind Etsy, Trustpilot, Notion, and Figma. They are one of the top venture capital firms for business SaaS, fintech, and digital businesses.

Index Ventures operates global and has a branch in London.

6. SFC Capital

SFC Capital is an innovative approach to generating funding. They attract investors by leveraging the UK’s Enterprise Investment Scheme (EIS) and Seed Enterprise Investment Scheme (SEIS).

These schemes inspire UK tax payers to invest in EIS and SEIS-qualified businesses in exchange for tax relief and capital gains relief. SFC Capital empowers everyday investors to support local businesses while providing early-stage startups with essential business capital.

To receive funding from SFC Capital your business must qualify for EIS or SEIS.

7. Scottish EDGE

Scottish EDGE provides seed funding for businesses in Scotland, including investing in young entrepreneurs. More than a VC fund, Scottish EDGE provides a range of programs to help small and medium-size enterprises (SMEs) succeed. This includes mentorship programs and loans.

Funding is available to registered businesses in Scotland.

8. Business Growth Fund

Business Growth Fund (BGF) is 8th on the list, but many consider it one of the top venture capital funds in the UK. This is due to their ability to attract influential investors from around the globe.

BGF specialises in helping SMEs operating at £1 Million+ scale to the next level of success. To receive funding from this VC fund, businesses must be registered in the UK or Ireland.

9. Entrepreneur First

Entrepreneur First is a pre-seed fund. A differentiating factor is their desire to invest in people and nurture their entrepreneurial aspirations. They match their investees with a strategic co-founder for maximum success.

Enterprise First prides themselves on investing in outliers often overlooked by traditional venture capital firms. This global fund has a branch in London.

10. Seedcamp

Seedcamp provides seed funding for technology companies aimed at solving complex global challenges through innovative software solutions. A key differentiator is their post-launch mentoring. Post-launch, they assist in setting up effective SaaS marketing and sales strategies.

While software is their primary industry, a small percentage of Seedcamp’s portfolio falls in to other industries. Seedcamp is based in London and invests in companies across Europe.

How to receive capital from a venture fund in UK?

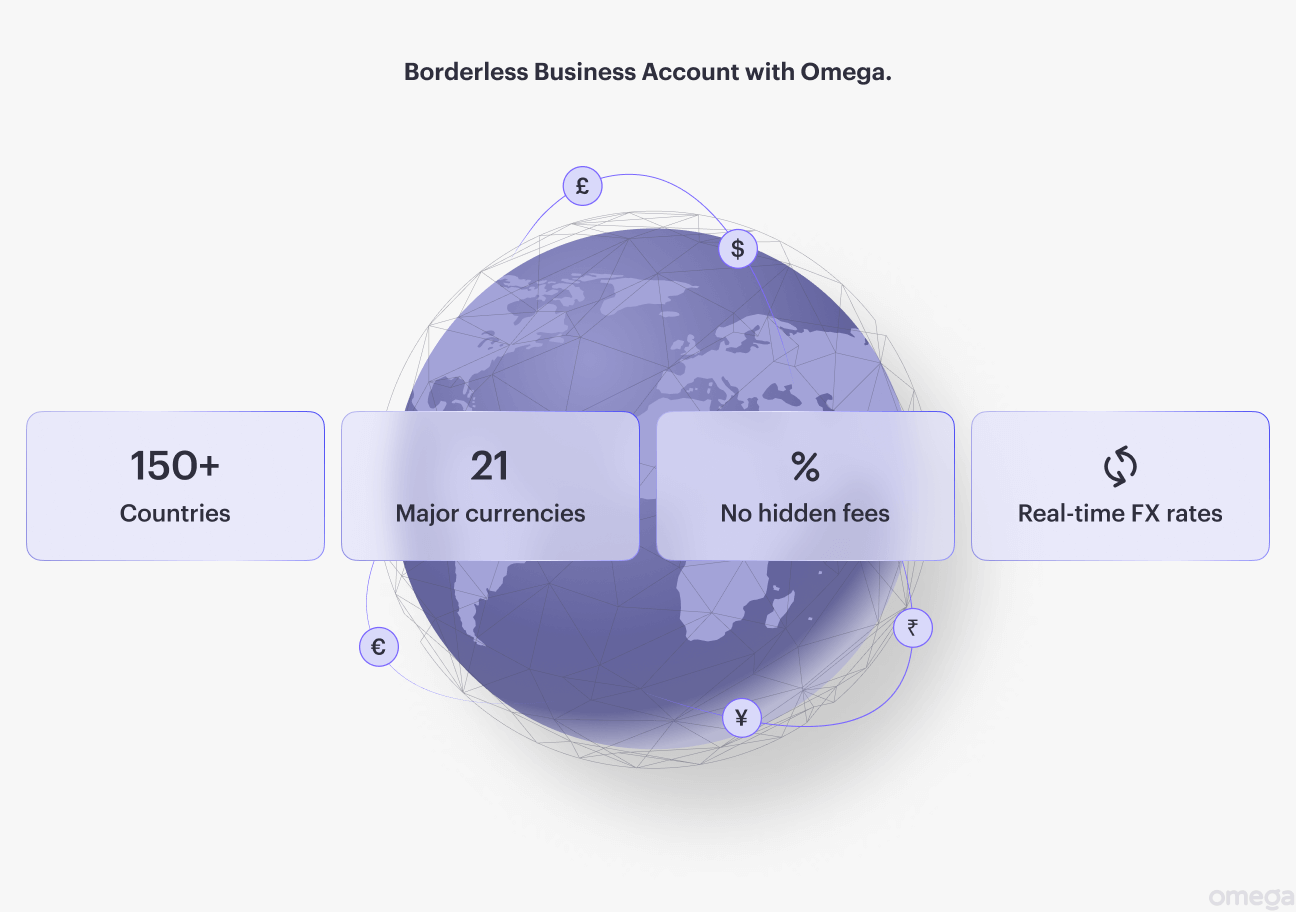

Ready to take your business to the new heights? Start with opening an Omega Business Account. Seamlessly register your business in the UK and access a powerful multi-currency account.