Technology and innovative solutions for payments, wealth management, budgeting and other areas related to the financial sector remain one of the most popular destinations for start-ups and investment attractiveness.

For many years, the UK has been one of the main centers of attraction for financial start-ups, confidently holding a leading position in the industry. We have collected some interesting facts, statistics and forecasts about fintech in the UK that you should know.

How big is the UK fintech market?

The size of the UK fintech market will reach US$11.9 billion in 2023. Looking ahead, IMARC Group expects the market to reach US$45.6 billion by 2032, with a CAGR of 16.1% between 2024 and 2032.

The sector contributes an estimated $13.4 billion (£11 billion) to the UK economy and provides more than 76,000 jobs.

What is the leading UK fintech by capital raised?

In 2024, Checkout.com emerged as the UK’s leading fintech in terms of capital raised. Founded in 2012, the international payments platform secured £1.36 billion in funding. Source: Statista

This is how the Top 3 looks like:

- Checkout

- Revolut

- Monzo

Need a Multi-Currency Business Account? Receive and make payments in 20+ major currencies. Sign up now.

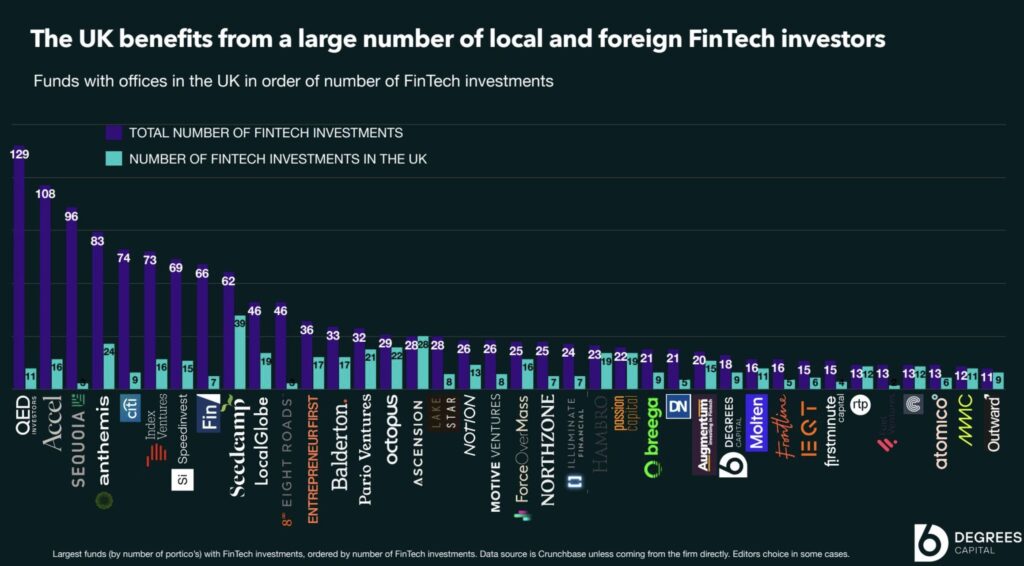

UK-based funds ranked by number of FinTech investments

Largest funds (by number of portfolios) with FinTech investments, ranked by number of FinTech investments. Data source is Crunchbase, unless provided directly by the company.

How many fintech unicorns are there in the UK?

As of June 2024, the United Kingdom is home to 52 of Europe’s 121 fintech unicorns. This compares to just 13 in France and 12 in the Netherlands. — UK Investor Magazine

How many fintech companies are there in the UK?

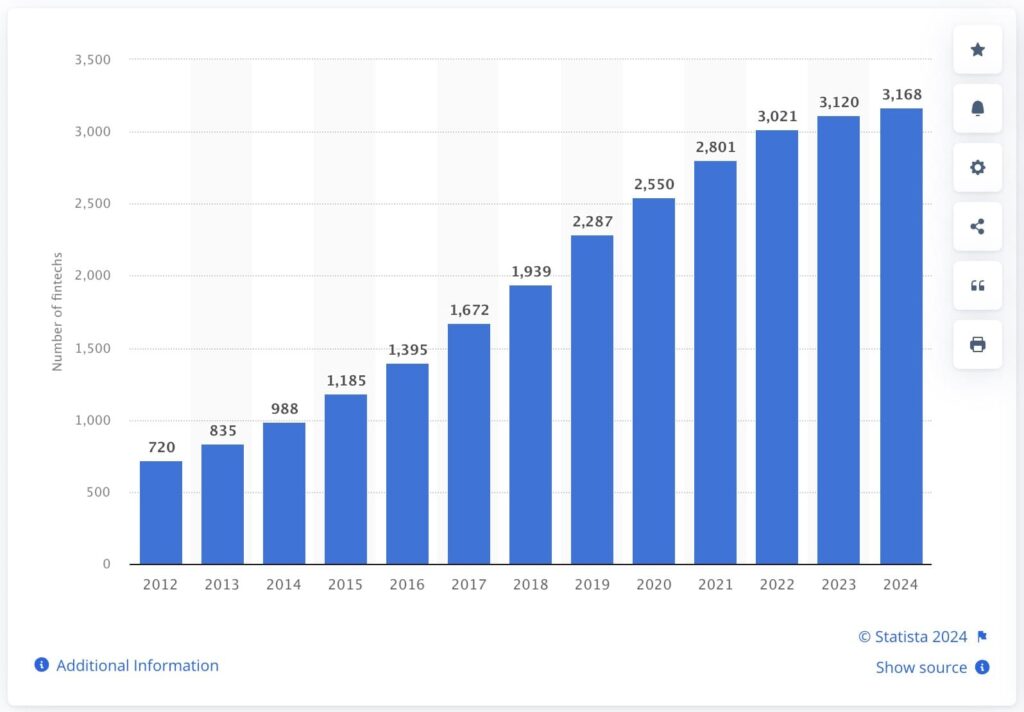

It is the leading fintech hub in Europe. More than 3,200 fintech companies are headquartered in the country.

The total estimated salary for a Fintech Analyst is £46,229 per year in the London area, with a mean salary of £40,647 per year (median). — Glassdoor

To be more precise, about 75 per cent of the start-ups are concentrated in the City of London and in Westminster.

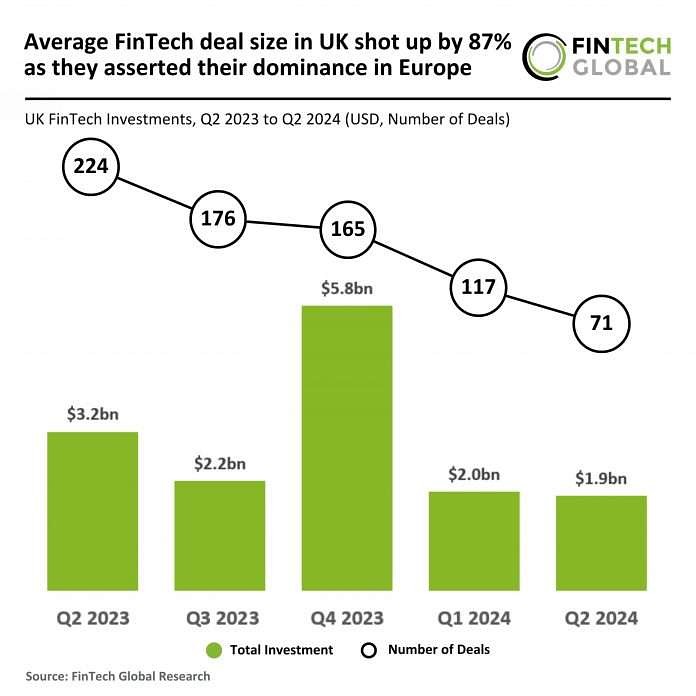

Deals and investments

The total value of fintech investment in the UK reached $7.3 billion in the first half of 2024, up from $2.5 billion in the same period of 2023. — KPMG’s Pulse of Fintech report

The UK fintech sector is the leading investment destination in Europe. It accounts for more deals and capital invested than Germany, Sweden, France, Switzerland and the Netherlands combined, and is second only to the US globally. — Great.gov.uk

The UK startup ecosystem is the number three tech ecosystem in the world for VC investment, behind the US and China.

The largest fintech deal in Europe in the first half of 2024 was the UK’s Monzo, which raised £500m in equity. — FFNEWS

In total, Monzo has raised more than $1.9bn in primary funding from investors including CapitalG, Tencent and Passion Capital since its launch in 2015.

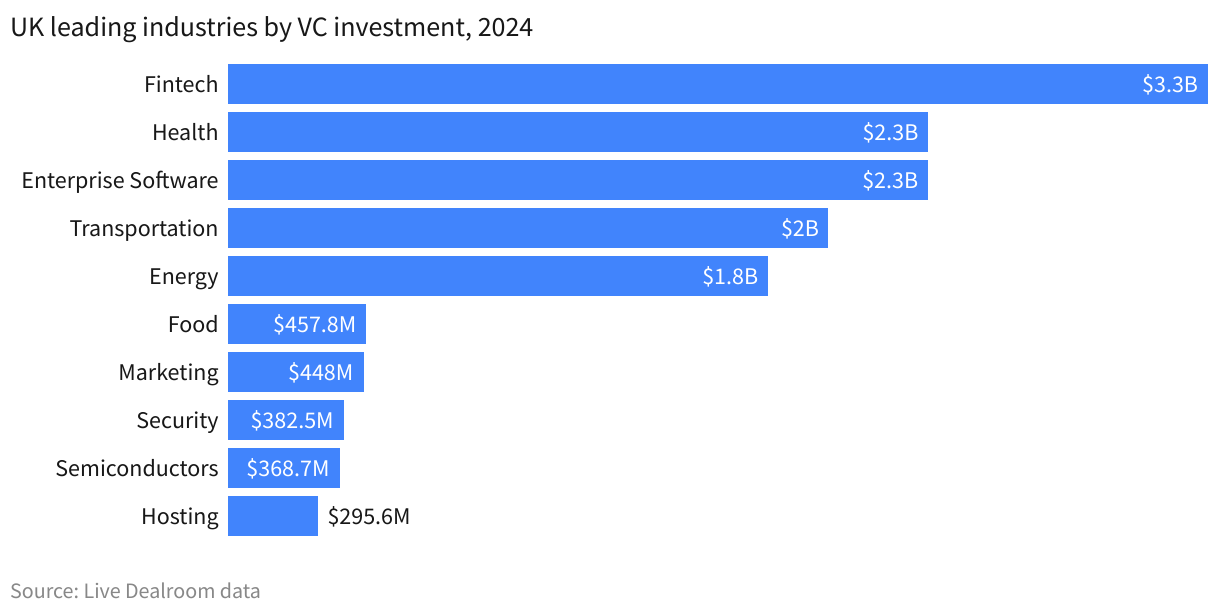

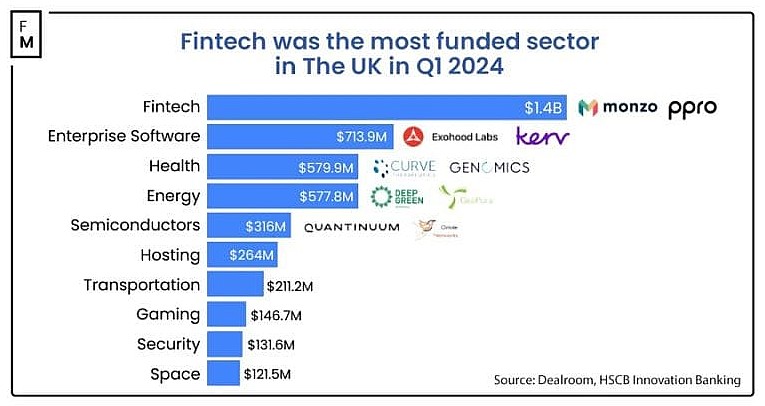

Leading funded industry

In 2023, energy overtook fintech to become the UK’s most funded startup sector for the first time, although fintech regained its usual top spot in 2024.

The UK FinTech sector has reclaimed its position as the country’s most funded startup sector, raising an impressive $1.4 billion across 73 rounds in Q1 2024.

Omega makes running your business magically simple. Ready to elevate? Get started

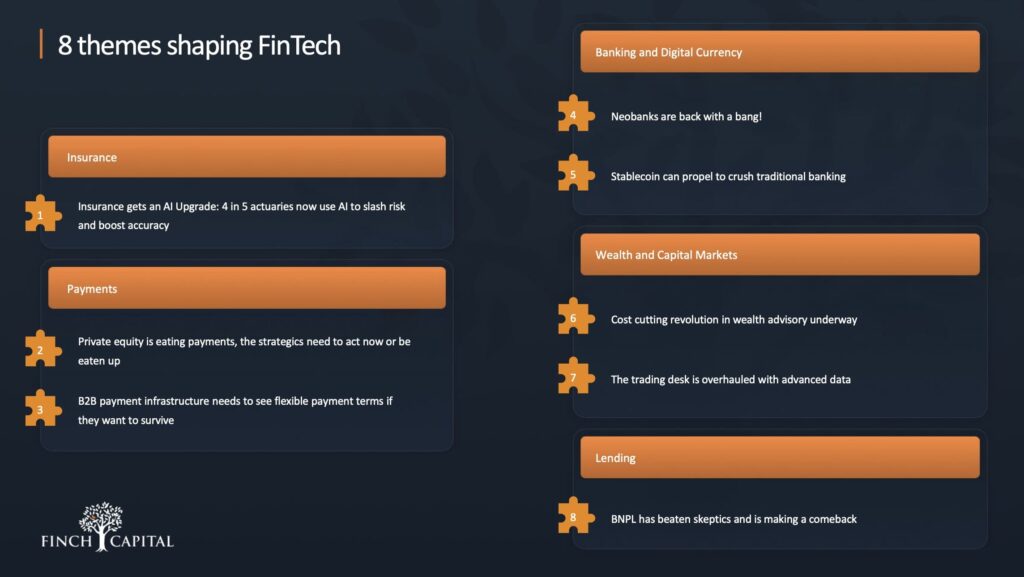

Key trends shaping fintech startups in the UK

The industry landscape is dynamic and evolving. The trends below will shape the industry’s trajectory in 2024, as fintechs continue to innovate and disrupt traditional financial services.

The average deal value in Q2 2024 was approximately $26.8m, a notable increase from the $17.1m average in Q1 2024.

The secure adoption of AI, which integrates artificial intelligence (AI) and machine learning (ML), is one of the key trends for 2024-2025.

How UK Fintechs continue to grow

The number of fintech companies in the UK increased significantly between 2012 and 2024, although the rate of growth slowed after 2018.

According to Deloitte, by 2021, wealth tech will account for 37% of UK fintechs. The second largest niche, accounting for 19% of the market, was payments.

According to EY, the UK consumer base has one of the highest fintech adoption rates in the world at 71%. This compares to a global average of 64%.