The journey of a thousand miles must begin with one step. Starting a company in the UK from the ground up presents new challenges and potential rewards when done correctly. To begin operating, new company registration in the UK is the first step, and this article delves into a high-level overview of everything you need to know about UK company formation.

What is a Company Formation?

As the name implies, a company formation essentially incorporates or registers your new or existing business as a limited company in the UK. Once your business completes this process, it becomes a distinct legal entity, whereby its assets, liabilities, finances, or property are separate from you, the esteemed business owner. Whether or not this company structure suits your business depends on your needs and circumstances.

Choosing the Right Legal Structure for Your Business

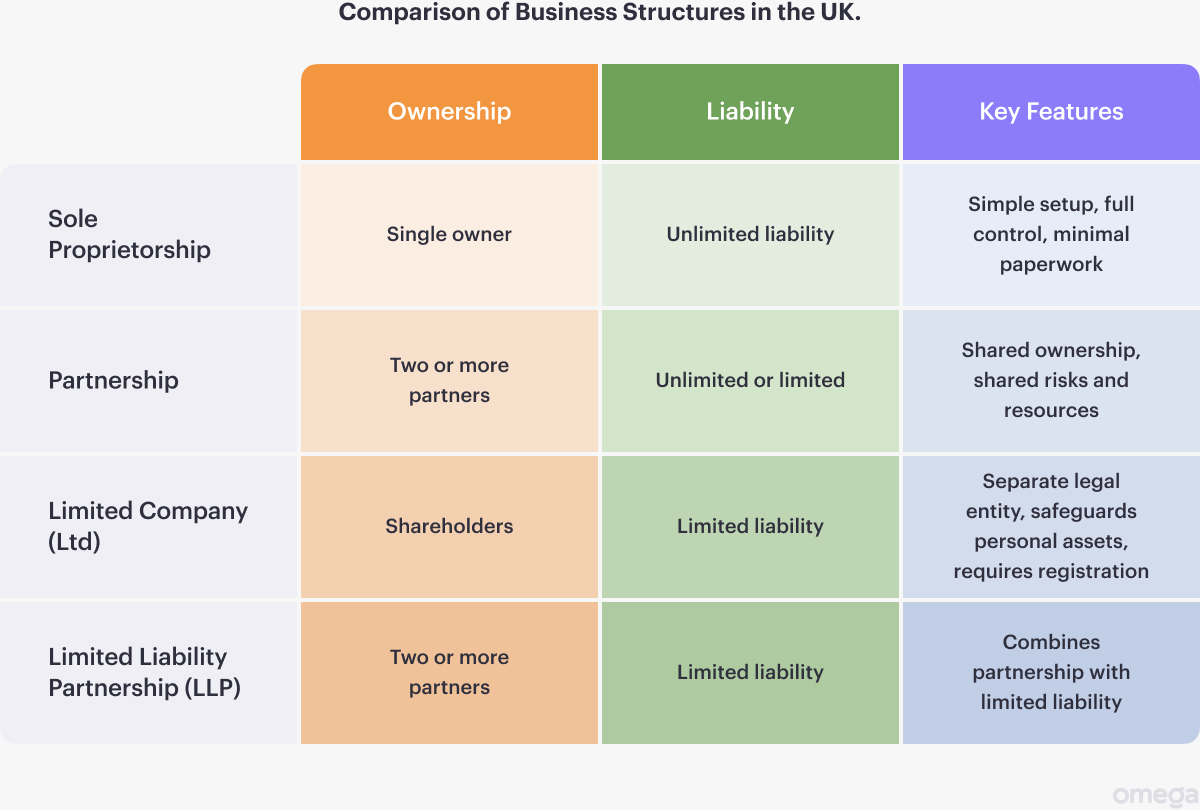

As a business venture, you are probably familiar with one or more of these terms, but here is a brief overview of the four forms of business ownership or structure in the UK.

Partnership

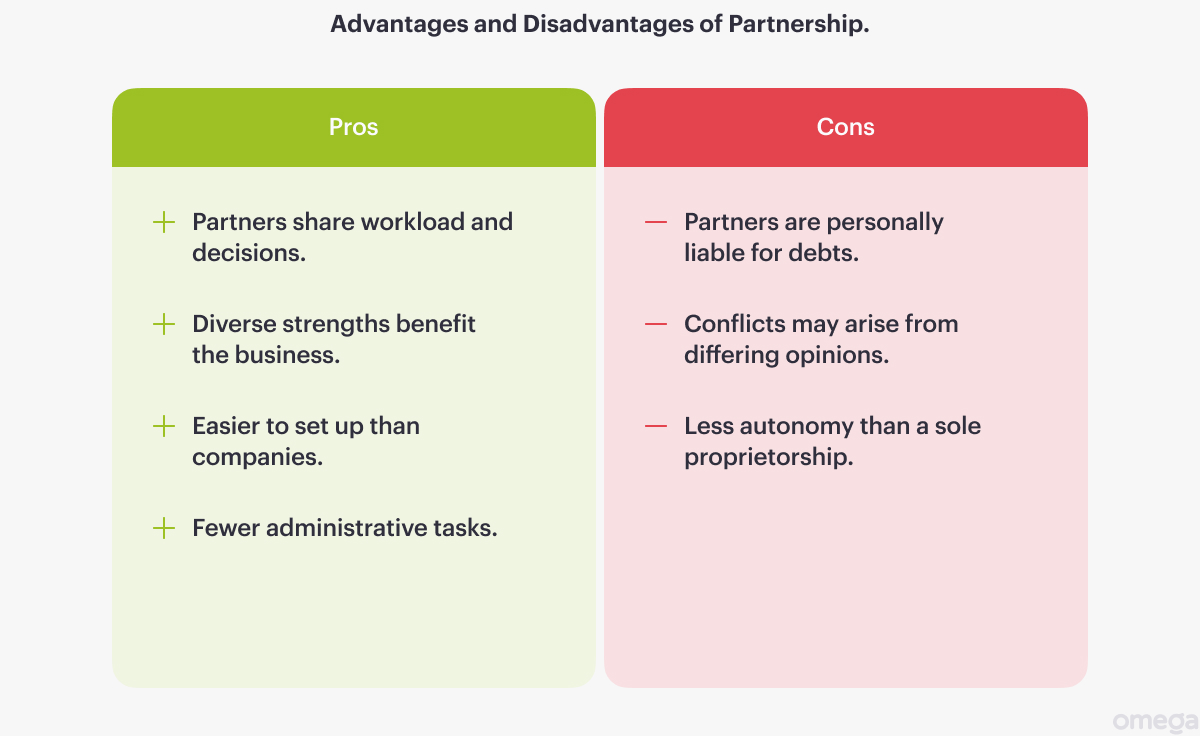

Partnerships involve two or more people owning and managing the business, which may have some benefits over sole traders. The business structure is a popular choice as it distributes the risks, resources, and expertise, and two or more of you will all share ownership, liabilities, and profit margins.

There are two distinct types of partnership:

- General Partnership: All partners share the business’s responsibilities and can be personally liable for debts.

- Limited Partnership: Limited partners invest capital but do not participate in day-to-day operations but are also personally liable.

Limited Company (Ltd Company)

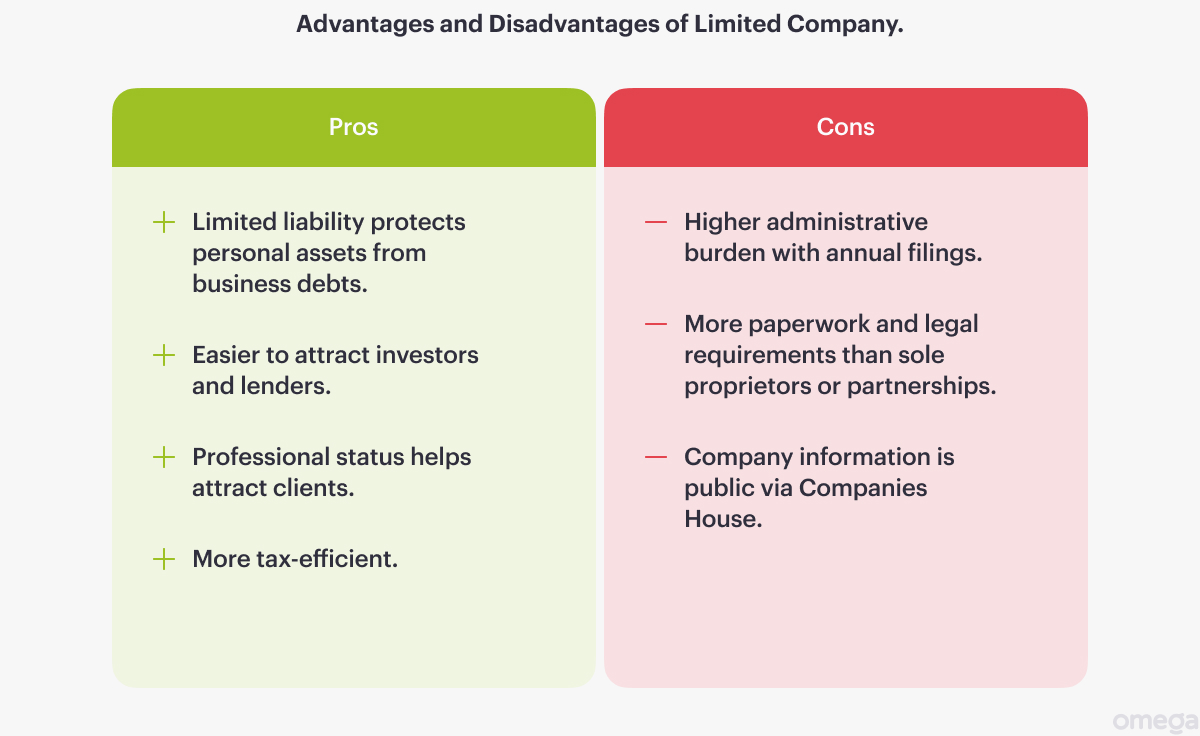

As mentioned earlier, a limited company means your business is a separate, distinct legal entity owned by shareholders. This makes the company liable for business actions and debts, not the people who run it, making your personal finances and assets safeguarded financially.

This particular business structure has over 500,000 new company incorporations every year, and its main feature makes it a no-brainer choice for many business ventures. Limited companies can be limited by two factors:

- Shares: These are typically found in profit-making businesses where shareholders own and hold shares in the company.

- Guarantee: Commonly found for non-profit organisations where instead of shareholders, members are guarantors.

Limited Liability Partnership (LLP)

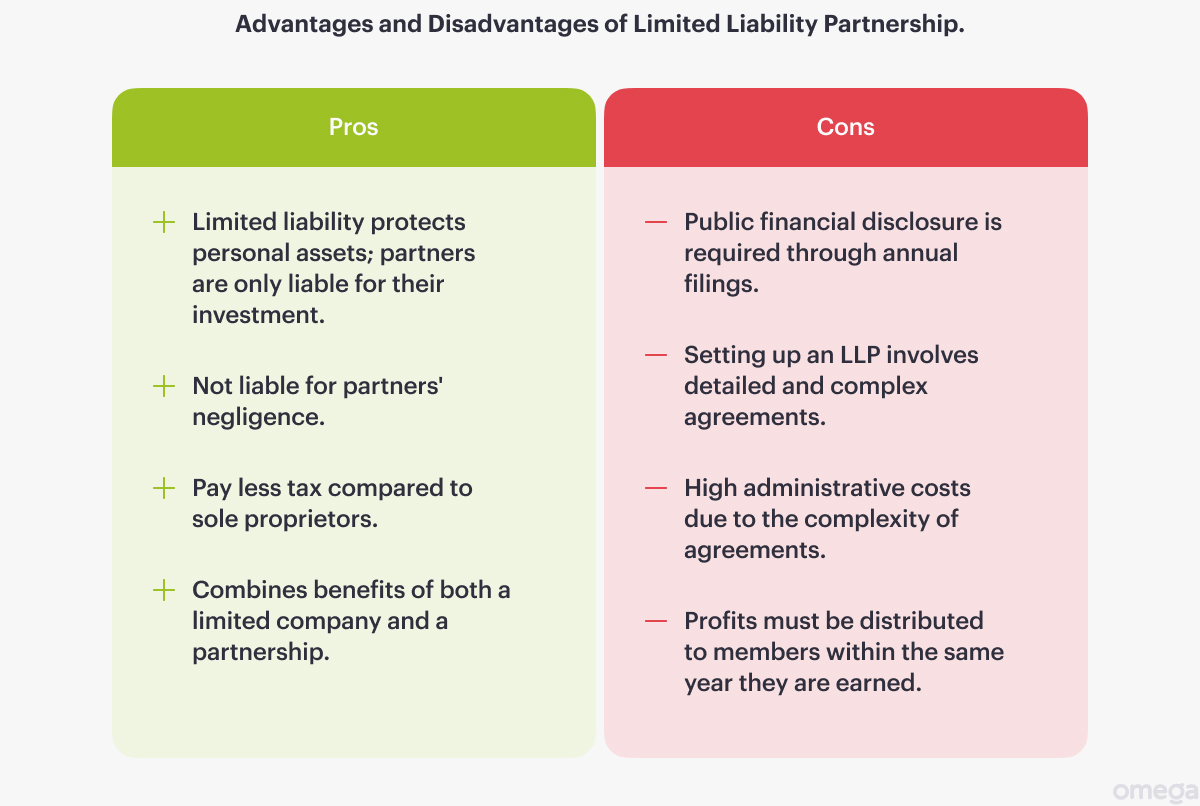

Think of it as a hybrid that combines the best partnership and limited liability benefits of a company. In this model, two or more partners jointly own and manage the business. The difference is that each partner’s liability is limited to the amount they invested, safeguarding their assets from business actions and debts (e.g., owning 30% means being liable to 30% of debts incurred).

Sole Proprietorship (Sole Trader)

In this structure, only one person owns and manages the business, making it the simplest business structure in the UK. A sole proprietorship is often a favourite choice due to complete control over business decisions and mitigated initial paperwork to get the business up and running.

Choosing Your Business Name

A business name is unique and differentiates itself from the sea of competitors who may also be selling the same goods and services as you. So, it is vital that you choose wisely and know how to register and protect your brand name. This is where trademarks play an essential role.

A trademark gives you the sole right to be the permission holder to use your mark for specific goods and services (e.g., the G for Google or the swoosh for Nike). Most importantly, registering a company name and logo secures your company from unwanted legal entanglements. This is especially crucial when you are just starting.

Appointment of the Director and Shareholders

As your company grows, it is crucial to understand the importance of appointing a director and their role among shareholders. Shareholders and the director both play distinct roles and should not be interchanged, where shareholders own shares in the company and the director manages those shares.

A common misconception is that shareholders can be directors and that the director has to be a shareholder, which is not the case unless stated on paper. Understanding these two roles clarifies and streamlines the company’s structure and business decision-making process, especially as it grows and expands.

Company Formation Documents, Address and Other Requirements

Here is a checklist of what your business will need to incorporate a UK company:

- Choose a unique business name and verify that it doesn’t infringe any existing trademark with the company name availability checker.

- Ensure your company has a registered office address, which you must maintain as long as the company stands.

- Choose a standard industrial classification of economic activities (SIC) code.

- Appoint at minimum one director and one shareholder.

- Create a Memorandum of Association, a shareholders-signed legal statement.

- Create articles of association that entail how your organisation will run by writing them independently or using model articles.

- Incorporate your company at Companies House in England and Wales, Northern Island, or Scotland.

Set Up a Business Bank Account

Your business and personal life should be kept separate, and that also means your personal finances should be separate from your business’s finances. If you are registered as a limited company, you must set up a business bank account by law with Companies House.

Aside from compartmentalising your finances, having a separate bank account for your business enhances your brand credibility and enables scalability in the long run.

Can a Non-UK Resident Incorporate a UK Company?

Yes. You will follow the same procedure as UK residents, and don’t worry; the registration process is straightforward.

You can complete this process online through approved company formation agents, the Companies House Web Incorporation Service, or by post with the Companies House paper application.

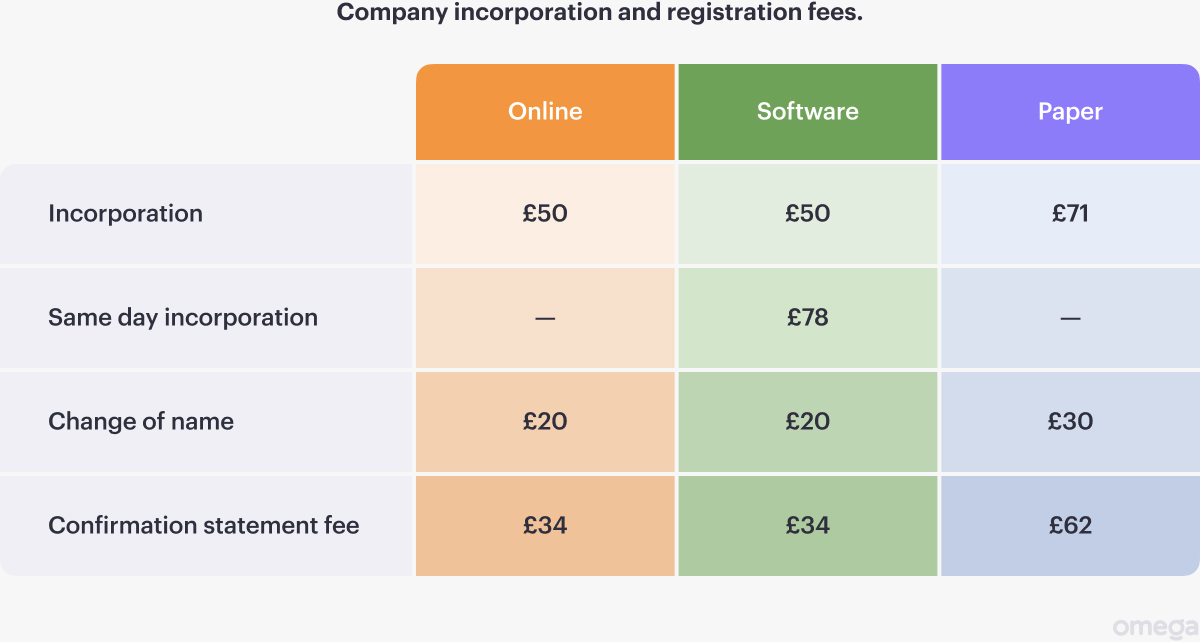

The Cost of Registering a Business in the United Kingdom

This is the most crucial part of your business journey as you take your business to the UK, and surprisingly enough, it is not as expensive as you think.

The typical cost of registering your business in the UK hovers between £50 and £100; however, the exact amount may vary from one company to another based on your method of choice and if any other services are required. By opening a business account with Omega, you can register your UK company complimentary.

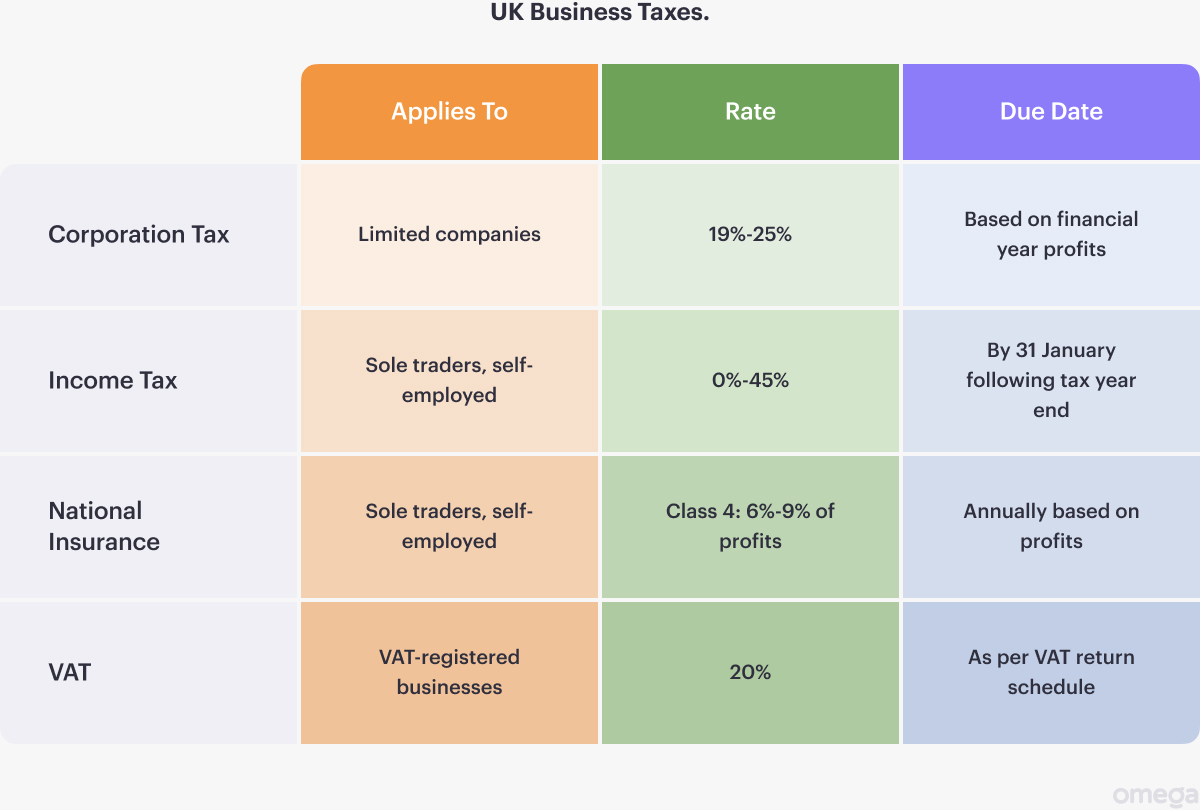

What Taxes Will My Company Pay?

As a company operating in the UK or any other country, you are legally required to pay business tax based on your business structure, profit earned, and how you take income as the owner (i.e., salary, dividends, etc.).

Though there are various business taxes, these are the common ones you need to know:

- Corporation taxes are paid annually based on profits made in your financial year if you are a limited company or a foreign company operating in the UK. Rates may vary between 19% and 25%.

- Income tax is commonly paid by freelancers, sole traders or self-employed individuals, which must be paid before or by 31 January following the end of the most recent tax year. For instance, if the 2023/24 tax year ended on 5 April 2024, the deadline is 31 January 2025. Rates can range between 0 and 45%, depending on how much you profit.

- National Insurance is required for freelancers, sole traders and self-employed individuals. Sole traders, freelancers and self-employed individuals are subject to pay Class 2 (£3.45 a week but has been abolished by 2025) and Class 4 National Insurance Contributions (9% of profits for 2023/24, which will be reduced to 6% of profits in the 2024/25 tax year).

- VAT (Value Added Tax) are added to most goods and services at 20% if you are a VAT-registered business. Note that you can only charge VATs if you are a VAT-registered.

Remember that there may be more types of taxes you may need to comply with, so ensure you do your due diligence.

How Long Does it Take to Register a New Company?

Once you have your documents in order and your application reviewed and submitted, a confirmed registration will take about 24 hours. However, the duration may be longer if there is a surge in the number of applications to process or if you decide to do a postal application (around 10 days).

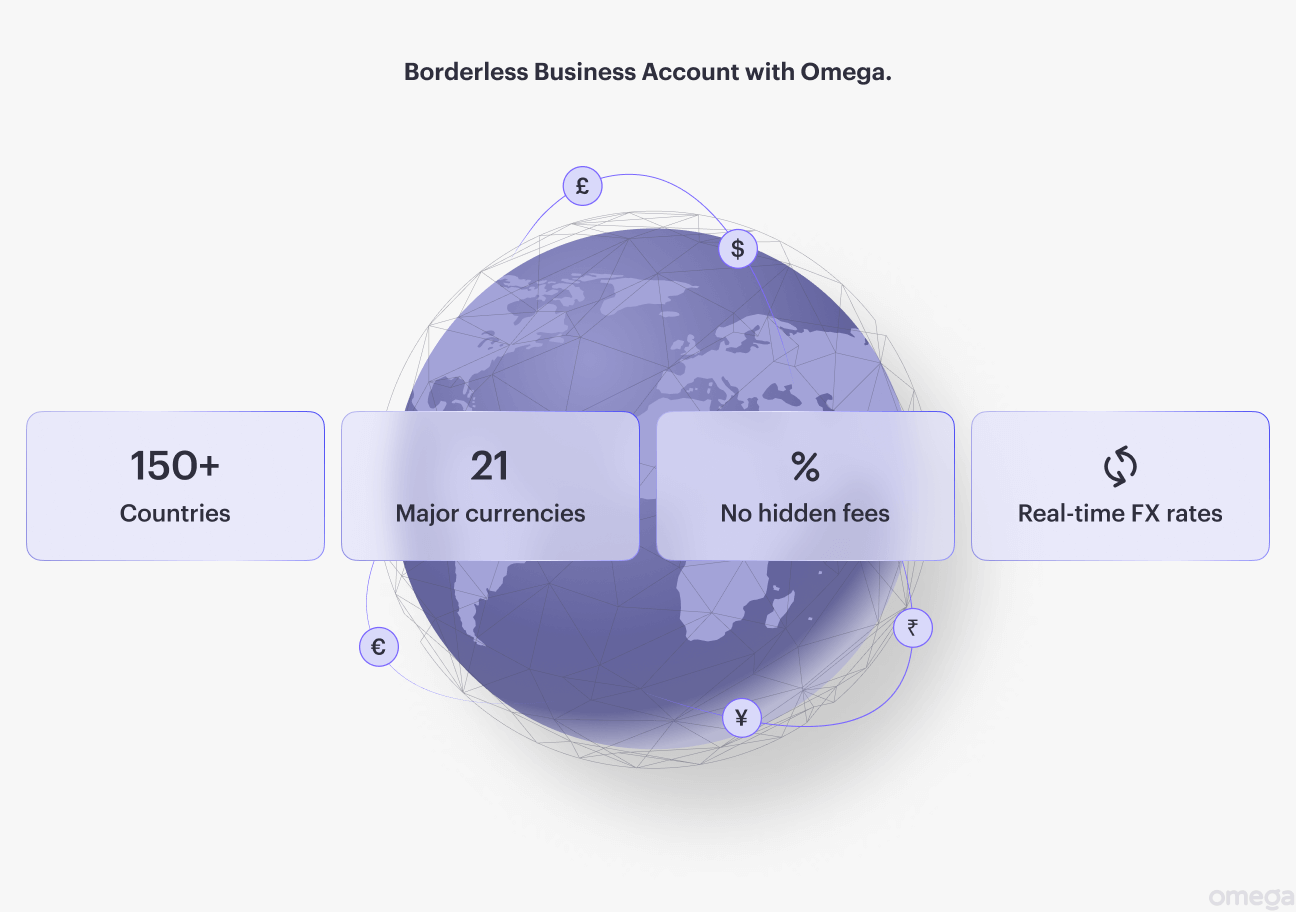

How Omega Can Help You Start a New Business

We know how seemingly tedious this may sound, but hey, the first step is always the most necessary. But what if we told you there was an all-in-one stop for all your business needs, from registering our company and opening a business account to being provided accounting, legal, and consultation services? Well, that’s Omega.

We pride ourselves on being more than just an electronic money institution by going the extra mile to help start, run and grow your business from registration to expansion. Learn more about how Omega can guide your business to do more than just survive.