Thinking of launching your own business in the UK? Before you get started, you need to choose the best business ownership structure for your company.

The UK offers four business ownership types: sole proprietorship, partnership, limited company, and limited liability partnership. Each comes with its own advantages and challenges. Below, we will explain the four forms of ownership and business structures.

What Is a Sole Proprietorship?

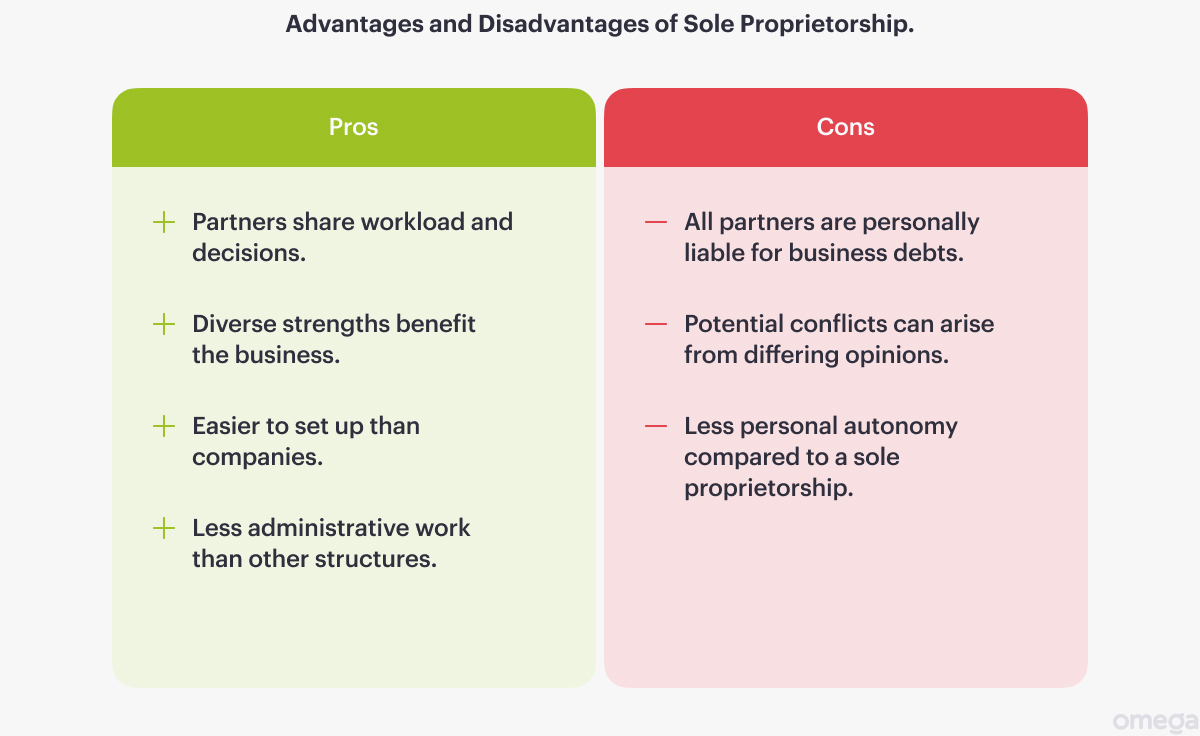

A sole proprietorship (also called a sole trader) is a business owned and managed by one person.

It is the simplest type of business ownership to establish in the UK. You have complete control, and there is minimal paperwork to get started (at least compared to other forms of ownership).

Interestingly, there are 3.1 million sole proprietorships which make up about 56% of all UK businesses (clearly a favourite among entrepreneurs).

Some examples of sole proprietors (traders) include: freelancers and those working in the gig-economy such as copywriters, photographers, tutors, accountants, plumbers, etc.

What Is a Partnership?

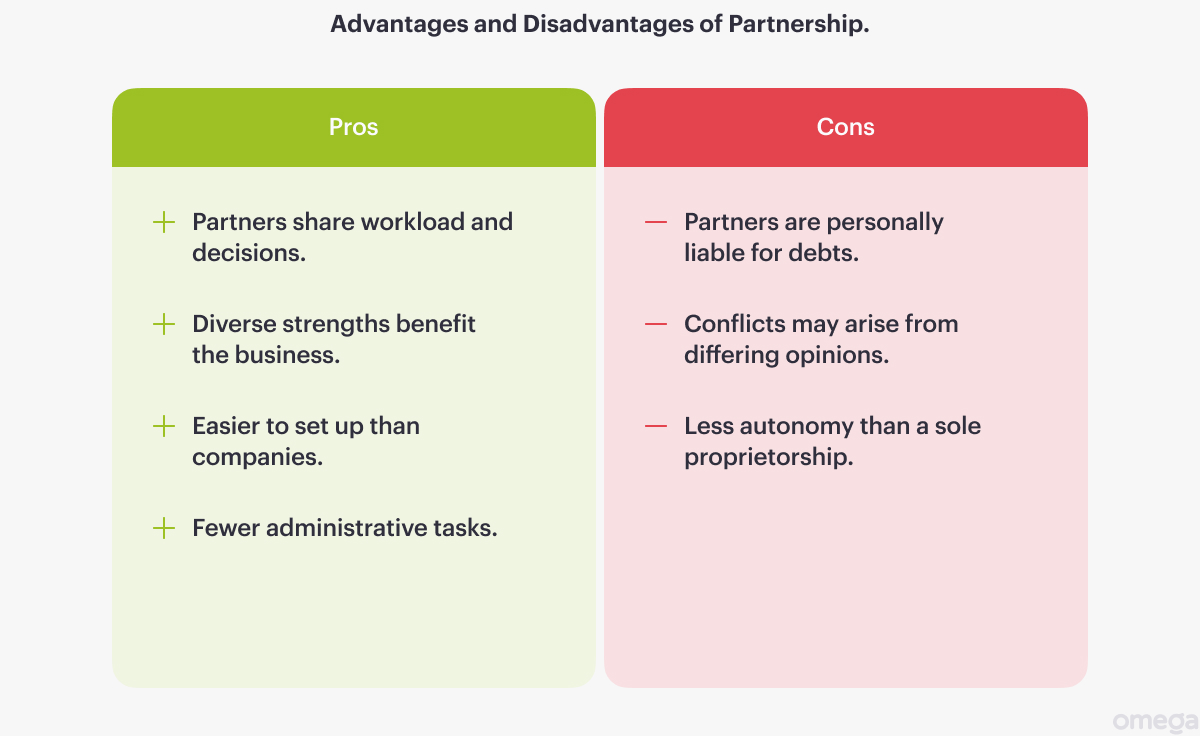

A partnership is a business owned and managed by two or more people.

These types of business structures are a popular choice for those who want to pool resources and expertise, and many businesses in the UK operate as partnerships. Basically, you will each share a responsibility for the ownership, liabilities, and profits for the business.

There are two main types:

- General Partnership: All partners share responsibility for managing the business and are personally liable for debts.

- Limited Partnership: Includes both general and limited partners. Limited partners invest capital but have limited liability and don’t partake in daily management.

For this business structure, we are talking about general partnership (more on limited partnerships later).

What Is a Limited Company?

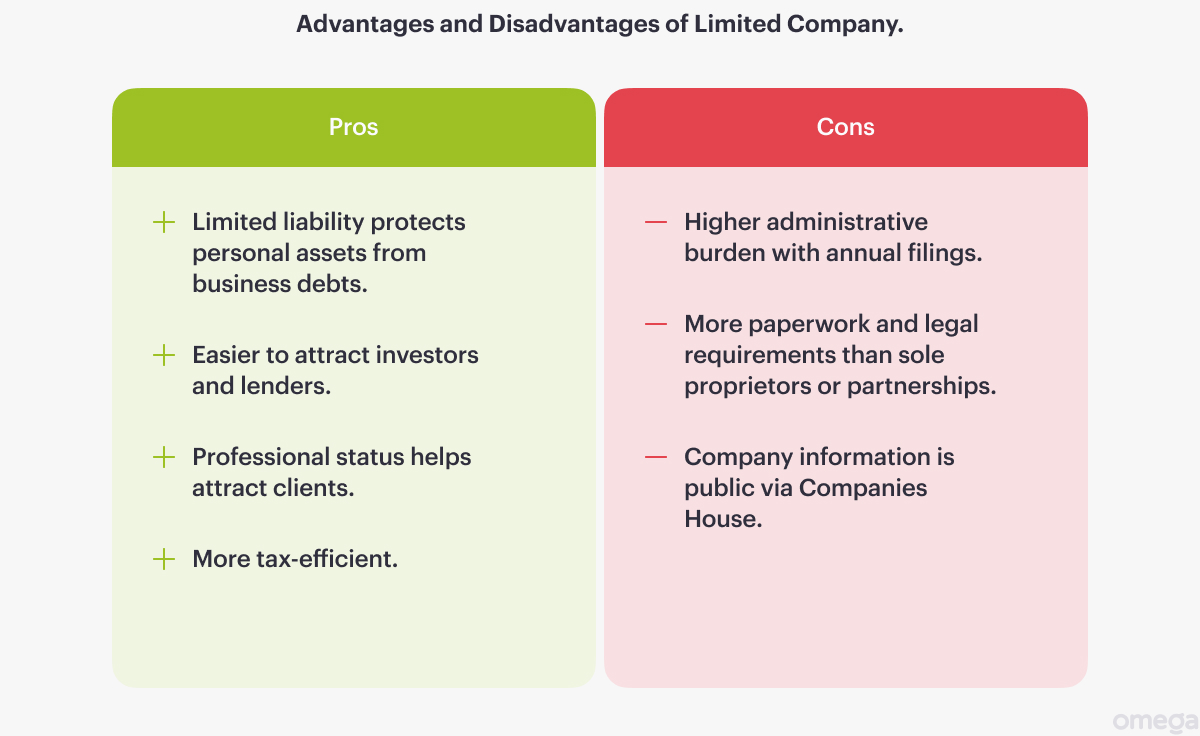

A limited company is a separate legal entity owned by shareholders.

This means the company itself is responsible for its actions and debts, not the individuals who run it. In the UK, limited companies are popular with over 5 million companies currently registered with Companies House (and with 500k new companies incorporated each year, it’s definitely a popular choice).

Limited companies can be:

- Limited by shares: Common for profit-making businesses. Shareholders own shares in the company.

- Limited by guarantee: Used by non-profit organisations. Members here act as guarantors rather than shareholders.

What Is a Limited Liability Partnership (LLP)?

A Limited Liability Partnership (LLP) merges the flexibility of a partnership with the limited liability benefits of a company.

In an LLP, two or more individuals or entities (partners) own and manage the business together. Each partner’s liability is limited to the amount they invest, protecting personal assets from business debts.

LLPs are common among professional services like law and accounting firms.

How Omega Can Help You Start Your Business

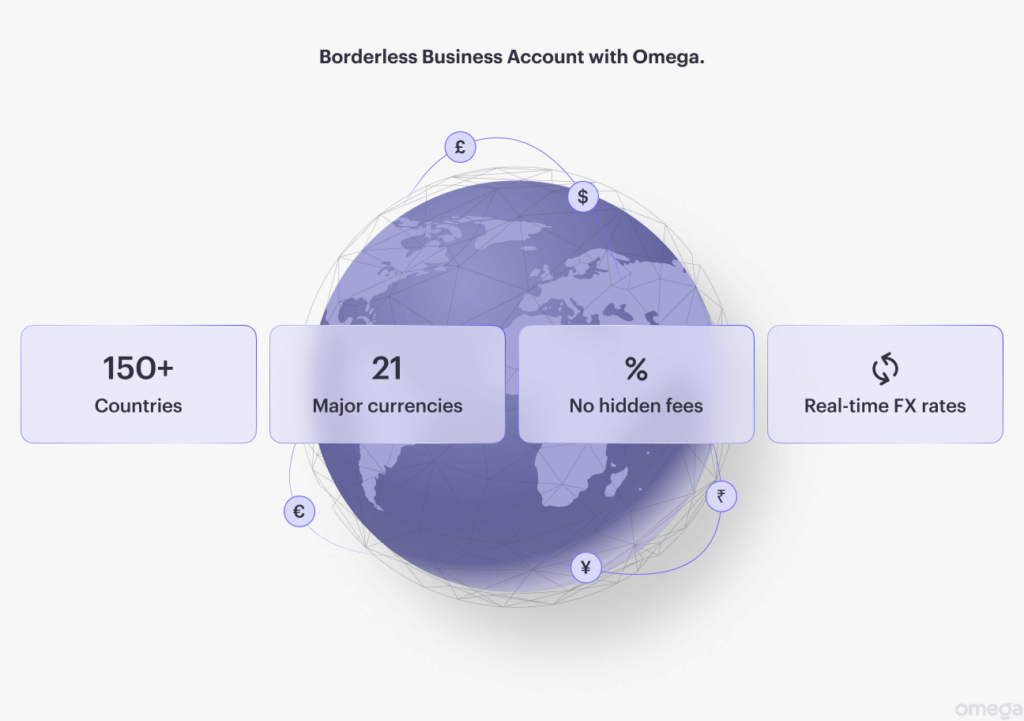

Starting a business is exciting but can be complicated. That is why we build Omega. Omega simplifies everything for you, from registering a company in the UK all the way to managing your finances all in one place.

We provide business accounts for entrepreneurs like you to help you manage your business from day one, even offering free up-to-date business tools to help you strategise and grow your business.

Conclusion

The UK offers four different forms of business ownership: sole trader, partnership, limited company, and limited liability partnership. Each has its own pros and cons, but the best choice depends on your business goals.

No matter which path you choose, managing your business alone can get complicated. We provides a multi-currency business accounts and convenient UK business registration services.

Ready to take the next step? Try Omega to learn more about getting help starting a business in the UK.

Disclaimer.