If you are an entrepreneur looking to operate globally, you have likely heard about cross-border transactions, in reference to doing business internationally. And, as the global economy has become more interconnected, cross-border transactions are now more common than ever. Though it might be a popular term, you may not be familiar with what a cross-border transaction actually is and why it is a complex process.

In this article, we will explain what cross-border transactions are and give five examples, so you will come away with practical knowledge on how these kinds of transactions might apply to your business.

What Is a Cross-Border Business Transaction?

A cross-border transaction is any exchange of money between a buyer and seller in different countries. In cross-border transactions, the buyers and sellers might be businesses, or they may be individuals. If both parties of the transaction are businesses in different countries, this is referred to as a B2B, or business-to-business, cross-border transaction. And a transaction between a business and an individual consumer is called a B2C, or business-to-consumer, cross-border transaction.

Whether the two parties are businesses or individual consumers, when money travels between two parties located in different countries and involves different currencies, this is a cross-border transaction.

Why Are Cross-Border Business Transactions Complex?

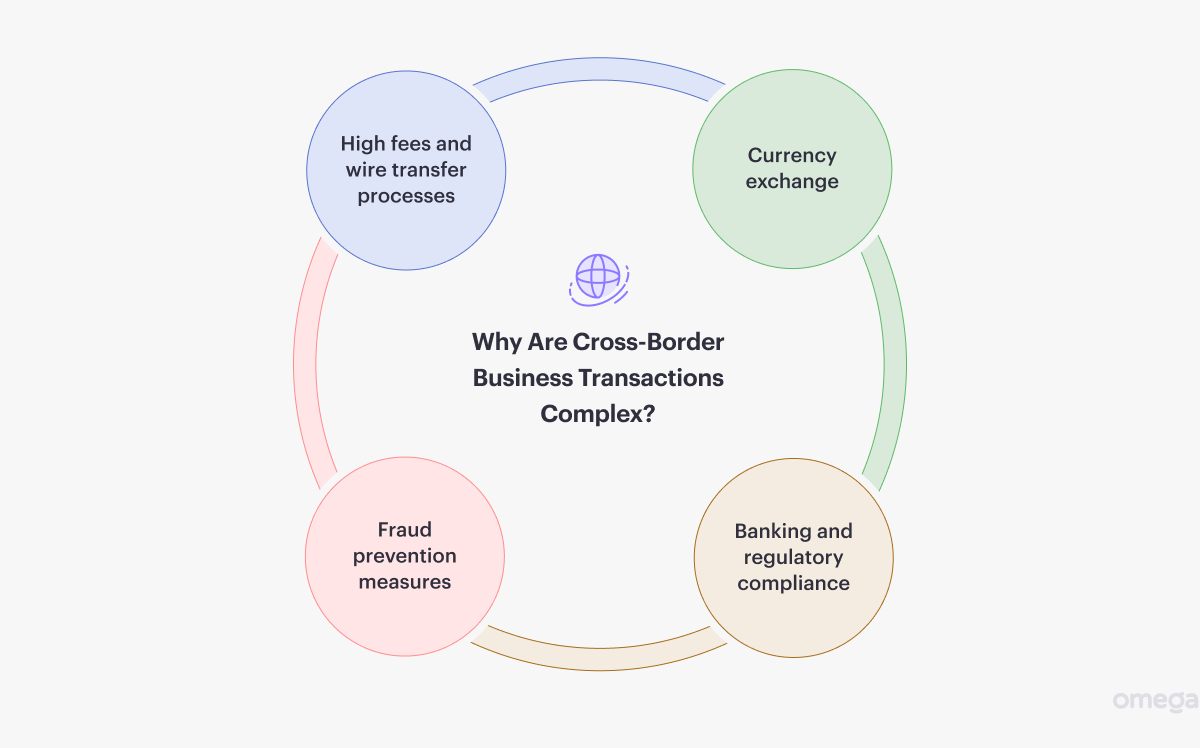

Though it has become routine to send and receive cross-border payments, it is not always a simple process.

The institution that facilitates the payment must allow one party to pay in the currency of their country and allow another party to receive the payment in the currency of a different country in their own business account. The two financial institutions involved often are not connected, and require an intermediary to facilitate the transaction.

There are also various requirements that both parties must meet to verify details of their accounts on both sides of the transaction, in order to prevent mistakes or fraud. Then there is the issue of determining exchange rates, which change rapidly and may vary depending on who carries out the payment. In addition, each country has its own system of banking and security regulations to adhere to, adding to the complexity of sending payments internationally.

Most cross-border transactions today are carried out by wire transfer, which is quick, but can be costly. Therefore, businesses or individuals who want to send a cross-border payment will usually pay high fees.

So even though cross-border payments are generally faster and more widely available than in the past, these remain complex transactions with a lot of variables to consider.

Examples Of Cross-Border Transactions

Let’s have a look at some of the most common types of cross-border transactions that take place today.

1. E-commerce Purchases

A customer in the UK purchases a gift from an online shop in Greece, through the website. The UK customer pays for the item in GBP, from their credit card, while the business in Greece will receive the funds in its account in euros. This is a frequent scenario in which funds need to move across countries and currencies.

B2C transactions like e-commerce purchases currently represent the fastest growing segment of cross-border transactions today.

2. International Workforce Payments

A Canadian company hired a team of web developers working in Spain and needs to establish a dependable and secure way to pay them. Compensation of contractors or permanent employees in foreign countries is an important example of the need to conduct cross-border transactions. With businesses becoming more widely distributed in the digital age, it is critical that they have a way to pay workers, no matter where they are in the world.

3. Business-to-Business International Trade

Another example would be when a manufacturer in Germany purchases raw materials from a supplier in China. B2B purchases like this one represent the largest percentage of all cross-border transactions, since these payments support the entire global supply chain.

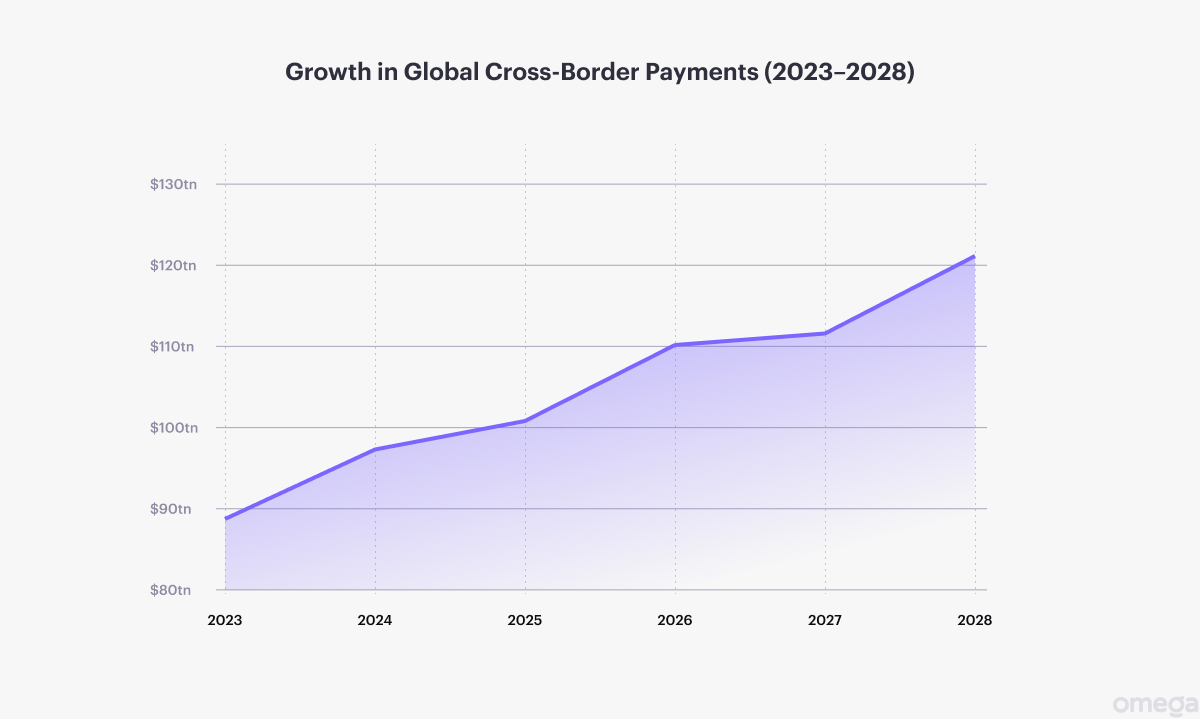

In fact, global cross-border payments are expected to soar from $89 trillion today to $124 trillion by 2028. It’s critical for businesses planning for growth to be prepared to issue payments to suppliers all over the world.

4. Global Investments

An individual in the UK wants to invest a portion of their savings in the US stock market. They send funds through a financial institution to purchase shares of a US company’s stock, which they hold in an investment account. This is another example of a cross-border transaction.

Many individuals or companies are able to take advantage of favourable conditions in other economies by purchasing stocks or other financial assets of foreign markets. Investments like this can involve moving large sums of money between different financial institutions. Foreign investment transactions were once only conducted by banks. But today, investing in foreign markets is possible even for individuals, thanks to advances in cross-border payment capabilities.

5. Remittance Payments

An individual from the Philippines is temporarily living and working in the UK. Monthly, they send a portion of their pay to a family member in their home country. A cross-border payment facilitator is needed to make sure the money arrives safely in their family member’s account back home.

Though a much smaller portion of the overall cross-border transaction total, remittance payments are a critical part of the international economy. For many low- and middle-income economies, remittance payments from other countries provide a lifeline for survival for individuals and families.

How Can My Business Conduct Cross-Border Transactions?

There are several options available for businesses that need to conduct international transactions. The best option for your company depends on the type of business, its operations, and your particular goals.

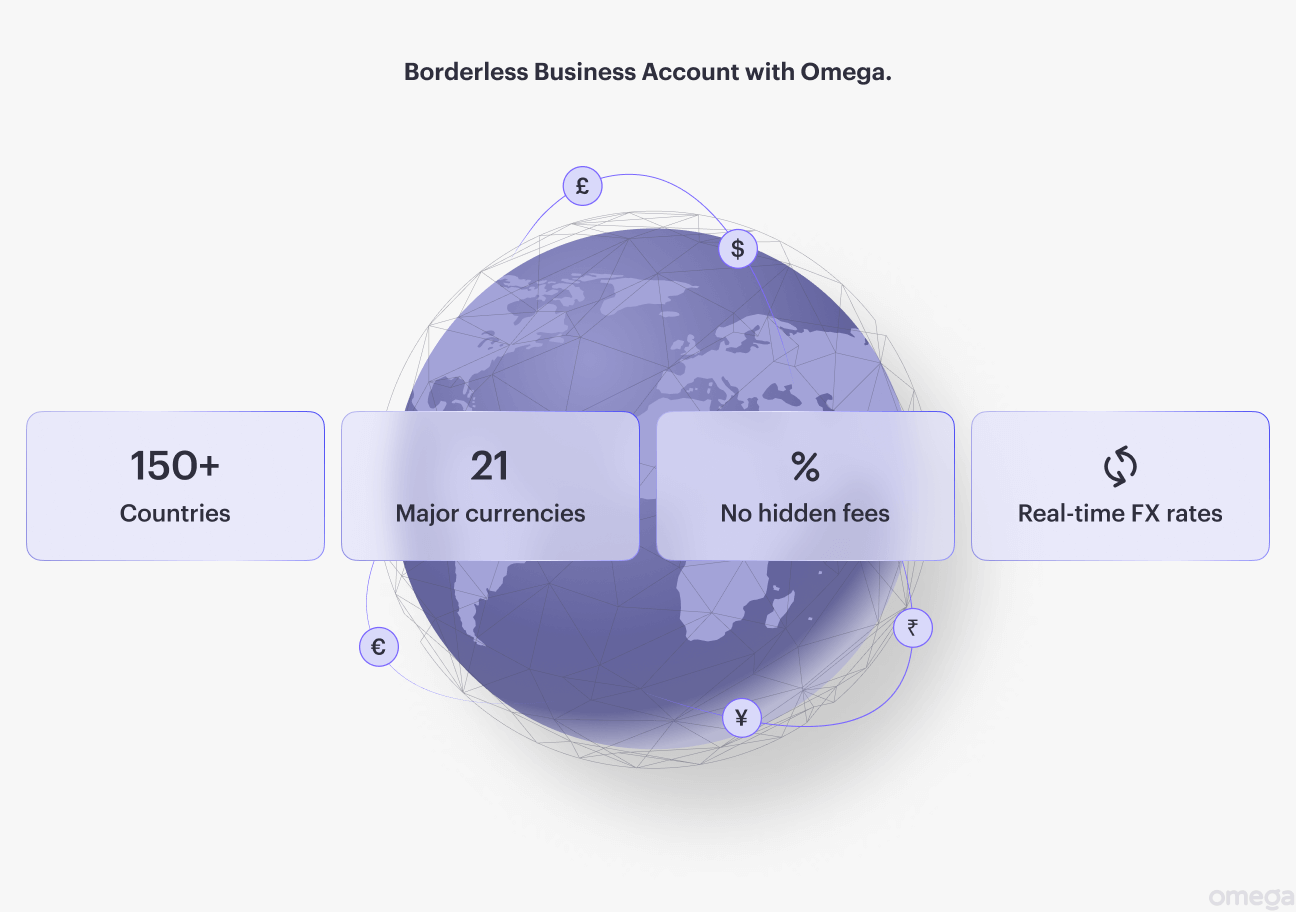

One excellent option to consider for cross-border payments is Omega. Omega is an Electronic Money Institution, or EMI, that facilitates cross-border transactions. Omega can hold funds and conduct international business payments in 21 major currencies. And we provide business account services to residents in over 150 jurisdictions, as long as the legal entity is incorporated in the UK.

With the capability to serve everything from small startups to large operations, Omega has helped many companies become well-positioned to take advantage of global market opportunities through cross-border transactions.