A multi-currency IBAN (International Bank Account Number) serves as a powerful financial tool for individuals and businesses handling global transactions. Rather than using multiple accounts for different currencies, it allows you to manage various currencies under a single account umbrella. This helps you save time and money, plus you can keep your finances organised in one place.

Here is how you can open a multi-currency business account using Omega financial services.

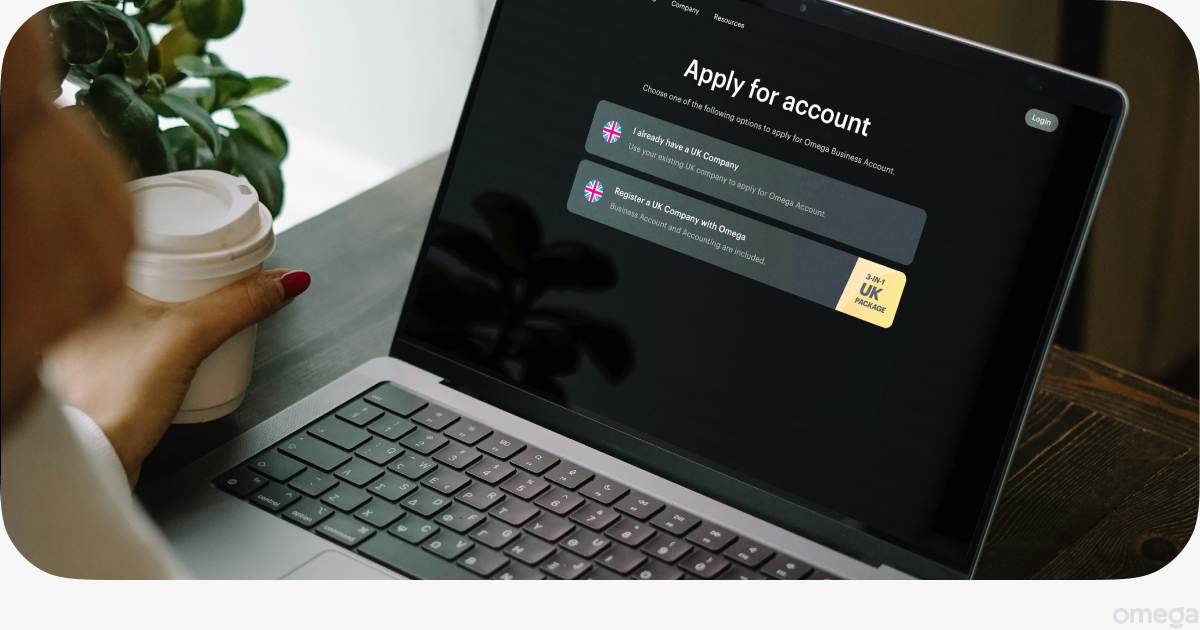

Ways to Apply for a Multi-Currency IBAN

Omega offers two ways to get your GB IBAN:

- Use an existing UK-registered company to apply for an account.

- Register a business in the UK for the account.

Let’s review each option in more detail.

Use My Existing UK Business

If you already have a business registered in the UK, you are on the fastest path to applying for a multi-currency international bank account. Our easy-to-use application wizard collects specific data from you, including your business name and personal documents to verify your identity and eligibility.

The application process takes about five minutes, and you will receive confirmation of your successful application within 1-2 business days.

Register a Business in the UK

If you do not have a business registered in the UK or in a country we service, you will need to register your business before applying for a GB IBAN. This is a separate step that will need to be completed before you apply for a multi-currency business account.

To register a business in the UK, you will need to provide a few documents:

- Your legal name.

- Address.

- Phone number.

- Country of residence.

- Company details and documents.

You will also need to choose a business name. Omega will verify its eligibility as part of the registration process. It is a good idea to have a few back-up names in case you are unable to secure your first choice.

Once you have your documents and business name, you will need to complete a short form on our website, then we will handle the rest.

After your business has been registered, we will set up your multi-currency business account so you can start managing your global finances from a single place.

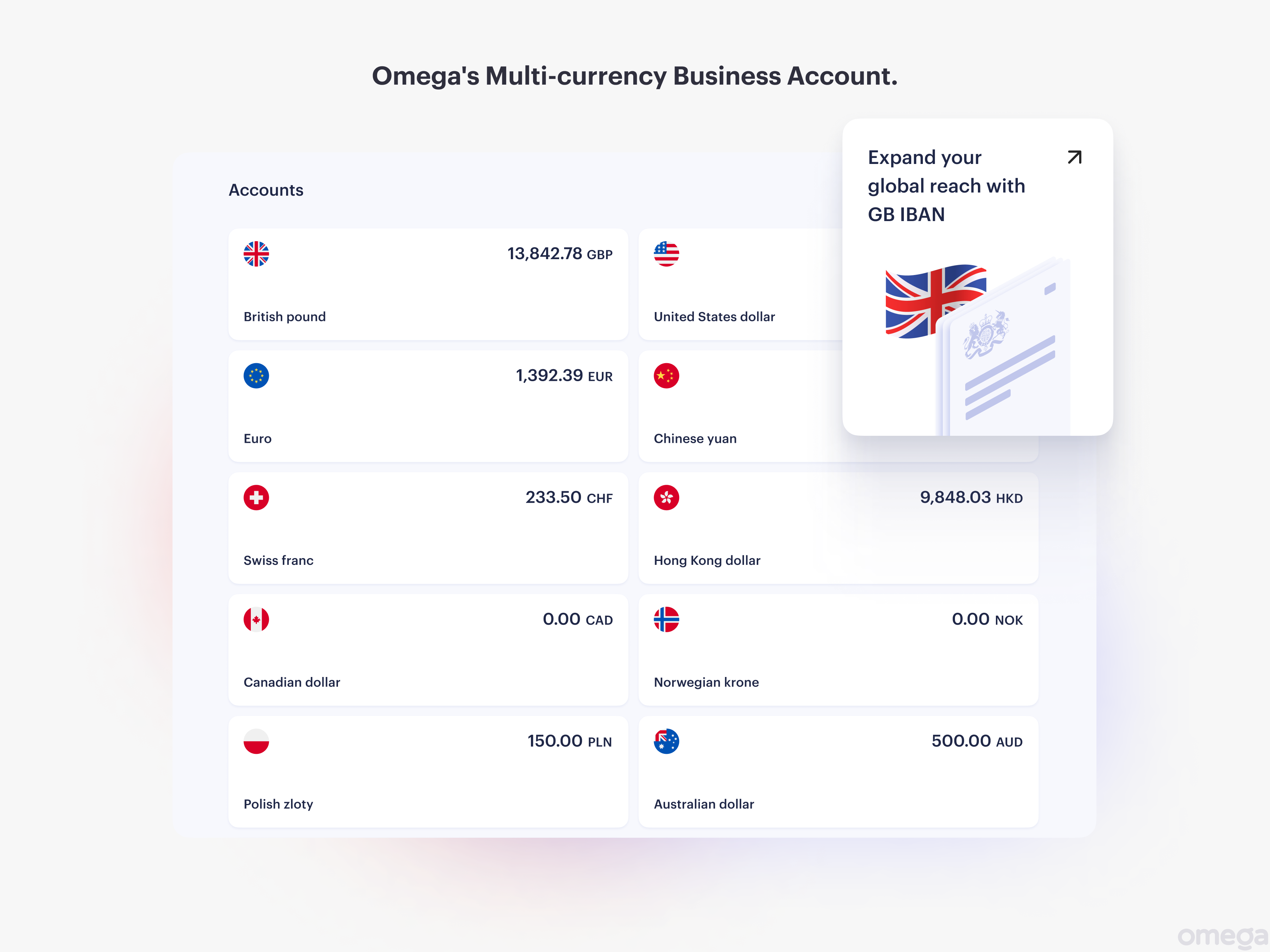

The Benefits of Using Multi-currency Business Account

Today’s companies need flexibility and real-time visibility that allows them to do business beyond borders. The option to manage multiple currencies from a single account enables a seamless operation while expanding your opportunities.

As a result, companies and customers alike benefit from multi-currency capabilities:

- Improve customer relationships.

- Accept more business from more places.

- Avoid delays associated with currency conversions.

- Deliver faster service.

- Gain greater financial visibility.

- Track expenses and revenue in local currency.

- Make decisions on actual data rather than fluctuating exchange rates.

In short, a multi-currency account for business isn’t just about convenience – it is also good for profitability!

Apply for a Multi-currency Business Account with Omega

Omega’s instant account creation gives you a simple way to access multiple currencies. With no transaction limits, you can send payments to 150 countries and receive payments in 21 different currencies. We offer the highest level of security with account encryption and safeguard your funds in the UK’s most trusted banks.

Unique to Omega is our dedicated customer support. We are available seven days a week by phone and email to help you with your business’s finances. Support is available in your language, giving you confidence in conducting international business. It starts with our quick application process — sign up today and choose the multi-currency business account option that works for you!