As you are chasing the thrill of entrepreneurship, don’t neglect the importance of KPI tracking. Key performance indicators (KPIs) measure your business’s health and help you see whether you are meeting or progressing toward important goals. Monitoring certain financial KPIs for startups can help you understand your cash flow, revenue, costs, and profit so you can make informed decisions that will help you grow faster.

Here are 10 financial metrics for startups that you should be tracking on a regular basis.

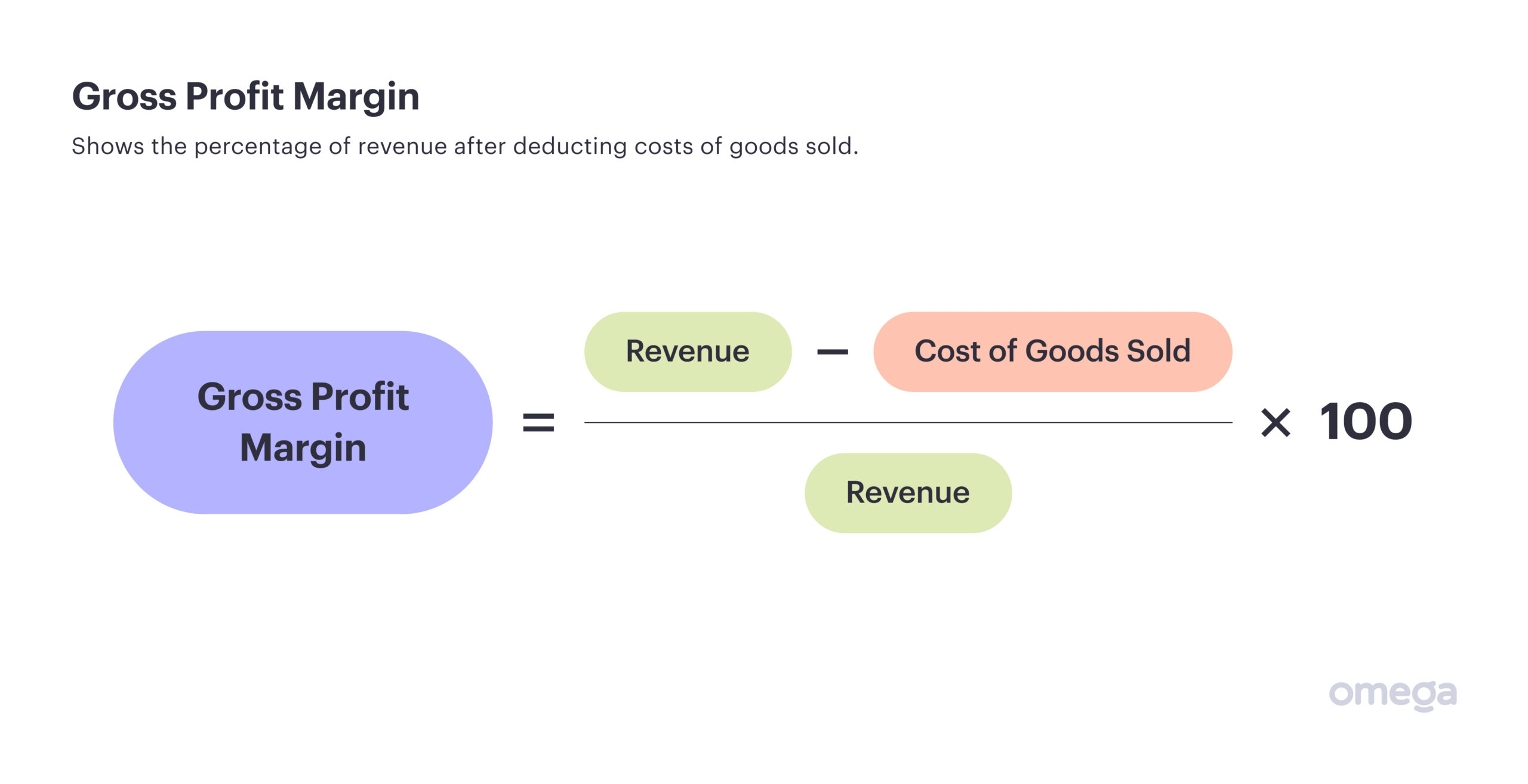

1. Gross Profit Margin

Your gross profit margin is the percentage of revenue that exceeds the cost of goods sold. A high profit margin suggests you are producing your product or service efficiently. A negative gross profit margin indicates your cost to produce a product or service is greater than the revenue you earn from it.

Let’s say you earn £100,000 in revenue and your cost of goods is £60,000. Using the above formula, your gross profit margin would be £40,000, or 40%.

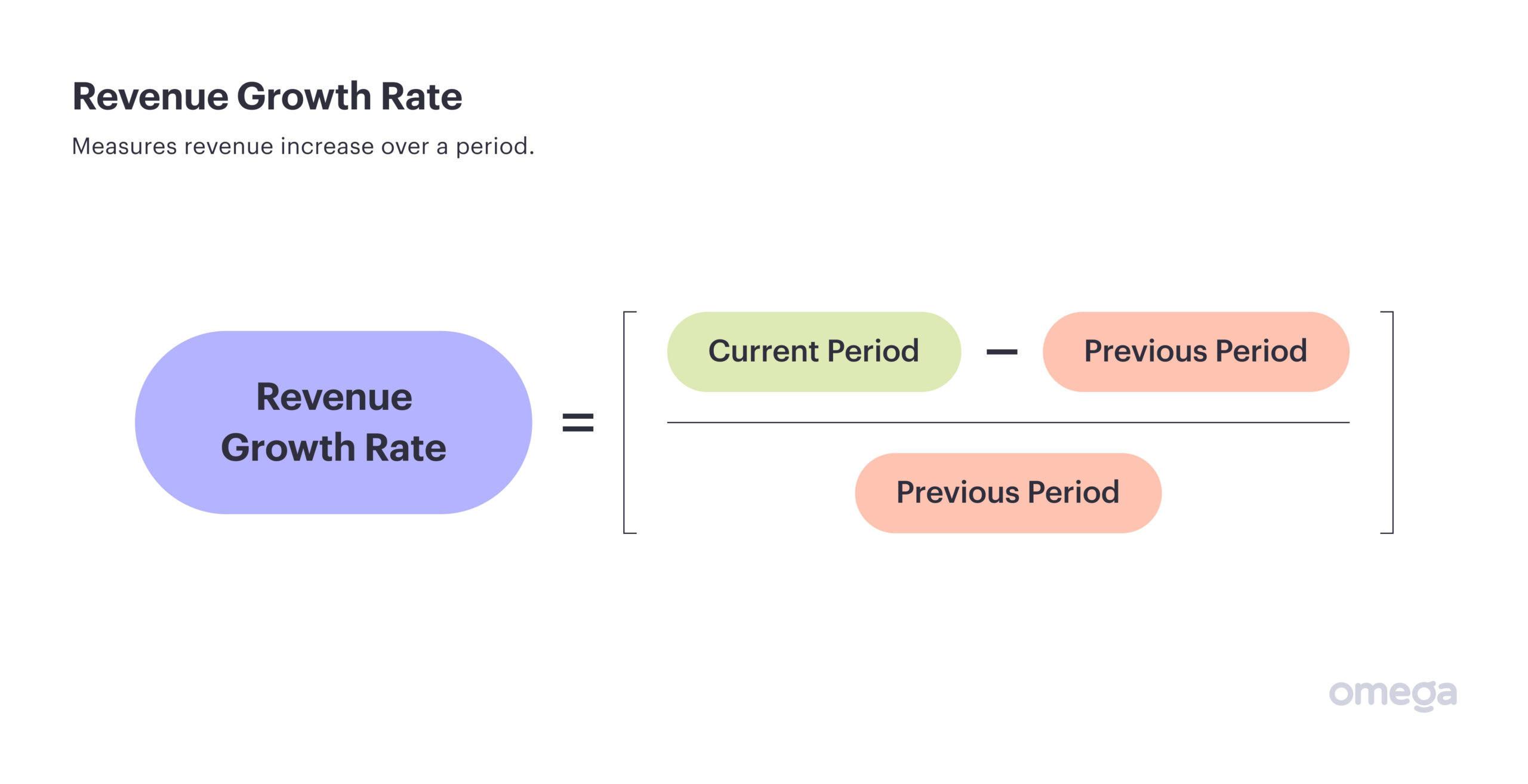

2. Revenue Growth Rate

Revenue growth rate measures how quickly your business revenue grows over time. This is one of the most critical revenue KPIs for startups looking to scale up. You need to know how quickly your revenue is growing so you can make key investment decisions for your business.

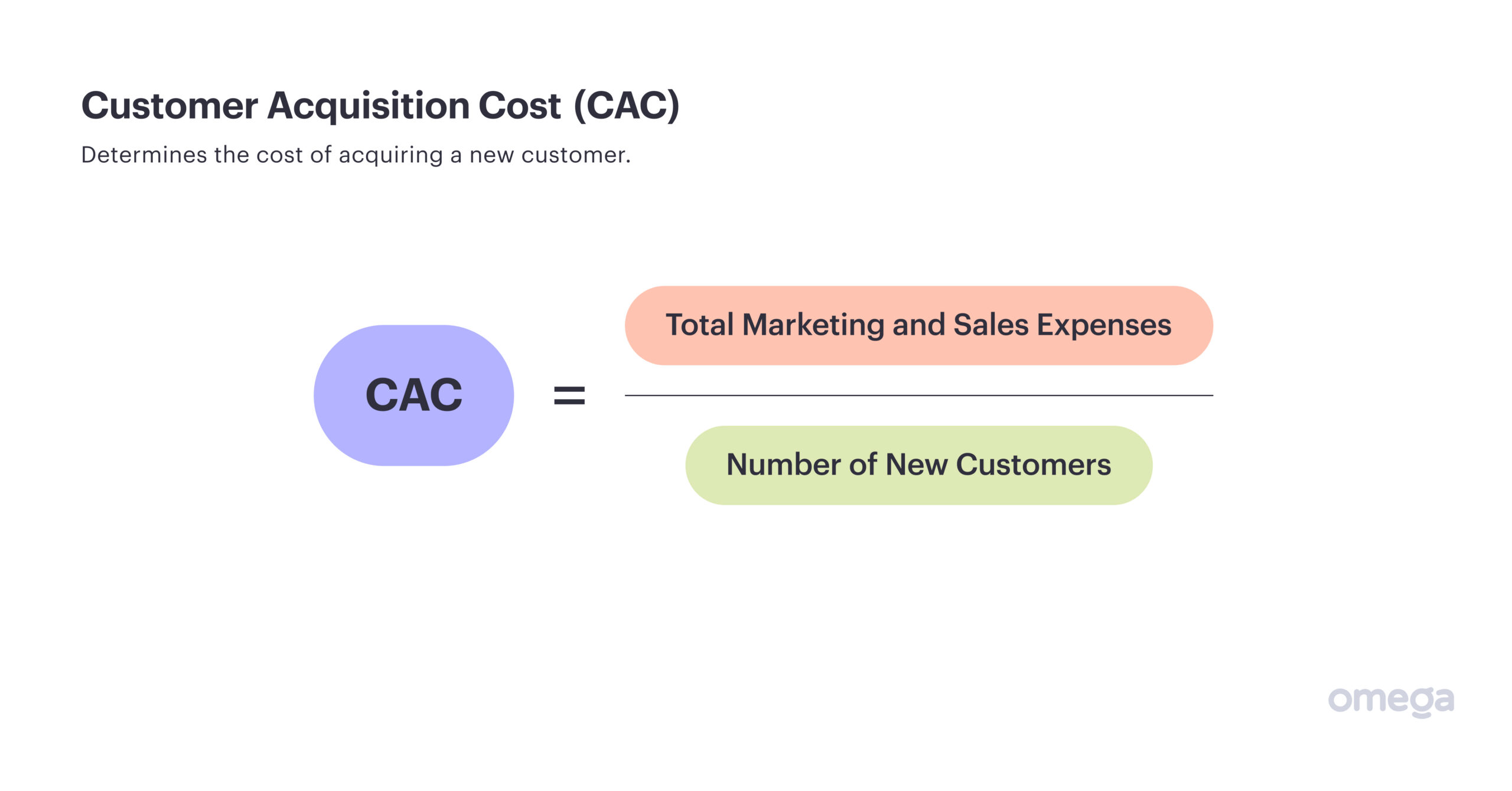

3. Customer Acquisition Cost (CAC)

You have to spend money to make money. Customer acquisition cost (CAC) tells you how much it takes to turn a looker into a buyer. This figure includes marketing and sales expenses. Generally speaking, a lower CAC is better because you are not using as many resources to convert a customer.

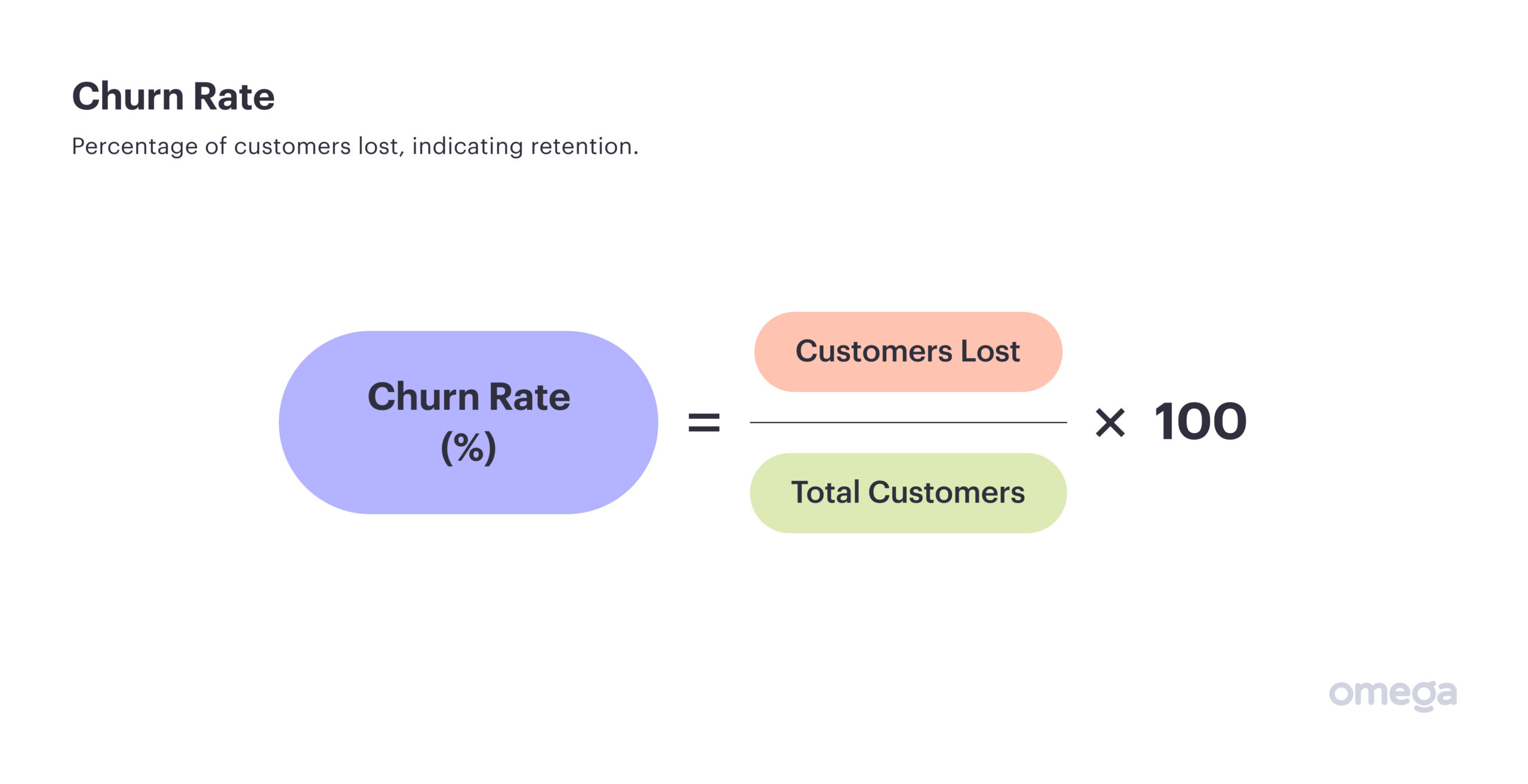

4. Churn Rate

Not all customers stay with a company. Churn rate (one of the most important financial KPIs for SaaS companies) measures the percentage of customers who stop using your product or service in a given period. A lower churn rate is ideal for business growth and positive cash flow.

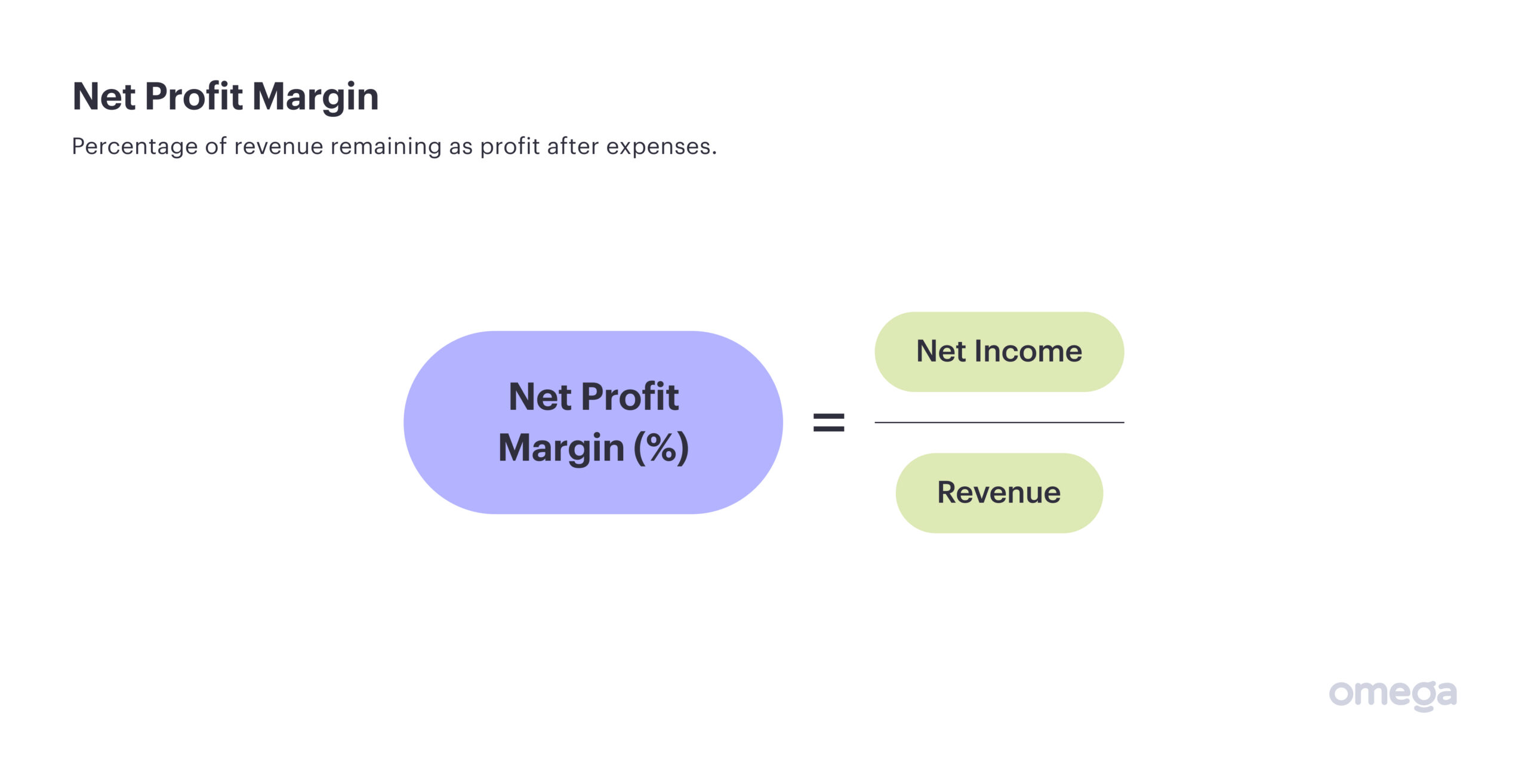

5. Net Profit Margin

The money you take in isn’t all yours to keep. Once you pay for your overhead, you are left with your profit. Your net profit margin, therefore, is the percentage of revenue left after you account for all of your expenses. This is the strongest measure of your business’s overall profitability.

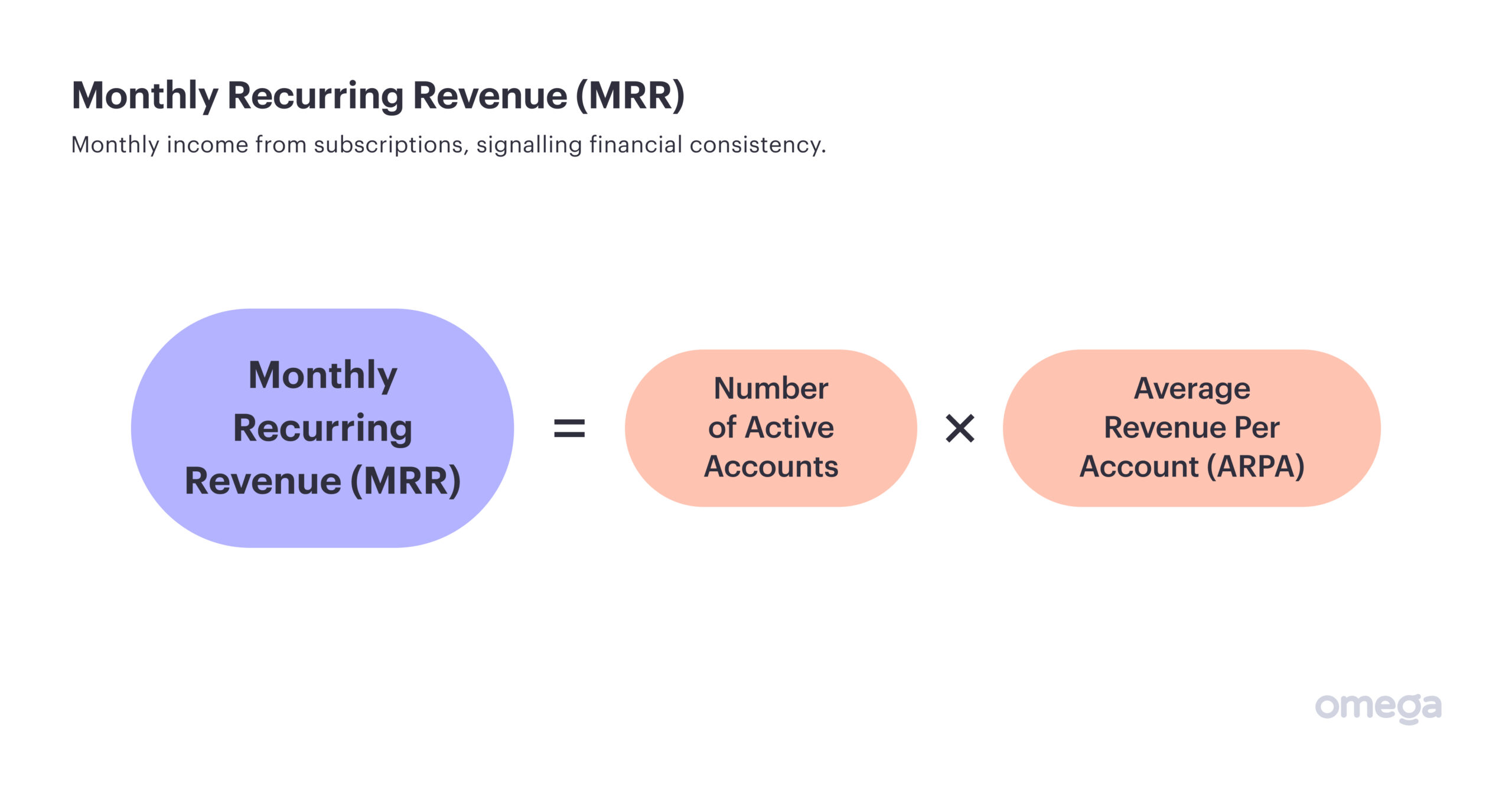

6. Monthly Recurring Revenue (MRR)

Another quintessential KPI for subscription businesses (like SaaS), monthly recurring revenue measures the amount of revenue you can expect to generate in a given month. This is important because you can use income predictions to make smarter investments in your business.

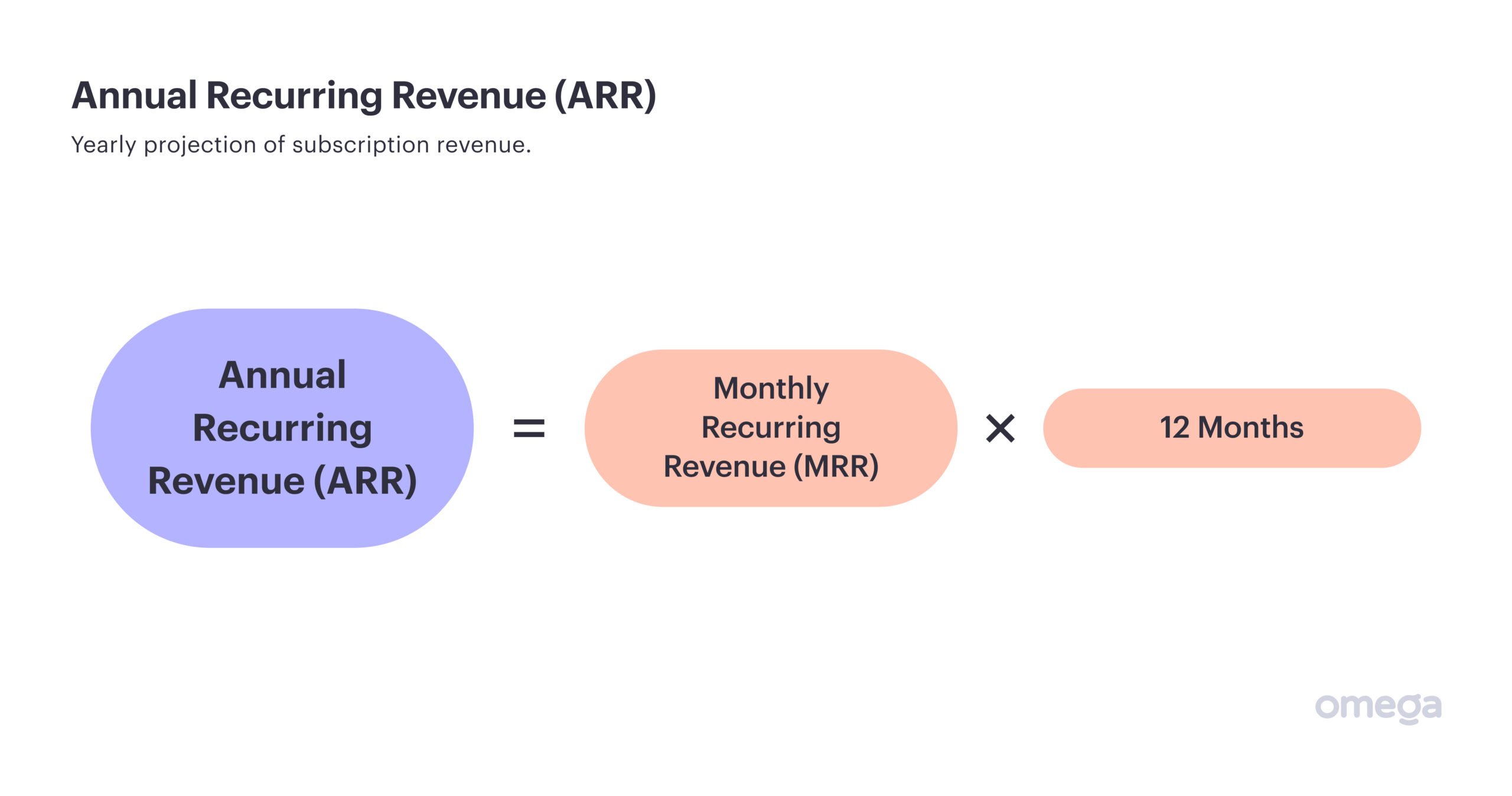

7. Annual Recurring Revenue (ARR)

Similar to MMR, annual recurring revenue predicts how much income you will receive in a given year. This gives you a broader view of recurring revenue so you can track your growth trajectory. Again, this is among the important SaaS sales KPIs that can make a difference in subscription-based businesses.

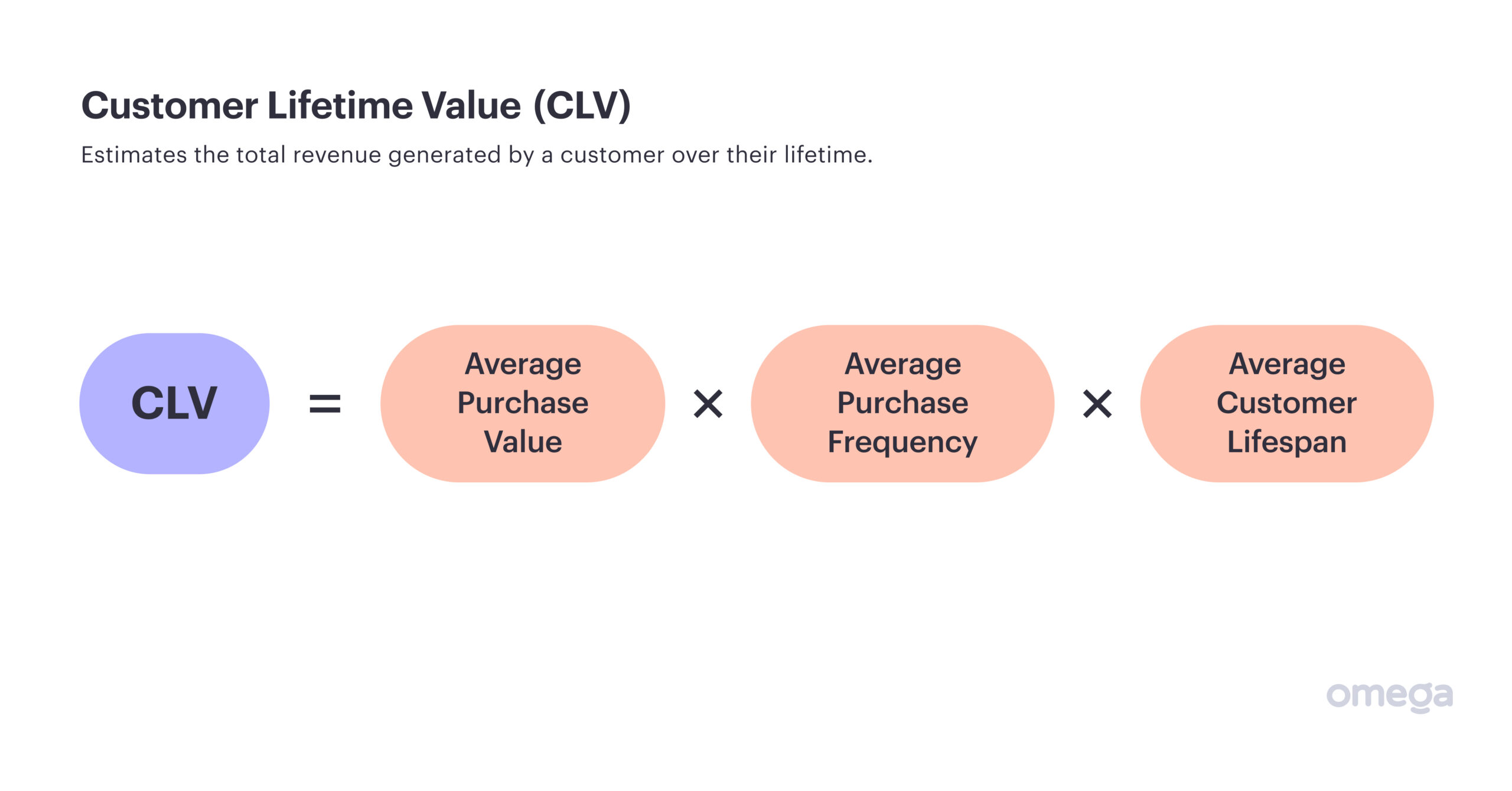

8. Customer Lifetime Value (LVT)

Another startup KPI is the total lifetime value of a customer. It is easier to market to existing customers than attract new ones, which is why many businesses focus on the value of the entire future of a customer relationship. A high lifetime value and a low cost per acquisition offers an ideal scenario.

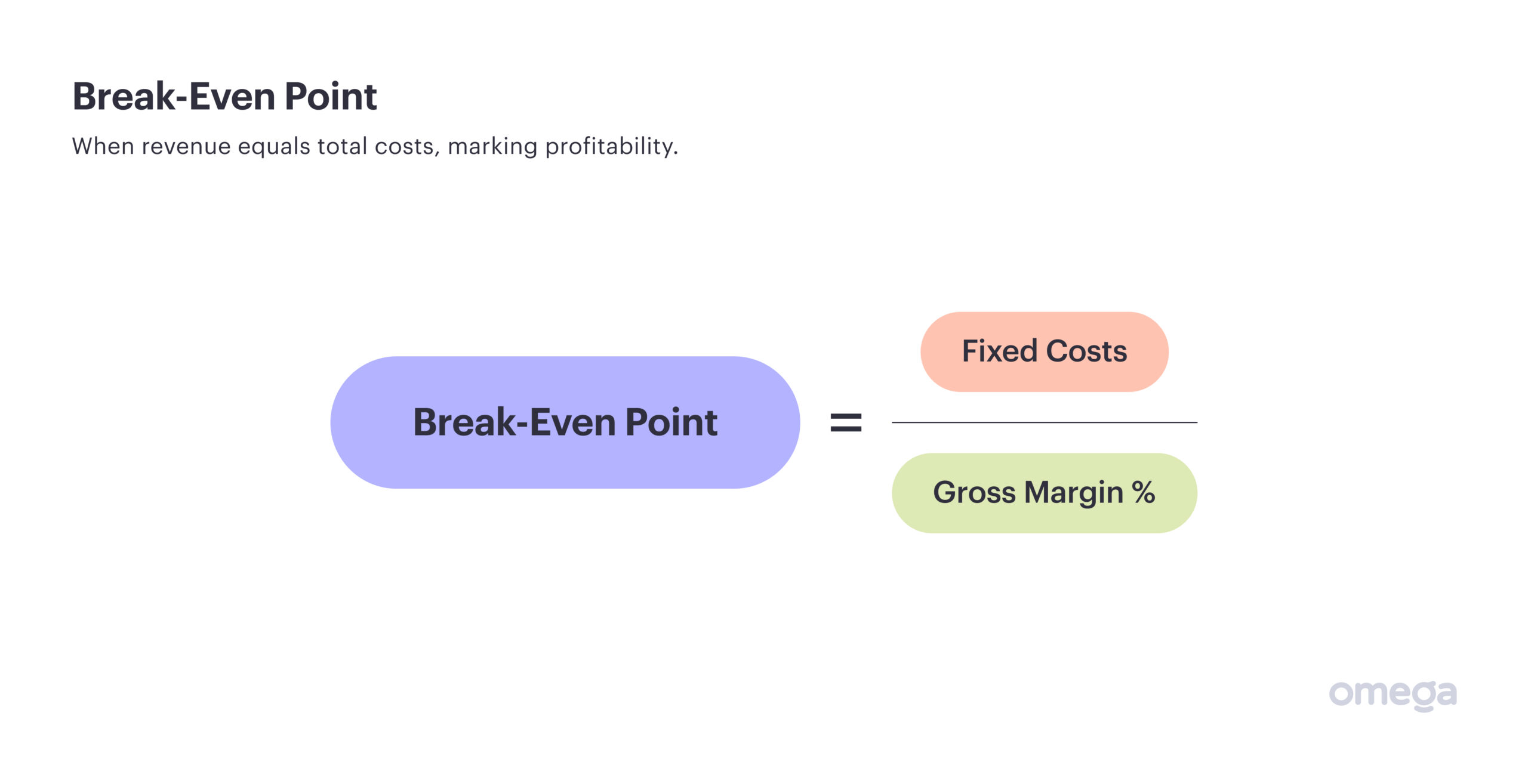

9. Break-Even Point

No matter your business type, one of the most key financial metrics for startups is your break-even point. This metric tells you how much revenue you need to earn to pay for your overhead and other costs. After you reach your break-even point, your business can start generating a profit.

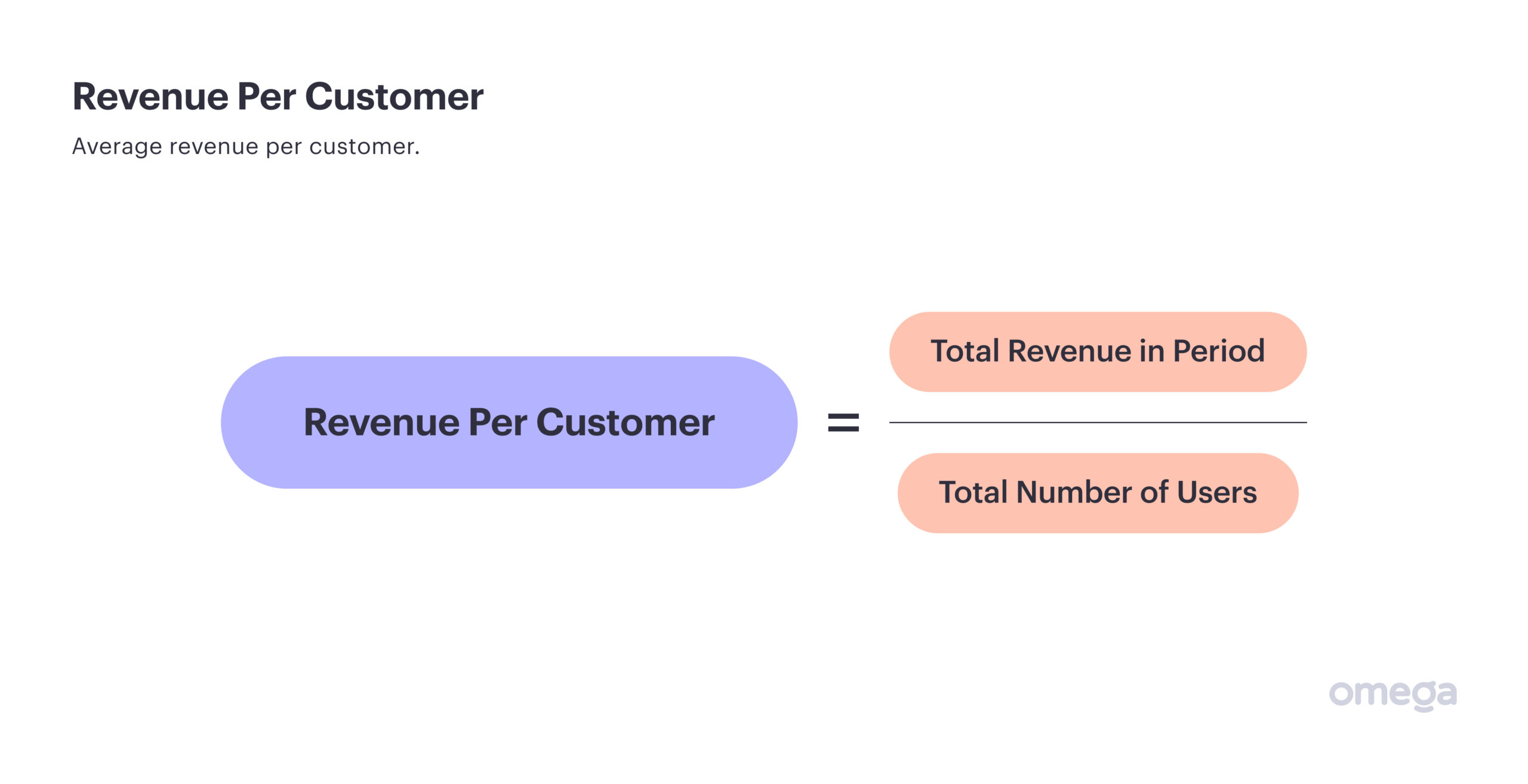

10. Revenue Per Customer

The revenue per customer metric is an important FinTech KPI if you are using financial data to meet certain business goals. It tells you the average revenue each customer brings to your business.

If you have a specific financial goal in mind, you can use this metric to understand how many customers you need to reach that goal. It is also helpful in understanding customer profitability, which might affect how you market your business and how much you spend on sales and marketing initiatives.

Track Your Financial Health with Omega

Keep in mind your key performance indicators for startups may vary depending on the nature of your business. For instance, a KPI for an SaaS business might be different from one for eCommerce that handles one-off sales.

No matter your business type, Omega can help you centralise your finances and make tracking KPIs for startups faster, easier, and hassle-free. Our business finance services let you send and receive local and international payments, manage assets, handle accounting, and more from a single place, so you always know where your business’s cash reserves stand. Contact us today to learn more.