You can buy commercial property in the UK even if you are foreigner. Overseas investors and business owners often expand their investments to the United Kingdom, given its strong economy and high quality of life among its people.

However, the process can vary by country — you will need to know what to expect in the UK market. Here are six considerations for buying commercial property in the UK so you can make an informed decision.

The types of tenure for a business property

We have two types of property tenure in the UK:

- Freehold: You own the property and land outright with no expiry date (as long as you pay your annual taxes).

- Leasehold: You own the property (but not the land) for a predetermined time.

Freehold is typically best when you:

- Can invest substantial capital to purchase the UK house or other.

- Can afford to be responsible for maintenance, repairs, and insurance.

- Want unlimited control over how you use the property and land (e.g., making improvements, adding on to the building).

- Want a long-term investment.

Leasehold might be better if you:

- Prefer to test your business idea

- Don’t want the expense of total ownership

- Have less to invest upfront

- Don’t want the hassle of re-selling the property later

Both types of tenure come with unique benefits and considerations. It ultimately depends on how long you intend to use the property, budgets, and burdens of responsibility.

Talk with local lenders for financing options

Financing a commercial property as an outsider may come with extra fees and fewer financing options. For example, you might have to come up with a higher deposit, pay higher interest rates, and/or be subjected to currency conversion fees.

Your best option is to connect with a UK-based lender that specialises in foreign transactions. They can work with you to explore your finances, explore your loan options, and budget for real estate fees.

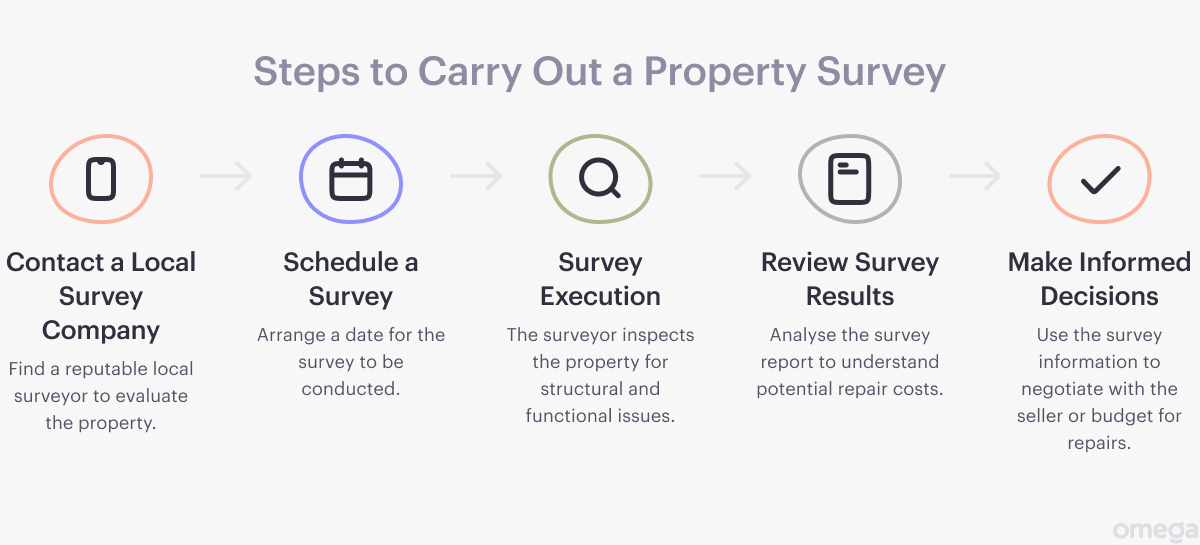

Carry out a property survey before the purchase

Many foreign real estate buyers making buying decisions based on photos and public data like pricing, location, property age, and annual tax rates. While these things are important, you also want to make sure the property is in good shape. Photos only tell part of the story.

Before you purchase, you’ll need to hire a local survey company to conduct a property survey. This survey looks for structural issues, functional problems, and other “surprises” a photo might not show. Survey results will help you get a better idea of what your investment will cost upfront, as you might have to make important repairs to make your property usable.

Based on the survey results (or your own observations), you might try to negotiate some of the repairs or changes with the seller. This is a helpful way to save money and get your property closer to being ready for your business. And, as an international who might not have local connections with contractors or service providers, this can save you a lot of time and effort.

Negotiate further works with the property seller

Based on the survey results (or your own observations), you might try to negotiate some of the repairs or changes with the seller. This is a helpful way to save money and get your property closer to being ready for your business. And, as an international who might not have local connections with contractors or service providers, this can save you a lot of time and effort.

Budget for your stamp duty and other fees

UK’s Stamp Duty Land Tax is imposed on all real estate transactions, including commercial properties. This tax must be paid within 10 days of your property purchase and ranges from 2%-5% of the transaction amount.

In addition, you will also need to budget for:

- The property survey (£400+ based on the property’s price tag)

- Title review and search of public registers

- Planning permission (not applicable in all cases)

- Legal fees

- Lending fees

Real estate fees can add up quickly. It is important to know how much you might pay in fees before purchasing a commercial property in the UK. This way, you feel certain about the price range you can afford.

Have a plan to pay for the property in local currency

When buying a commercial property in the United Kingdom as a foreigner, you will need to use local currency to complete the transaction. Converting foreign currency into the British pound incurs fees, which may vary based on your country of origin.

Buy commercial property in the UK with Omega

Omega is here to help international entrepreneurs to start and grow their business in the UK. On top of the multi-currency account, Omega Business Account also provides access to third-party corporate service providers and legal advisors who can assist you in navigating purchasing property in the new legislative environment.

Disclaimer