Starting a business is one of the most rewarding and exciting experiences one can have. It is a process that requires planning, patience, and a lot of paperwork. Just when you feel like you have figured it out, you are again faced with a new set of challenges, decisions, and responsibilities.

One of the trickiest questions you will have to ask yourself is, ‘Do I need to register for VAT?’ And if so, when is the best time to do it? VAT can be intimidating for anyone running their own business, so we’ve created a guide explaining when to register for VAT and other important matters.

What is VAT?

In 2023, there were 2.727 million VAT businesses in the UK. So what is VAT, exactly? In simple terms, ‘Value-Added Tax’ or VAT is a consumption tax added to nearly all goods and services bought and sold in the United Kingdom. However, not all businesses are required to charge VAT to their customers. This obligation only applies to companies registered with HMRC.

The upside is that registered businesses can claim back any VAT they have paid on their business expenses.

When does a company have to register for VAT?

The answer to whether you have to register for VAT largely depends on your company’s turnover. If your annual taxable sales have exceeded £90,000 per year (this is the new rule in place since 1st April 2024) or are expected to do so in the next 30 days, you must register for VAT. This is compulsory.

However, there may be exceptions when a business decides to register for vallue-added tax before reaching the threshold. This is known as voluntary registration and can sometimes benefit companies who want to claim back input on their expenses.

What happens if you don’t register for VAT after meeting the threshold?

As mentioned before, registering for VAT when your business surpasses the threshold is compulsory. If you fail to do so, you risk serious consequences, including

- Tax investigations (in some cases, fines and even legal action).

- Penalties and interest from HM Revenue & Customs (HMRC)

How to register for VAT

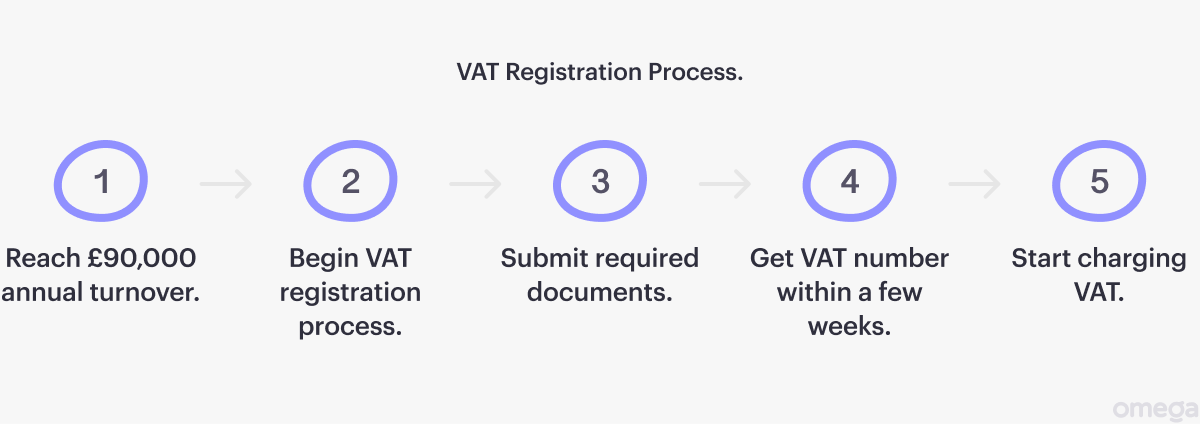

To avoid unnecessary stress and potential problems, it is best to register your company as soon as you expect to exceed the limit. Fortunately, the process is quick and easy.

You can register online through HMRC’s website. With an Omega Business Account, you can delegate VAT registration to one of our industry-leading third-party accounting professionals directly through your account.

Final thoughts

As your business grows, you’ll be faced with many decisions, including whether (and when) to register for VAT. If you are liable to pay the tax, make sure you are charging the applicable rate on the goods or services you offer.

Likewise, if you have any questions, it is best to check with Omega’s accounting experts – they will clear any confusion you might have. For more tips and tricks on registering and managing a business in the UK, don’t forget to follow our blog.

Disclaimer.