Implementing strategies to safeguard your business is just as important as implementing strategies to grow your business. Licensing and insurance are often the first safeguards that come to mind, but you must not forget business fraud protection. A proactive approach is the best approach, so you must learn what types of fraud your business is at risk for.

In addition to general theft and fraud, there is an ever-evolving range of cybercrimes you must be aware of. With the right systems, checks and balances, and cybersecurity measures you can drastically reduce your risk for all types of fraud.

What is business fraud?

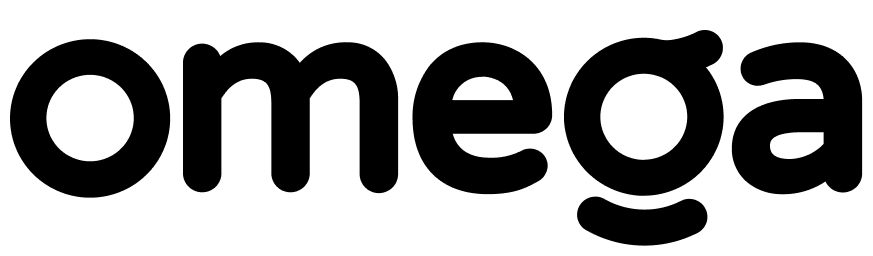

Business fraud is a white-collar crime conducted by an internal employee or external third party. According to PwC, 50% of UK businesses have experienced fraud. Surprisingly, 60% of these crimes involve an internal employee.

Fraud in business isn’t accidentally making an error that results in a financial loss. For example, accidentally giving a customer an extra 20 pence when providing change for a cash payment. Or an accidental bookkeeping mistake that has financial consequences.

Fraudulent activity can be conducted by:

- Employees.

- Investors.

- Customers.

- Vendors.

- Cybercriminals.

- External third parties.

What is the definition of fraud in a business context?

To create an internal business fraud prevention plan you must identify what you are most at risk for. Below are some of the top types of fraud in business.

Payment Fraud

For brick-and-mortar businesses, you must be mindful of counterfeit bills, stolen credit cards, and in-store theft. If your business is online-only, you are still at risk for stolen credit card use.

Internal fraud, theft, and misappropriation

This includes stealing property, inventory, or cash, using the company credit card for personal expenses, falsifying expense reports to include personal expenses, falsifying timesheets, and ordering supplies from a company account for personal use or personal resale.

Disclosure fraud

Disclosure fraud is internal fraud that occurs when a current employee, former employee, or third-party contractor shares trade secrets or IP without consent.

Invoice fraud

Verified vendors and suppliers can engage in fraud by sending false invoices or adding false charges to invoices. Fake vendors may seek payment, typically by email or phone, for services they haven’t provided in the hopes that you will pay.

Payment diversion

Internally, an employee or investor could route payment to a personal account. Externally, your email can be hacked and your company email used to route payments to fraudulent third parties. Or someone could call or email, posing as a verified supplier, to request changes to payment details to route your next payment to them.

Cybercrime Fraud

This includes ransomware attacks that encrypt company websites, accounts, or data and demand payment for release. Or hacking computers to access or steal company data. You must also be mindful of emails and downloads that include malware, trojan horses, or viruses that can be used to disrupt business or steal data.

How to prevent business fraud?

The 9 tips below will help you to prevent or swiftly identify fraud. Even if you are a solopreneur or have a small team, you must put preventative measures in place.

1. Purchase insurance

Consider investing in business insurance that includes theft. This includes monetary theft, digital/document theft, and business interruption caused by cyberattacks and other disruptions.

2. Know your protective policies

Understand the fraud protection included with your insurance policies, bank accounts, credit cards, and Omega account for business. Most have insurance to protect you when you are a victim of fraud.

3. Complete background checks

Complete background checks to verify the reputation of your vendors and suppliers. Employee background checks aren’t standard in all industries, so consider what is right for your business.

4. Know your point of contact

With most communication completed electronically, it is important to know who your vendor, supplier, and third-party contractor contacts are.

5. Invest in cybersecurity

Even if you are a solopreneur, primarily work with freelancers, or have a small team—cybersecurity is a must. Work with a cybersecurity specialist to determine what safeguards are required for your computers, cloud storage, and mobile technology.

6. Outline your policies

Have employees sign relevant non-disclosure agreements and ensure they understand your cybersecurity policies. For example, you can minimise your risk for business credit card fraud by only allowing online business purchases using company computers and mobile devices.

7. Reconcile your PNL

Even if your bookkeeper inputs the data, sit down at least once a month to review paid invoices in search of false charges or fraudulent invoices.

8. Reconcile expenses

The most effective way to prevent business expense fraud is to match employee receipts with their expense report and travel dates. Also, be sure to clearly outline spending limits.

9. Identify trusted forex partners

As you take your business global, you must identify global foreign exchange payment and money management partners. Omega business accounts provide startups and established businesses with a comprehensive suite of services. From establishing your business in the UK to global payment processing, secure transfers to over 150 countries, and a growing list of essential business services.

In Conclusion

Even with a proactive approach, fraud can and will happen—but the earlier you catch it the better.

Setting up the safeguards above minimises the risk of internal and external fraud. Not all fraud is substantial, but a loss is a loss.

In addition to monetary loss, you can’t recover lost time, sales, confidential data, intellectual property, or consumer trust and loyalty. Preventative systems and internal audits help you protect your business, clients, and data.

Disclaimer.