As a foreign entrepreneur in the UK, you will need a local business account. Let’s explore how to open a UK business account for non-residents and why Omega is the best choice.

What Is a Business Account?

A business account is more than a place to keep your earnings. Generally, a business account offers more insights and functions than the traditional bank account. It diligently organises every transaction, gives you cash flow visibility, converts currencies for foreign transactions, and more.

Ultimately, a business account serves as the financial backbone of your operations. However, if you’re not a UK resident, opening a business account here may prove challenging, which can delay your foreign business goals.

Why Is It Difficult for Non-residents to Open a UK Business Bank Account?

One of the biggest hurdles is the UK’s stringent anti-money laundering regulations that banks enforce. These measures help protect businesses against financial crimes, but they inadvertently create a barrier for legitimate entrepreneurs who don’t have local ties or credit history.

International entrepreneurs need to provide extensive documentation to qualify for a business bank account. Proof of identity, residency, details about your business activities — the list goes on. Many non-residents struggle to meet these requirements, especially when doing business outside of their native language.

Banks are naturally cautious when it comes to foreign entities. They need reassurance their customers aren’t just passing through for a quick profit. Even well-prepared individuals may face delays or outright denials due to risk assessment protocols. While it is challenging and time consuming, it is not impossible.

Why Open a Business Account With Omega as an International Entrepreneur?

Our team specialises in smooth business registration in the UK along with setting up business accounts that you can manage from anywhere around the globe.

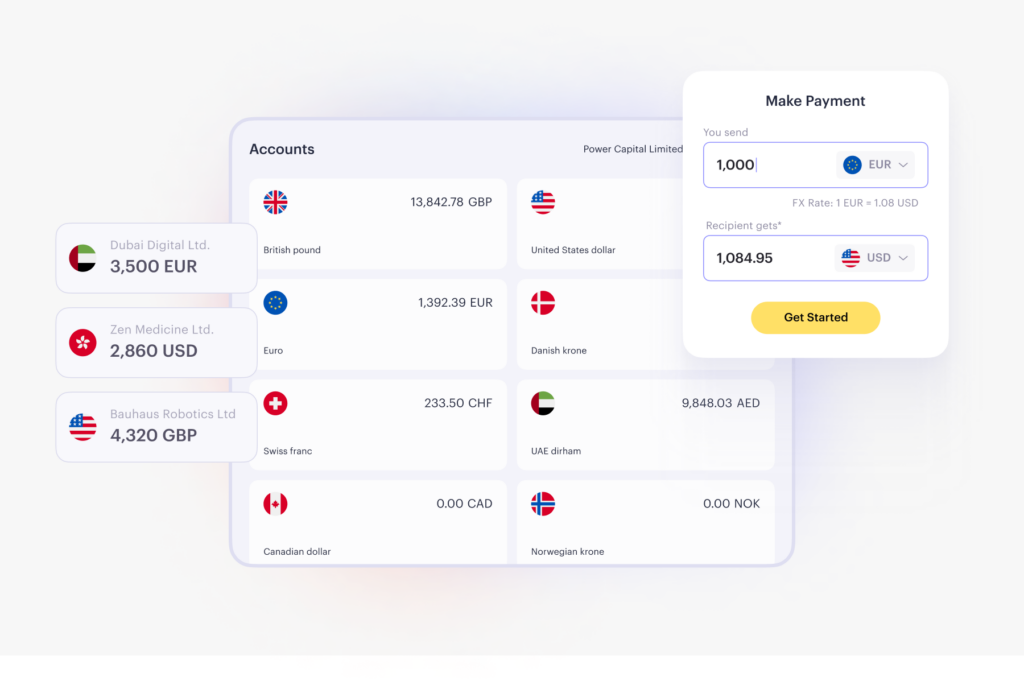

With an Omega Business Account you can get money management tools and third-party business services such as accounting, legal support, and all from a single platform.

Our all-in-one account is designed to help you operate globally and includes:

- Multi-currency IBAN on your company name.

- FX and transfers at competitive rates and fast speeds.

- A truly global account allowing payments to 150+ countries.

Who Can Open a Business Account With Omega?

We have designed our services for international entrepreneurs who want to grow and bring their business to the global stage. Currently, our business account is available to business owners from over 160 countries.

To officially open your account, you will need to provide the following:

- Your full legal name.

- Phone number.

- Address.

- Country of residence.

- Company details and documents.

See the full list of the required information to open a UK business account for a foreign company.

How to Open a Business Account With Omega

Omega has made it easy to open a UK online business account for non-residents, including helping you register your business in the UK. Here’s how it works:

- Visit omg.one and click Get Started.

- Choose the best solution for your needs:

- I have a registered business in the UK: You don’t need to register a new business, but you would like to use our comprehensive suite of services.

- I need to register a business in the UK: You do not have a registered business in the UK and would like to register one.

- I have a registered business abroad: You have a company registered in another country and would like to use our services.

- Follow the steps on the screen to set up your UK business account for non-residents.

Keep your business moving full speed ahead, no matter where you choose to operate. Get started today.