Businesses looking to manage their money are no longer limited to traditional vanguard financial institutions. A new wave of digital-first challengers have emerged with competitive fees for international payments and tools to enable simple business management.

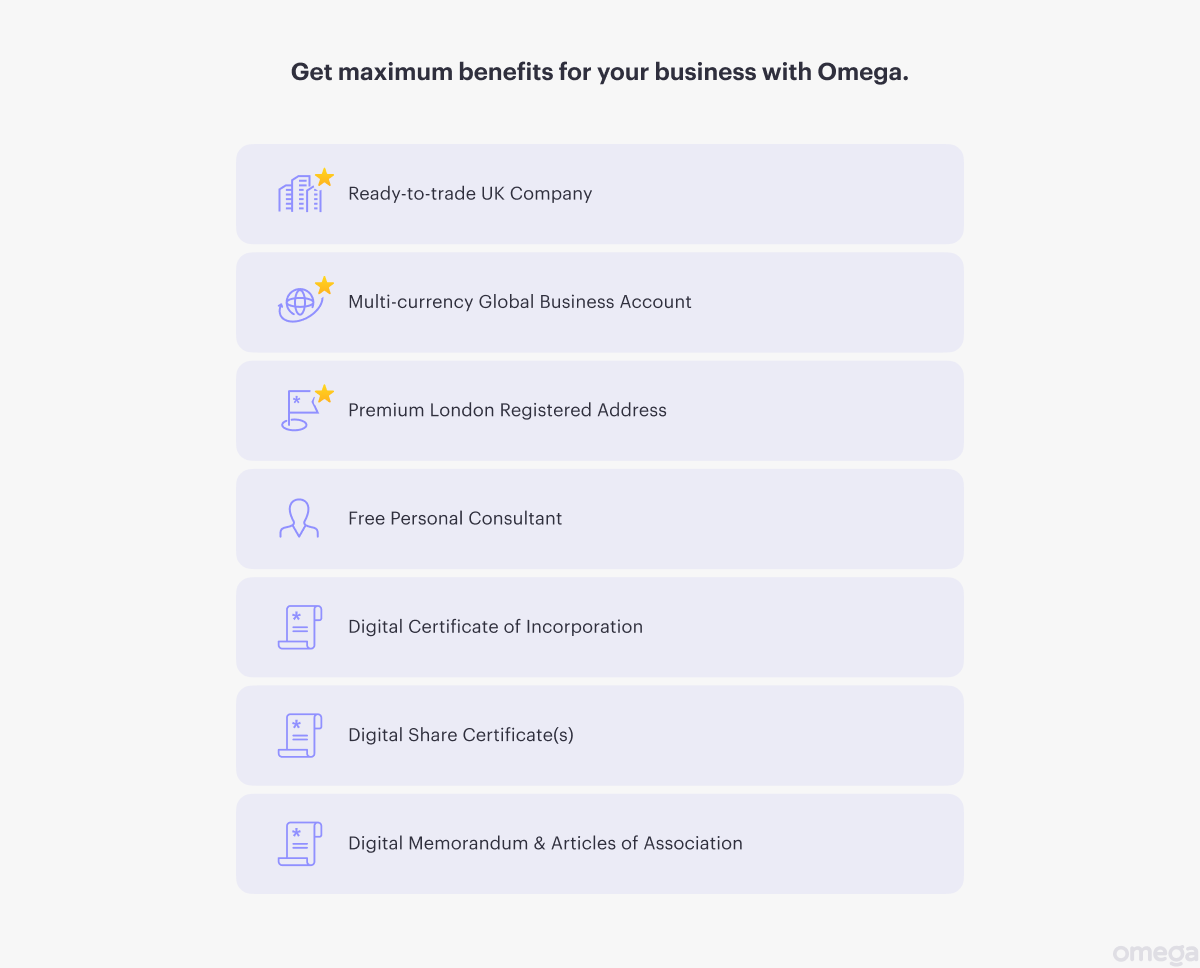

Omega’s business account stands out for features such as:

- Real-time FX rates for global payments

- Accounting and legal services such as UK company registration

- Multi-currency IBANs

Not sure if it is the right fit for you? Below, we have listed 5 industries that are the best fit for an Omega business account.

1. SaaS

Tech and IT businesses are a natural fit for digitally-focused banks since they are accustomed to using software as part of their operations. SaaS companies in particular can benefit from accounts that take a global approach since the nature of their business model means they often make and receive transactions from across the world.

Multi-currency accounts from Omega allow SaaS firms to handle these transactions in multiple currencies without incurring hefty conversion fees.

Omega also offers business services, which can help entrepreneurs to carry out a wide range of administrative tasks involved in running a business. This includes help with establishing an ultimate beneficial owner (UBO) or non-resident director to make it easier for foreign-owned businesses to operate within the UK.

This can be a game-changer for those who want to take advantage of the UK market without having a physical presence in the country.

2. E-commerce

When you are selling products across the globe, converting between multiple currencies is a core part of doing business. When using a bank account from a traditional financial institution, this can involve staggering fees and unfair exchange rates.

In contrast, Omega offers competitive FX rates and a clear fee structure, which means you can make international payments confidently and fast.

Some ecommerce businesses may also find it useful to take advantage of some of the third-party business services included with an Omega account, such as legal and accounting help. This helps with ensuring regulatory compliance and keeping a record of the many transactions involved in ecommerce.

3. Asset Management

Asset management companies generally handle investments in different currencies, making it invaluable for them to have a business account that allows them to easily manage them.

Omega allows its customers to hold money in various currencies so they can keep it in their currency of choice while waiting to purchase assets or for a better exchange rate. This offers a way to manage volatility as poor exchange rates can easily affect returns.

Plus, Omega is soon launching a feature providing end-to-end asset management, along with professional third-party advice.

4. Trade

Trade businesses will also be a good fit for an Omega account as buying and selling goods across borders is a key part of their operations. This includes importers, exporters, and intermediaries such as logistics companies.

Similarly, Omega can be a good fit for businesses that provide trade financing to facilitate international trade.

Since these companies make a high number of international transactions across multiple currencies, competitive FX rates help to minimise currency conversion costs. This is particularly important in volatile trading markets, which can pose an exchange rate risk.

Omega can also offer a dedicated compliance consultant to help companies navigate the complex regulations related to trade and trade finance.

5. Professional Services

As well as established businesses, Omega is a great fit for freelancers and business owners providing professional services, especially those that are focused on the digital sphere. Some examples include the following:

- Graphic design

- Software development

- Marketing

- Consulting

When working with international clients it’s essential to have the right cross-border payment solutions to manage foreign currency transactions. This is true whether you’re based in the UK and working with those outside its borders or are based outside the UK and want to work with British clients.

Doing so can help to increase profit margins by reducing the fees involved in these currency conversions. It can also offer more convenience to clients as it allows you to open an IBAN account in their own domestic currency and use it to receive payments.

Ready to Give it a Go?

Any business looking to expand globally or operate seamlessly across borders, especially when dealing with the UK, can benefit from Omega’s business services.

Sound like something that could help get your business off the ground, or take it to the next level? Get started with an Omega business account today. The signup process takes just minutes, and there are special services for those who want to sign up with a foreign company or use Omega to register their company for the first time.